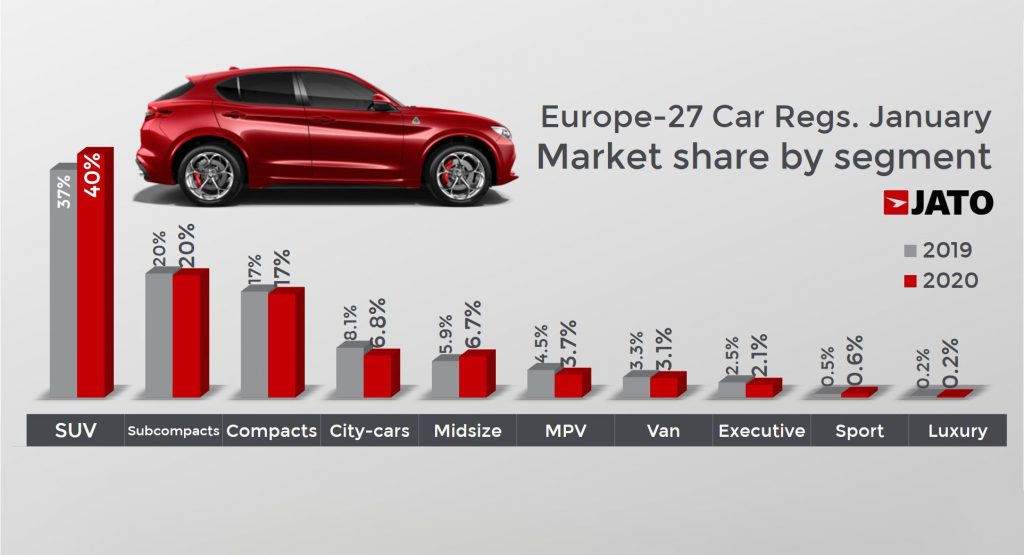

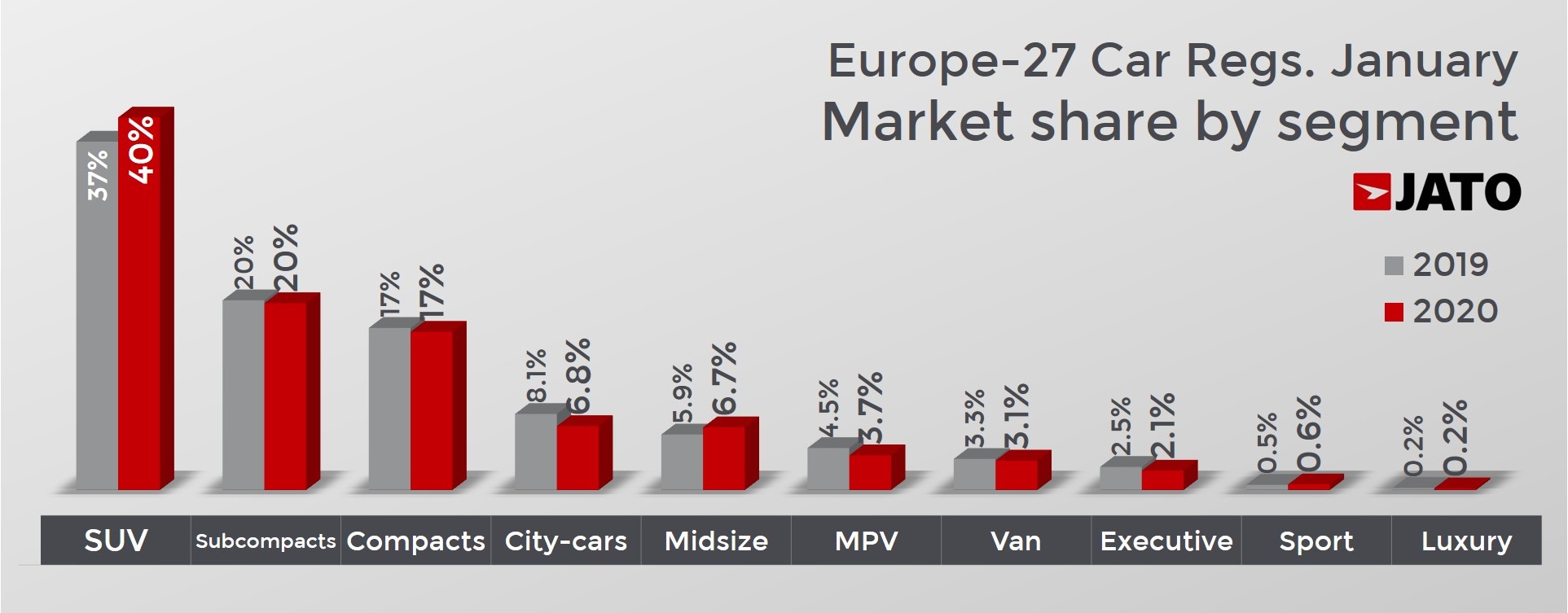

As consumer preferences continue shifting towards crossovers and SUVs of every size and price imaginable, most automakers have expanded their high-riding vehicle portfolios tackling a multitude of segments with different proposals.

