If you’re in the business of flipping classic muscle cars for a hefty profit, the 1971 Plymouth Barracuda should be your holy grail.

Of course, getting a maximum return on your investment relies heavily on the car being in mint original condition, but if that’s truly the case and you’re sitting on a 71 Cuda, you could be looking at a massive $2.5 million pay day.

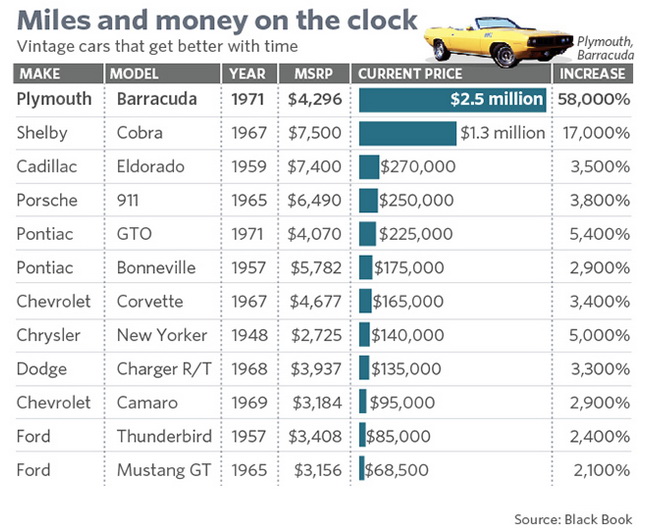

To put that into perspective, consider that the 71 Barracuda once cost $4,296. Now if you’re getting $2.5 million for it, that marks an increase in value of 58,000%.

According to vehicle valuation specialists at Black Book market research group, the Barracuda reigns supreme when it comes to valuation over time. In second place, as you can see in the graph below, sits the 1967 Shelby Cobra (17,000% & $1.3 million), followed by the likes of the 59′ Cadillac Eldorado (3,500% & $270k) or the 65′ Porsche 911 (3,800% & $250k).

There are other noteworthy models on the list, such as the GTO, the Corvette, the Charger and the classic Camaro, and they’ve all done quite well for themselves.

“Many people think today’s uber-expensive vehicles always came with a hefty price tag, but these vehicles show that’s clearly not the case,” stated Black Book exec Eric Lawrence.

Wealthy Gen X buyers who are currently in their late 30s and 40s have plenty of classics to choose from when it comes to snatching up something really valuable at an auction. However, according to Market Watch, newer exotics from the 1980s have started to gain traction lately as this new generation of buyers is set to take over from the baby boomers.

As for us, who knows what our cars will be worth in 40 or 50-years time? If you’re driving a fairly affordable, yet limited run something (anything, even a hot hatchback), some might think it could be worth holding onto it in the long run, but can and should you really not enjoy it today?