Tesla is opening its Supercharger network to non-Tesla vehicles, but a new study suggests the move won’t come close to meeting the demand for EV chargers expected in the coming years.

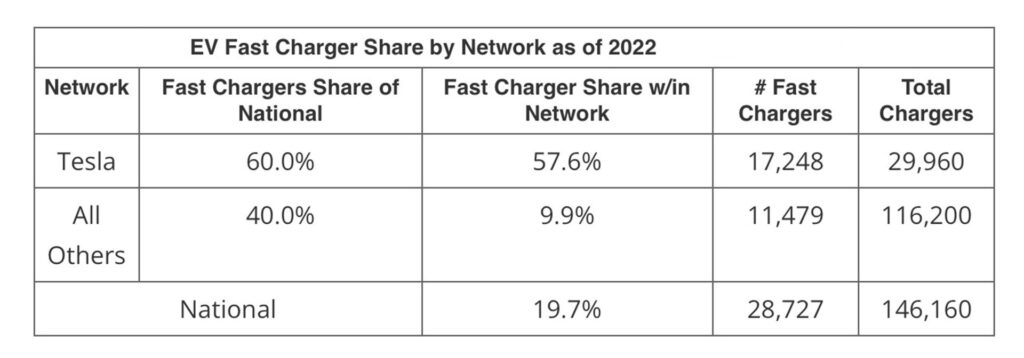

On the face of it, the tie-up between Washington and Tesla looks like a perfect deal for everybody. Tesla has over 17,000 Level 3 fast chargers in its network of almost 30,000 charging points, but only 11,479 non-Tesla chargers are fast chargers.

As a result of the deal the government suddenly has a ready-made charging network to persuade drivers to buy EVs because the addition of Tesla’s network could potentially more than double the number of Level 3 fast chargers available to non-Tesla owners. Consumers also feel more reassured about buying those EVs as a result, and Tesla gets a hefty chunk of the government’s multi-billion-dollar infrastructure grant for providing access. About the only people who might lose out appear to be existing Tesla drivers who might find the Supercharger network busier than it has been.

But data analysts at iSeeCars still think the deal will bring minimal benefit to most EV drivers. The problem isn’t that Tesla’s Supercharger network is too small, the study finds, but that the automaker has only committed to opening a small portion of it to drivers of other brand vehicles. Only 3,500 or around 20 percent of Tesla’s 17,000-plus Level 3 chargers will be available to non-Tesla drivers under the terms of the agreement.

Related: Tesla Opening Chargers To All Electric Vehicles After Deal With US Government

Those drivers do of course still have access to almost 105,000 less powerful Level 2 chargers, but the report suggests that these chargers are so slow they’re not practical for much more than overnight fill-ups and are certainly far too slow for anyone hoping to charge their EV in the middle of a cross-state or cross-country trip.

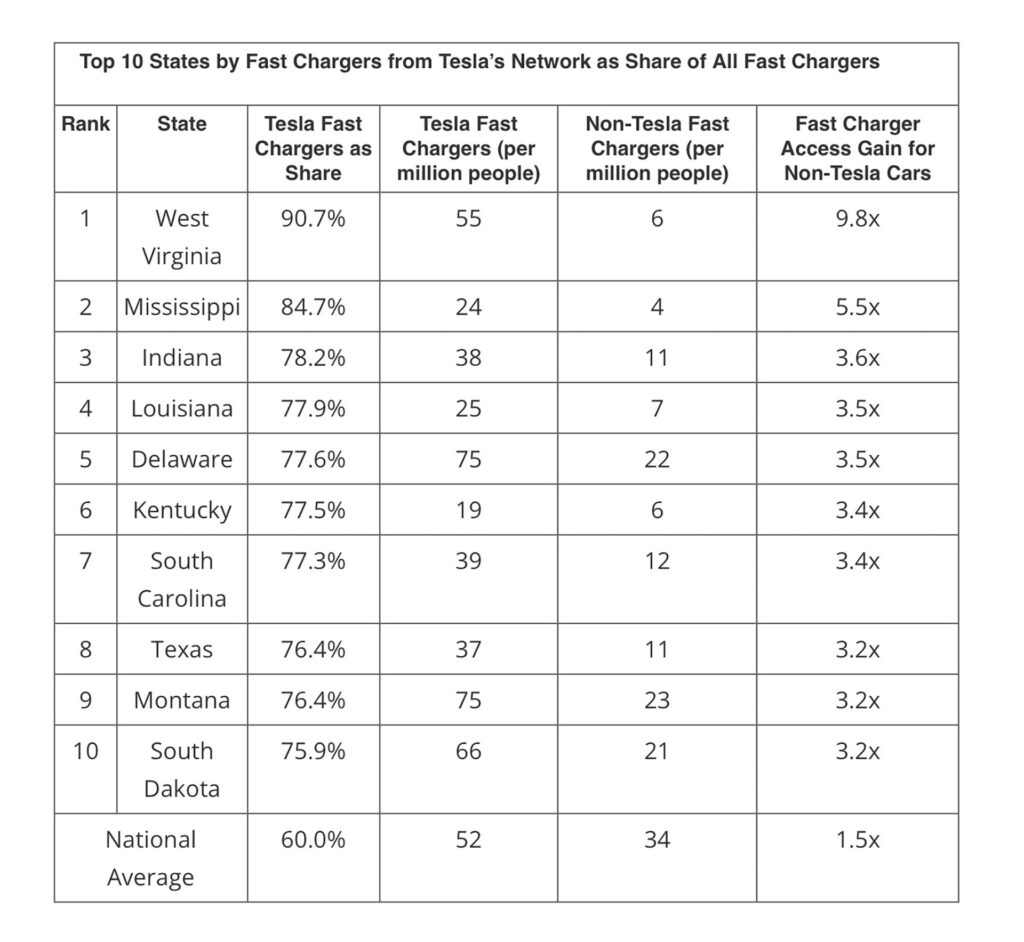

The study suggests that if Tesla opened its entire Level 3 charging network there wouldn’t only be an increase in the number of fast chargers available to EV drivers, but a more equal distribution of charging points. Many rural states in Mississippi, West Virginia and Kentucky that currently have limited access to non-Tesla fast charging points (just 4 per million people in the case of Mississippi) would be the biggest gainers.