This has led to a decrease in demand for sedans, station wagons and hatchbacks, sealing the fate of several nameplates that used to be popular. According to data published by Jato Dynamics, last year alone, sales of what used to be considered ‘traditional’ cars were down globally.

Read Also: There’s A Recession In Global Car Sales And It Shows Little Signs Of Abating

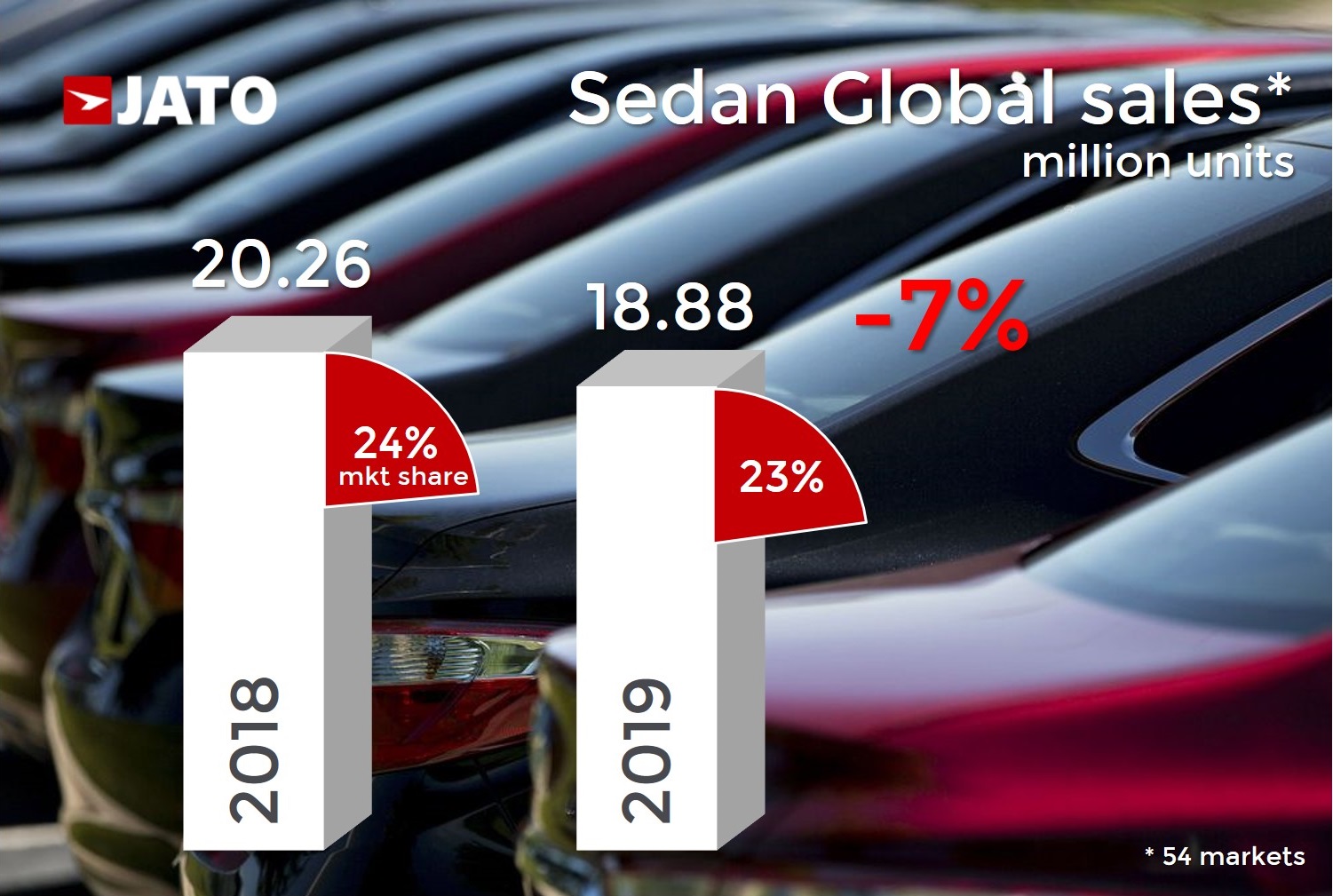

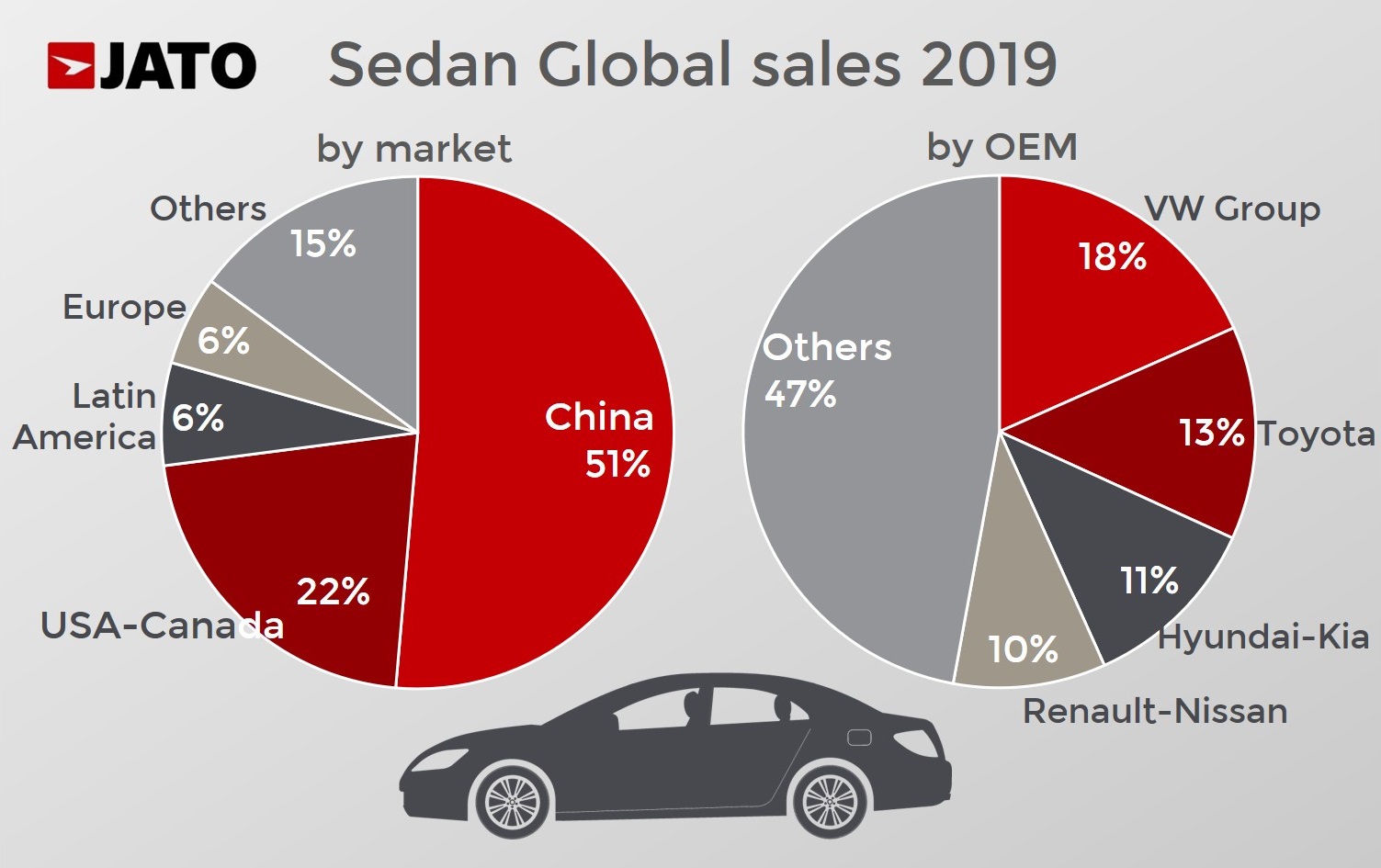

Sedans that used to hold a 24 percent market share in 2018, dropped to 23 percent last year, from 20.26 to 18.88 million units. The VW Group holds 18 percent of the category, followed by Toyota with 13 percent, Hyundai-Kia with 11 percent and Renault-Nissan with 10 percent.

With 51 percent of new car registrations, China remains the biggest global market for sedans, while the USA and Canada follow it with 22 percent. Latin America and Europe hold 6 percent each.

