Automakers tend to focus their marketing efforts on two goals: retaining the customers they have, and stealing other brands’ buyers. No automaker was better at doing both in 2022 than Tesla.

According to market research by S&P Global, Tesla’s share of first time buyers is much higher than most other automakers. Since it’s a young company, though, it should hardly come as a surprise that more than 80 percent of its buyers are what the industry refers to as “nomads,” or customers who are new to the brand.

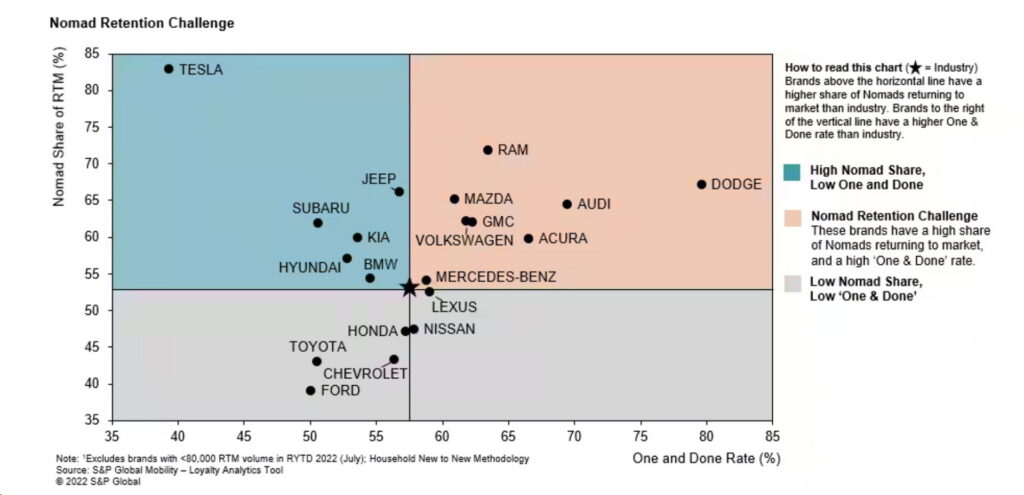

What is interesting, though, is how well Tesla has managed to convert those nomads into loyalists. The study found that just 39 percent of Tesla’s buyers leave the brand when it comes time to replace their vehicle.

Read: Tesla’s Grip On The EV Market Loosens As Buyers Start To Look Elsewhere In 2023

By contrast, the industry average “one-and-done” rate (that is, customers who buy a brand’s vehicle for the first time then defect to another brand the next time they need to buy) is 58 percent. Ford is the brand with the second-best one-and-done rate, with 50 percent of first time buyers leaving the brand the next time they go shopping.

That’s an important trick for Tesla to pull, though, because not only does hanging onto buyers mean more sales now, it also means more sales later. On average, just 43 percent of buyers who are new to a brand buy from that brand again. That number rises to 56 percent when they’ve bought from the brand before, though.

Turning nomads into loyalists is a particular challenge for automakers like Ram, Mazda, Audi, GMC, Volkswagen, Acura, and Mercedes. Dodge, though, is the worst brand at retaining nomads. In 2022, more than 65 percent of its buyers were new to the brand, but nearly 80 percent were one-and-done buyers.

The challenge of holding onto customers is more pronounced for brands that have a relatively small range of vehicles. Subaru, Volkswagen, Hyundai, and Kia, for instance, all made strides in holding onto customers recently by introducing new upper mid-size utility vehicles (such as the Ascent, Atlas, Palisade, and Telluride), which allowed customers looking for something bigger to stay within their ecosystem.

S&P Global’s associate director of consulting, Erin Gomez, says that rushing into every new market segment isn’t the only way to hang on to customers, though.

“Aside from the massive, long-term undertaking of creating products in new segments, there are other ways automakers can increase loyalty from their current Nomads,” Gomez said. “By understanding the loyalty makeup of their customer base, and where their Nomads are going, brands can take a more targeted and efficient marketing approach to retain them.”

With the highest rates of brand nomadism in more than a decade, though, the challenge of holding onto customers is one that all automakers are reckoning with except, apparently, for Tesla. Whether it can hang on to that advantage in coming years will be a true test of the company.