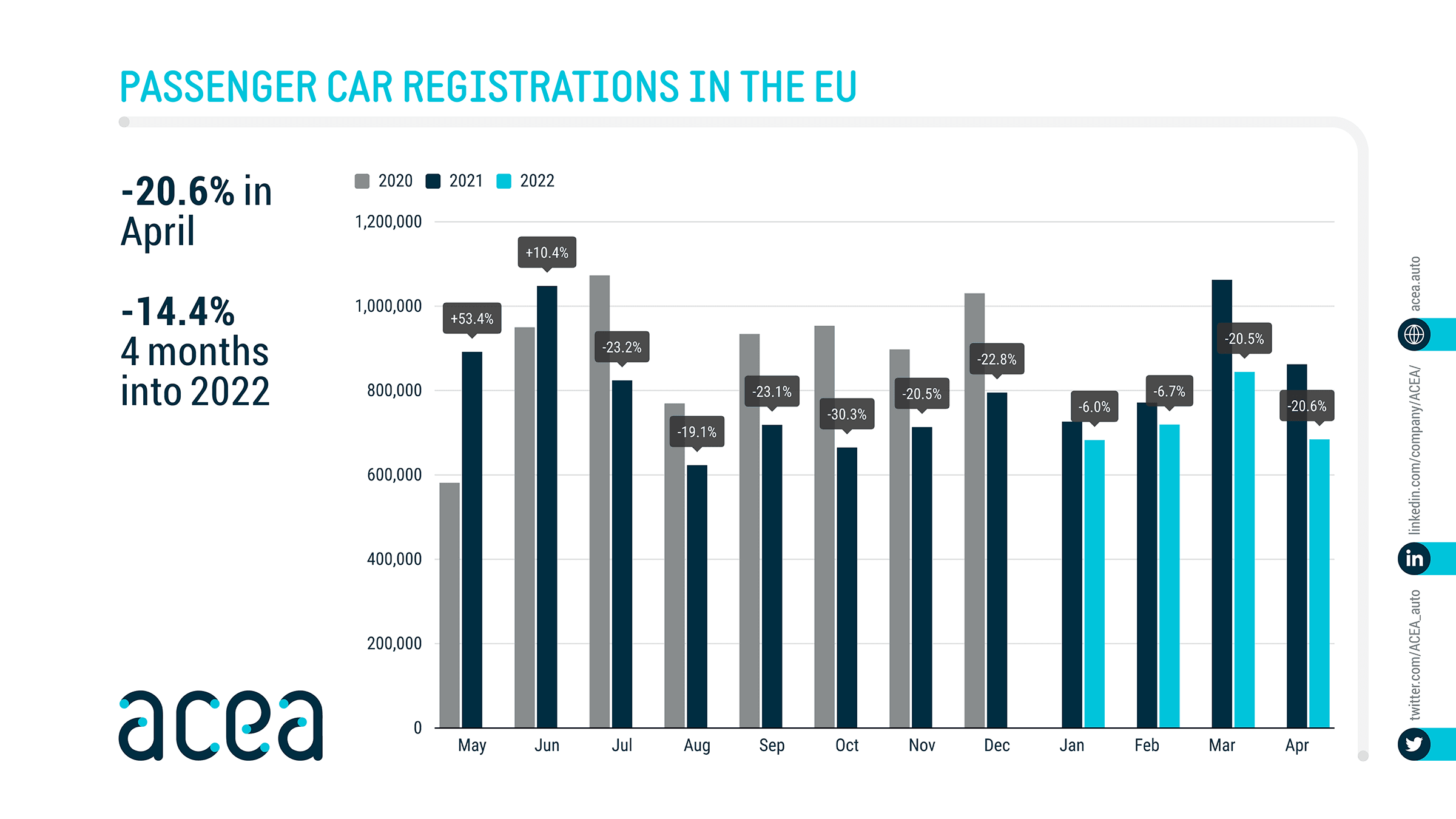

New car registrations slumped by over 20 per cent across the European Union in April in what was one of the worst months since the height of the Covid-19 pandemic in 2020.

