It seems that fully-autonomous cars will need to do a lot more than just read the road if insurers can hope to determine who was in control of the vehicle during a crash.

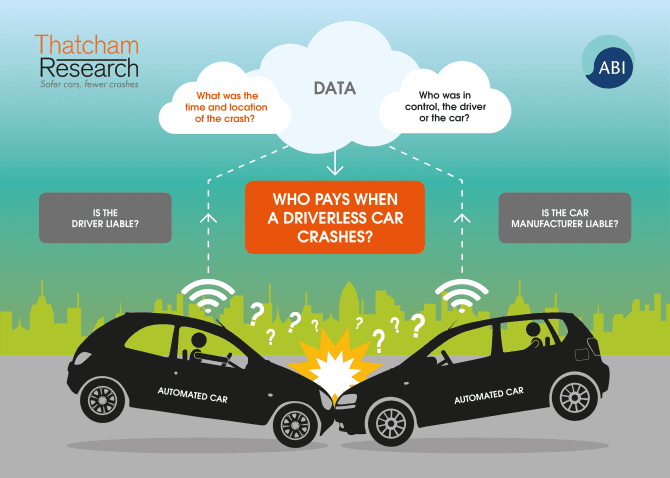

According to Thatcham Research, determining where liability rests in case of an accident will be one of the key challenges for future autonomous vehicles.

In other words, without knowing who was in control of the vehicle at the time of the incident (the driver or the car) it would be very difficult to settle insurance claims fairly.

“Future legislation needs to protect the consumer so that in the event of an accident, responsibility and who pays can be quickly determined,” said Peter Shaw, chief executive at Thatcham Research. “Was it driver error or a failure of the automated driving system? This can only happen if their insurer has access to key data about the crash. We would like to see car manufacturers and legislators working together with the insurance industry to develop a framework to make this happen.”

Currently, British insurers are lobbying for a standard set of data agreed at an international level, data which would include how the vehicle was operating at the time of the crash – autonomously or otherwise.

“It’s in everyone’s interests to be able to establish the facts quickly and the proposals for standardized data being put forward by UK insurers would achieve this,” added Shaw.

Aside from establishing liability, this information could also be used for emergency services’ investigations, making insurance claims more efficient and also to help vehicle manufacturers improve their products.

By having the 30 seconds before and 15 seconds after a crash recorded, insurers could have access to a GPS record of the time and location of the incident, confirmation of running mode, whether the car was parked or in motion, when the driver last interacted with the system if in autonomous mode, any sort of driver input on braking or steering and of course whether the driver’s seat was actually occupied and the seatbelt fastened.