What could manufacturers do to continue to appeal to new car buyers with saloons? The answer varies from company to company, so while Tesla wants to win them over with electrification, others, such as VW and Kia, see the so-called four-door coupes (Arteon and Stinger) as a possible solution (spoiler alert; it hasn’t worked so far).

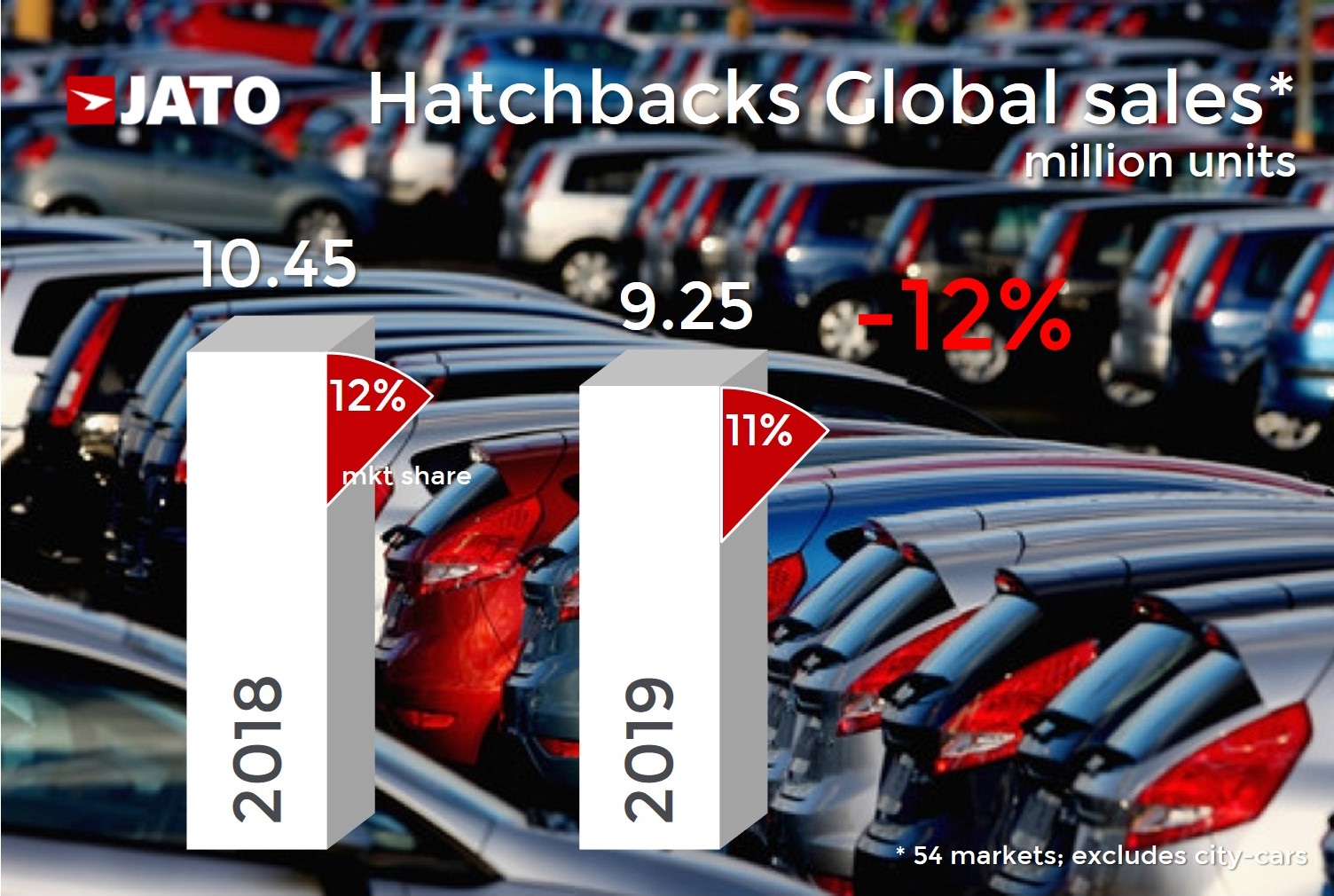

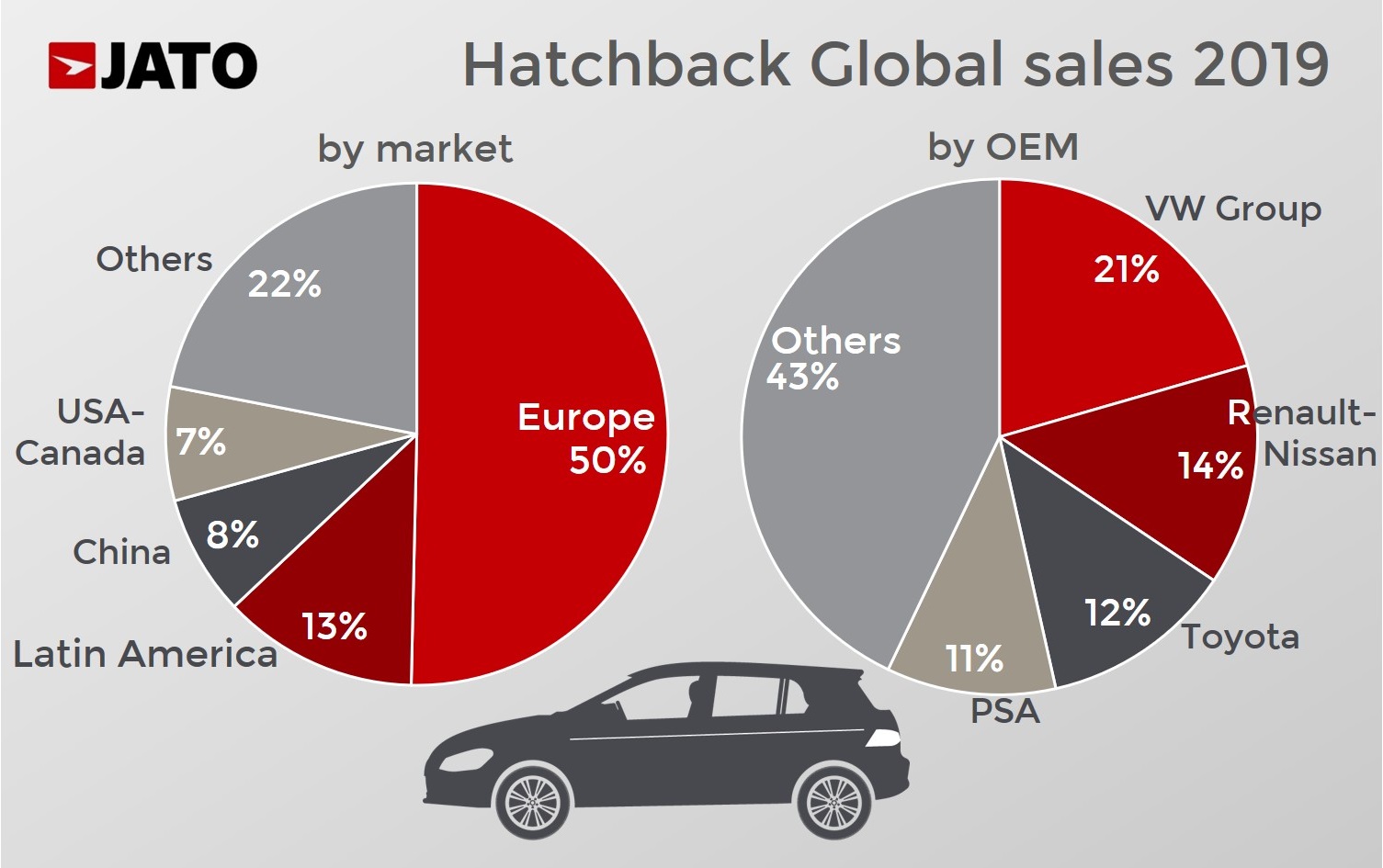

Hatchbacks haven’t been doing that well either, as they also lost 1 percent of the market share, dropping from 12 percent in 2018 to 11 percent last year. Sales of three- and five-door subcompact and compact models dropped from 10.45 million to 9.25 million in one year. Hatchbacks remain popular in Europe, which holds 50% of global sales in the segment at 4.6 million units, even though demand decreased by 7 percent over 2018. The second largest market for hatchbacks was Latin America, with 1.2 million units, down by 11%, while China was the third market in with 717,000 units, down by 36%.

In these two segments, the Volkswagen Group holds the high ground, with 21 percent, while Renault-Nissan has 14 percent, Toyota has 12 percent and PSA 11 percent of the market..

“The decrease in popularity across Europe and Latin America arose as hatchbacks increased in size,” says Jato. “The larger they became, the less functional and manoeuvrable they became. This increase in size put them in the same playing field as SUVs, which have recently been on a mission to decrease their size.”

Station wagon sales

Station wagons have lost ground to crossovers and SUVs, due to their similarities, says Jato. Much like hatchbacks, Europe is still the biggest core market for estates, which retained 70 percent of the volume in 2019.