A scarcity of lithium is expected to push prices of EVs up by around $1,000, as values of the mineral have already surged by 500 percent. With governments and manufacturers pushing for greater EV adoption, automakers have been scrambling to secure the supply of the precious raw materials needed to manufacture batteries.

However, Stellantis can seemingly afford to relax a little, as the company has secured a lithium supply from Controlled Thermal Resources Ltd (CTR). CTR operates in the Salton Sea found in California, which was created after the Colorado River flooded in 1905. The 343-square-mile lake is home to huge geothermal deposits of lithium.

CTR, meanwhile is no stranger to automotive deals, having signed an even larger contract with General Motors to supply 60,000 tons of lithium.

Read: New Indiana Plant Will Help Avoid EV Shortages, Says Stellantis

CTR will supply Stellantis with up to 25,000 metric tons per year of lithium hydroxide over the 10-year term of the agreement. “Ensuring we have a robust, competitive, and low-carbon lithium supply from various partners around the world will enable us to meet our aggressive electric-vehicle production plans in a responsible manner, ” said Carlos Tavares, Stellantis CEO.

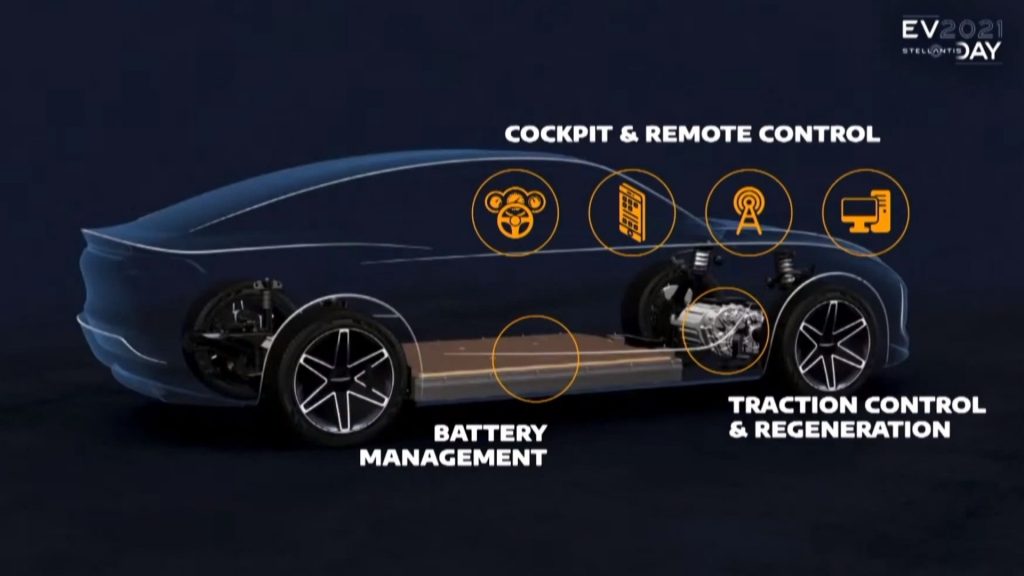

The deal is a crucial piece of the puzzle as the company plans to offer over 35 battery-electric vehicles across its U.S. portfolio by 2030. Earlier this week, Tavares predicted that a battery shortage was on the horizon for 2024 or 2025, and the CEO foresees a raw materials shortage befalling the industry a few years later.

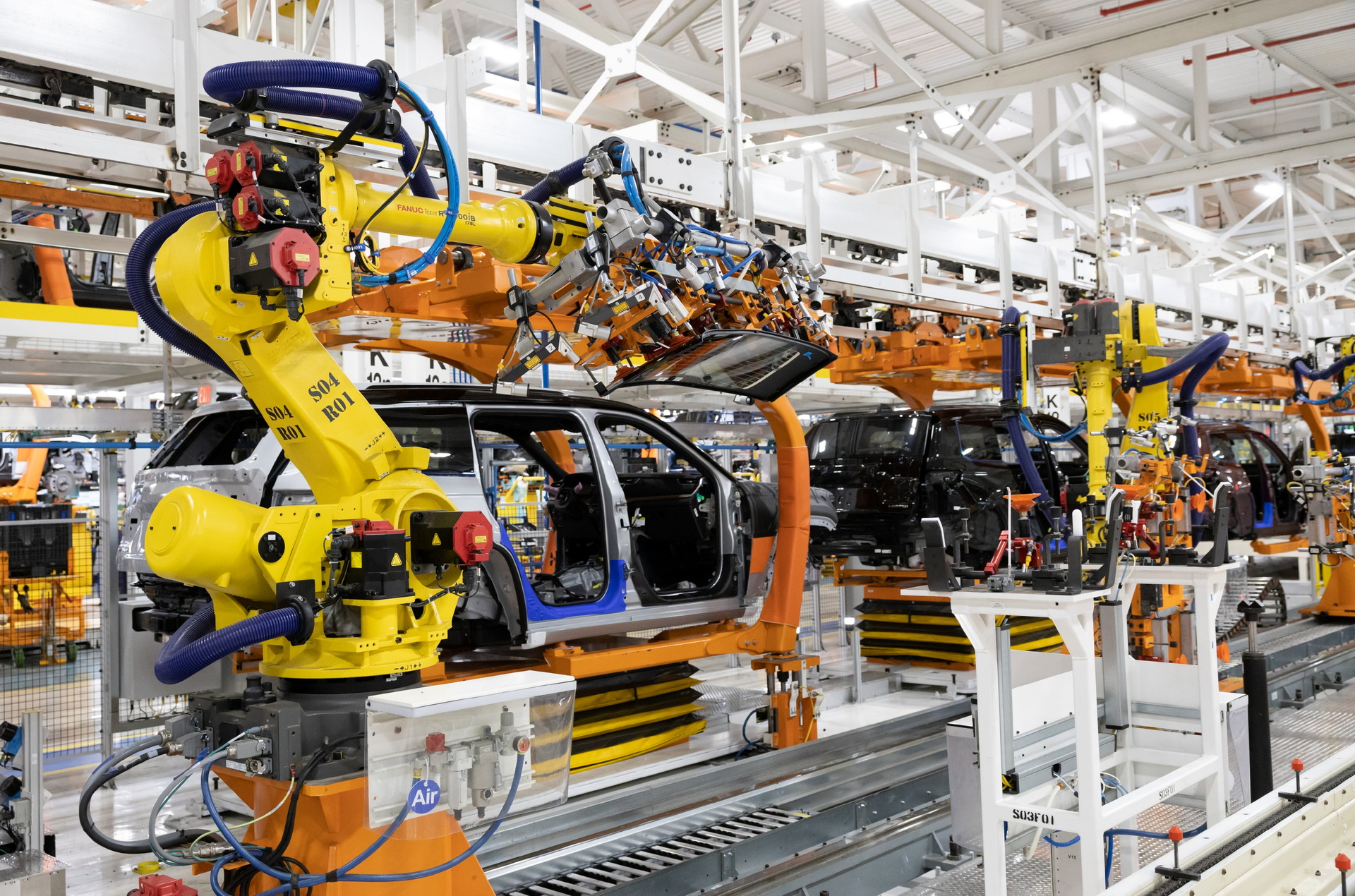

A deal with Samsung SDI to construct a battery plant in Indiana was seen as another crucial step for the company to overcome EV supply chain issues. The deal announced earlier this week will see Samsung SDI manufacture cells and modules for various Stellantis EVs in North America.