Gas prices aren’t the only thing that has skyrocketed in the wake of Russia’s invasion of Ukraine as nickel prices have also gone through the roof.

As CNBC noted, the London Metal Exchange suspended nickel trading yesterday after “three-month contract prices more than doubled to over $100,000 (£75,895 / €90,192) per ton.”

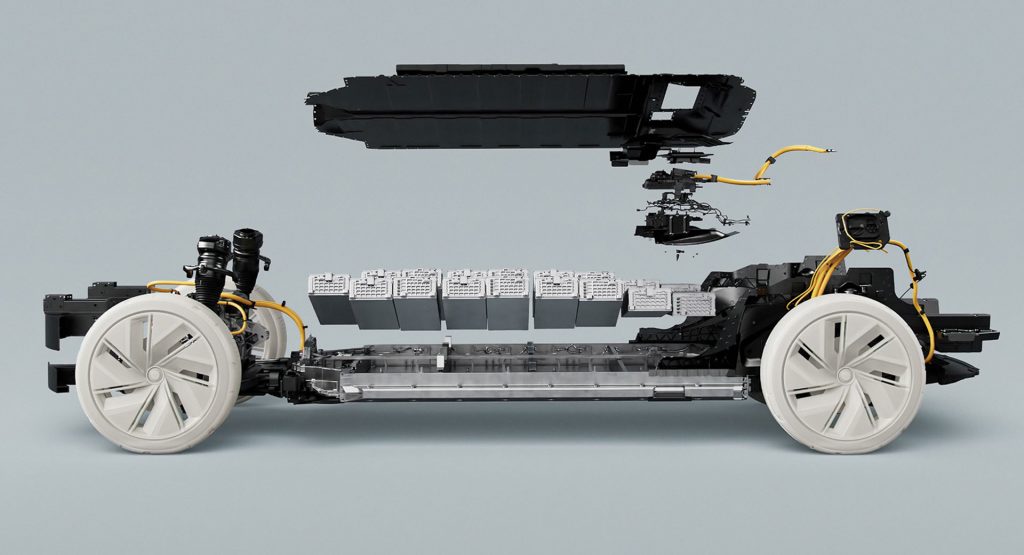

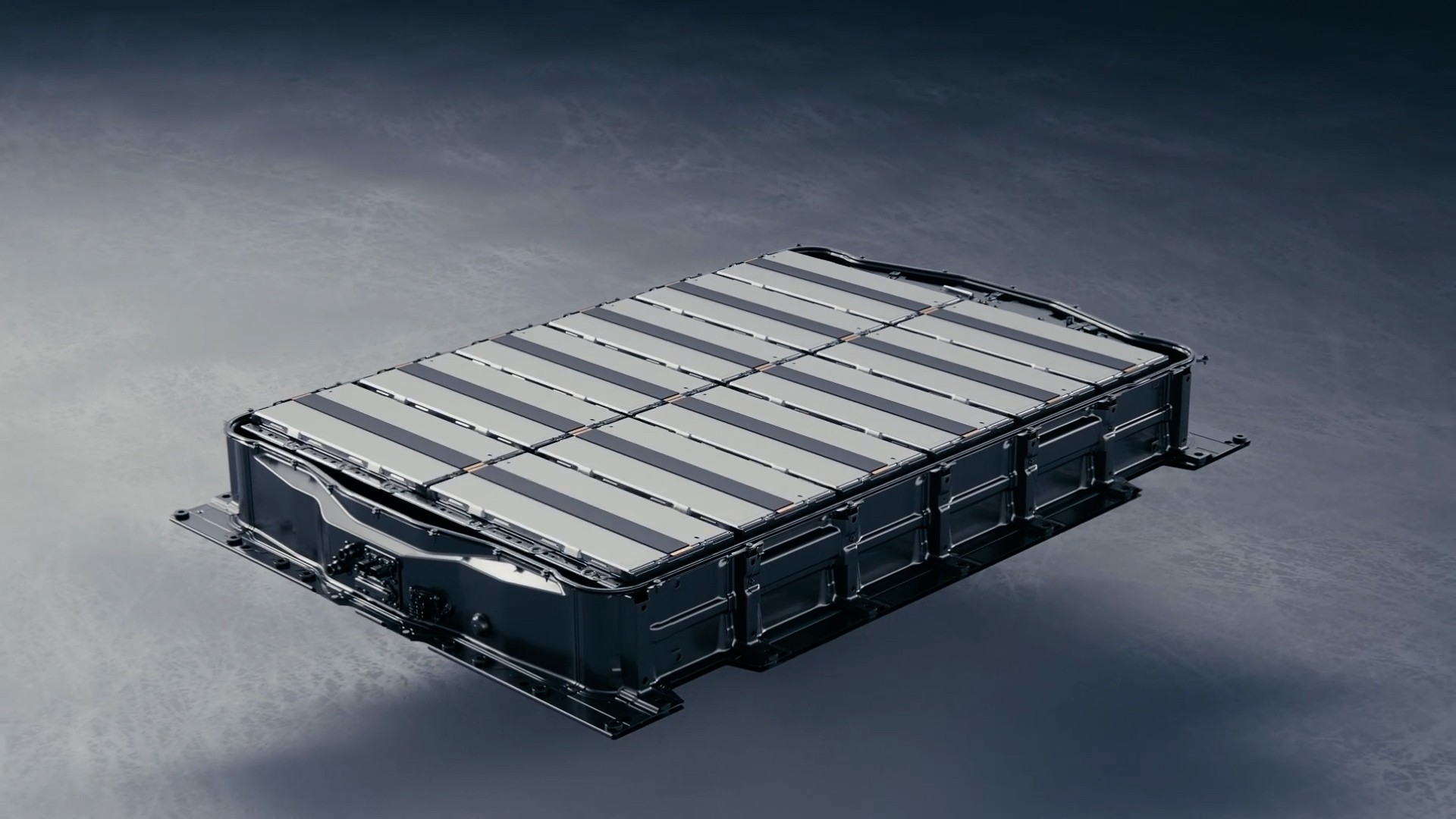

This is a serious problem for automakers going electric as nickel is one of the key ingredients in lithium-ion batteries. The situation is so bad that Morgan Stanley’s automotive analyst warned on Monday that “nickel is up 67.2% just today, representing around a $1,000 (£759 / €902) increase in the input cost of an average EV in the U.S.” Adam Jonas also cautioned this could result in lower earnings for automakers as well as slower electric vehicle adoption.

Also Read: Lithium-Ion Battery Prices Fell 6% Last Year, But Trouble Is On The Horizon

The Wall Street Journal notes Russia accounts for 5-6% of the world’s nickel supply and while nickel exports haven’t been targeted directly by sanctions, “shipping firms and traders [are] reluctant to deal in the nation’s resources.” However, that’s not the only issue as Russia is responsible for 17% of high-purity nickel production and that’s critical for electric vehicles.

Concerns about nickel existed before the war and CNBC noted some analysts warned that global demand for high-grade nickel could outstrip supply by 2024. The situation has gotten significantly worse since those warnings last fall, but there are alternatives such as lithium iron phosphate batteries that don’t use nickel or cobalt in their cathodes. However, there are tradeoffs including lower energy densities.

How much of an impact this has on electric vehicles remains to be seen, but will largely depend on whether or not nickel prices continue to remain high. If they do, automakers and consumers will likely be stuck paying more for EVs.