Autonomous driving technology promises to change how we move but it doesn’t appear that it will significantly affect insurance premiums.

According to Bloomberg, the switch to autonomous vehicles shouldn’t result in insurance companies becoming less profitable as drivers will continue to need coverage and new products could be introduced specifically for driverless vehicles.

One potential change that could occur is who pays for the policy. Most owners pay for their insurance but in the future, automakers or technology companies could be the one footing the bill. Volvo CEO Hakan Samuelsson hinted at this possibility back in 2015 when he said the company would “accept full liability” for any accident that occurred while one its models was operating autonomously.

Besides automakers potentially paying for insurance, another possible change is the introduction of new insurance products tailored specifically to autonomous vehicles. One mentioned in the article is so-called “cyber insurance” which would protect people whose vehicles were hacked. Given the growth of over-the-air updates that can significantly impact vehicle performance – the Tesla Model 3’s improved braking for example – it is possible that hacking insurance could become popular in the future.

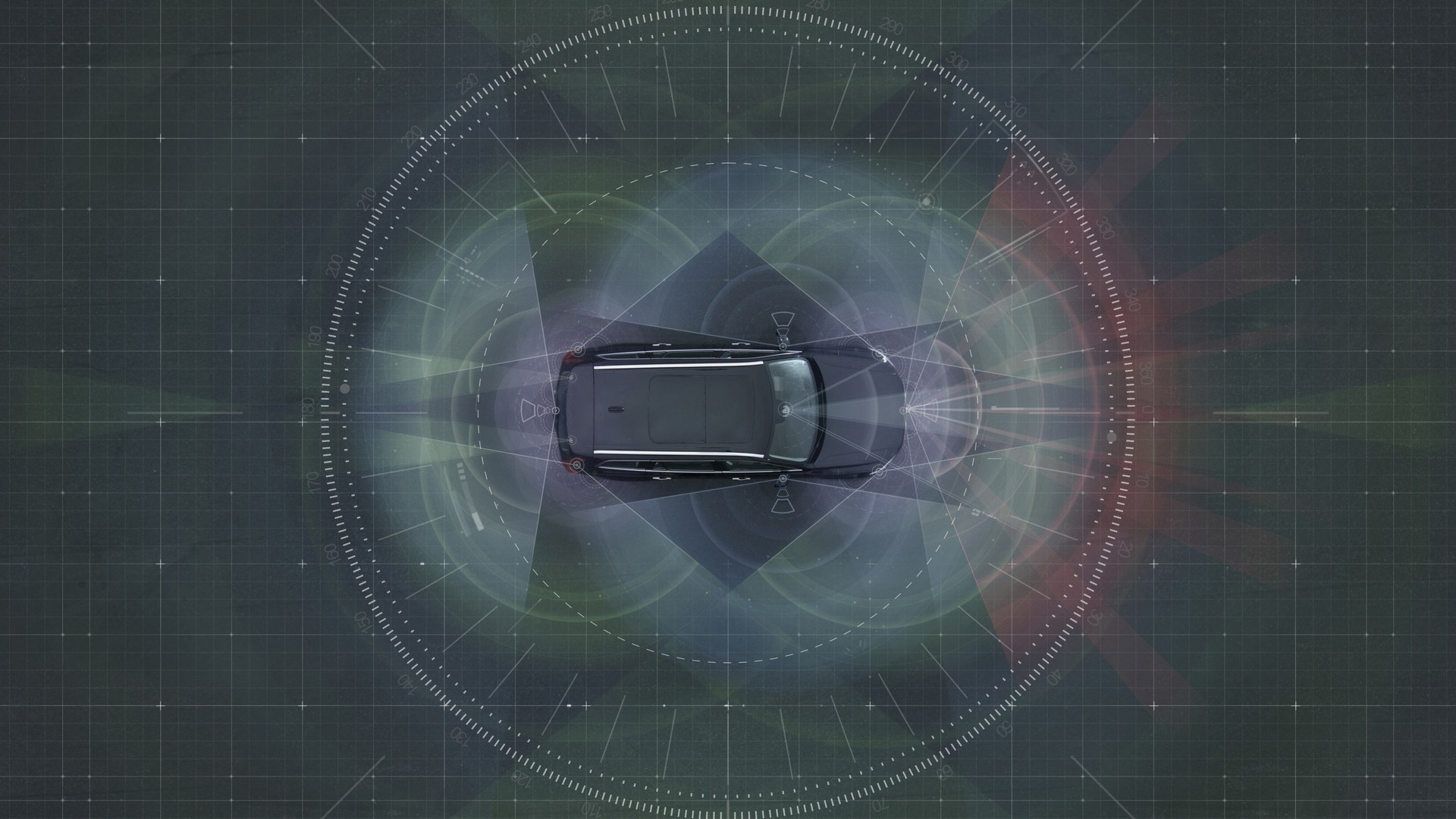

Another factor working against cheap insurance for autonomous vehicles is the fact that they are equipped with numerous cameras, sensors and computers. The technology might reduce the number of accidents that occur but when one does, the insurance payout will likely be higher to cover the cost of the high-tech components.

The switch to fully autonomous vehicles also won’t happen overnight so they’ll be sharing the road with ‘dumb’ vehicles driven by humans who could hit them. Technology also isn’t foolproof and this could lead to autonomous vehicles having accidents on their own.