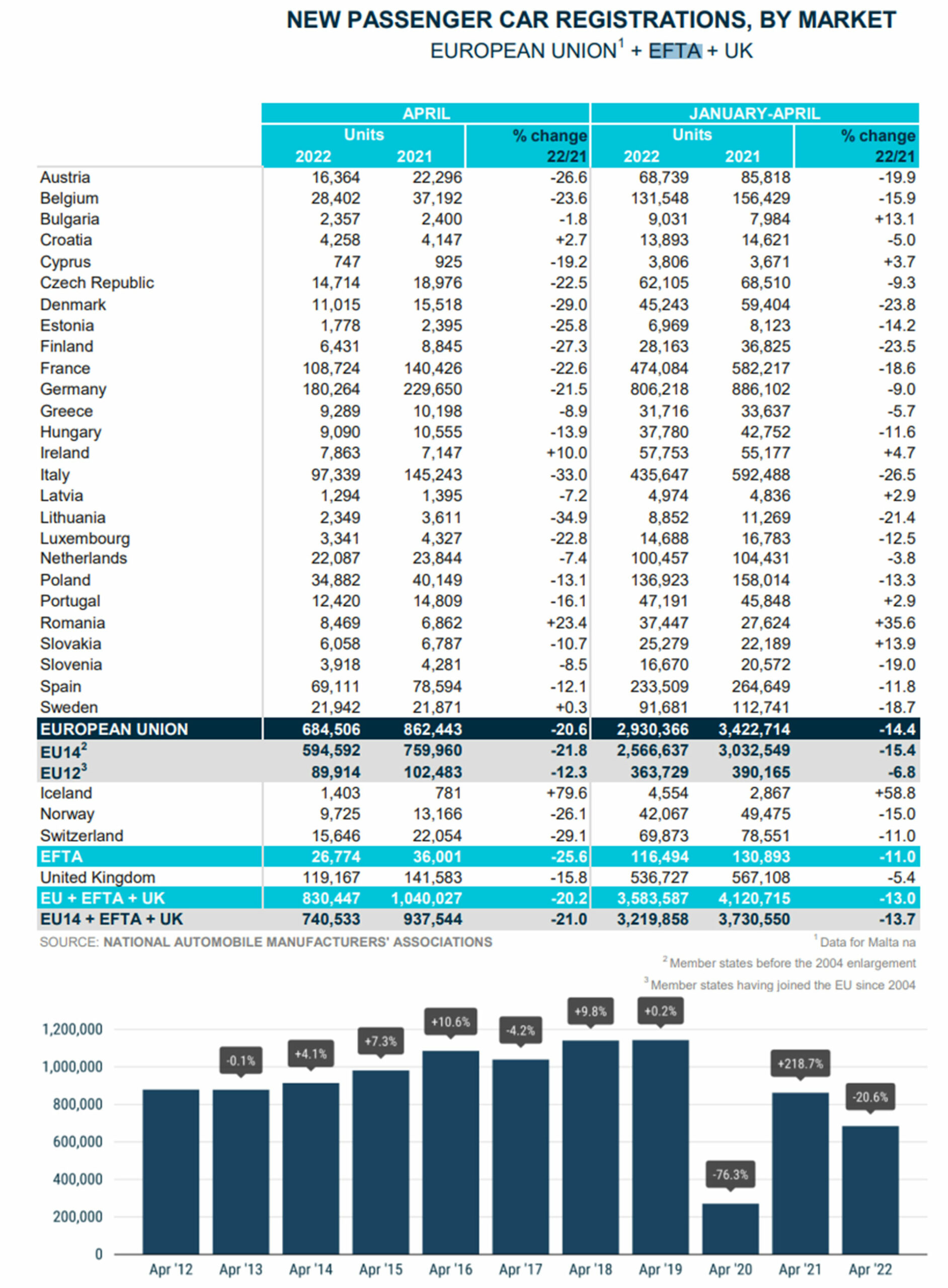

Data from European Automobile Manufacturers’ Association (ACEA) reveals that 684,506 new vehicles were sold in the European Union last month compared to the 862,443 units sold in April 2021. When including sales from the European Free Trade Association (EFTA) such as Iceland, Norway, and Switzerland, plus adding the United Kingdom into the mix, total sales peaked at 830,447 through April. That was a 20.2 per cent decline from the 1,040,027 vehicles sold in the same month last year across the region.

Read Also: Dealers Are Now Willing To Sell Used Cars With 200,000 Miles Themselves

From January-April, 2,930,366 new vehicles have been sold across the EU. That too is a significant fall of 14.4 per cent from the 3,422,714 registrations recorded in the first four months of 2022.

Some car manufacturers have been hit harder than others across Europe. For example, sales of Stellantis models plummeted by 32.1 per cent last month from 202,306 units down to 137,455. Similarly, the Volkswagen Group suffered a 27.1 per cent decline in sales from 230,038 to 167,786.

Elsewhere, the Renault Group reported an 18.2 per cent decline in sales, Toyota a 3.6 per cent drop, BMW Group a 20 per cent drop, and Mercedes-Benz a 21.2 per cent drop from 53,088 to 41,841. Ford also reported an 18.1 per cent fall in sales for April while Volvo reported a 20.7 per cent drop and Mazda a huge 32 per cent decline.

The winners

There were some car manufacturers that managed to increase sales during April, however. Perhaps most notable was the Hyundai Group with its sales rising by 10.8 per cent from 65,073 to 72,095. Kia reported a boost of 14.7 per cent while Hyundai itself recorded a 6.5 per cent bump in sales. Similarly, Mitsubishi and Honda reported sales increases of 11.9 per cent and 33 per cent respectively but with just 5,629 Mitsubishi models and 4,077 Honda models sold, they remain relatively small players.

Supply chain issues and inflationary pressures are the main factors behind shrinking new car registration numbers throughout Europe. LMC Automotive forecasters have cut estimates for Western European passenger-car sales this year to less than 10 million units.

“Global supply issues show no significant signs of easing, while underlying demand prospects are eroding, too,” LMC recently wrote. “Households will experience a serious squeeze to real income this year. Supply issues do remain the key determinant for registrations for now.”