As production difficulties have put Tesla behind schedule and slowed the roll-out of the 4680 battery cell, the automaker was forced to delay the launch of the Cybertruck. Now it is turning to partners in China, Japan, and Korea to ensure it doesn’t happen again.

Tesla has long been extolling the virtues of the 4680 battery cell, which is named for the external dimensions (46 mm in diameter by 80 mm tall, 1.8×3.1 inches) of the cell. It hopes to make the new batteries in Nevada and Berlin for use in vehicles such as the Model Y and the Cybertruck.

According to CEO Elon Musk, the battery cell could cut costs by as much as 50 percent thanks to its larger size (Tesla currently uses 2170 cells), a new dry coating electrode process, and more.

Read: Troublesome Batteries And Tight Supply Lines Are Why You Still Aren’t Seeing GM EVs On The Road

Although Tesla has been successful in dry coating the anode (the negative electrode), it has struggled with dry coating the cathode (the positive electrode), which is where the majority of the efficiency gains are expected, unnamed sources told Reuters.

That led the first-generation 4680 cells, built in Fremont, California, to miss energy density targets. The company thinks it will be able to figure out the dry coating process and increase production significantly in 2023, but years of delays are now leading it to hedge its bets.

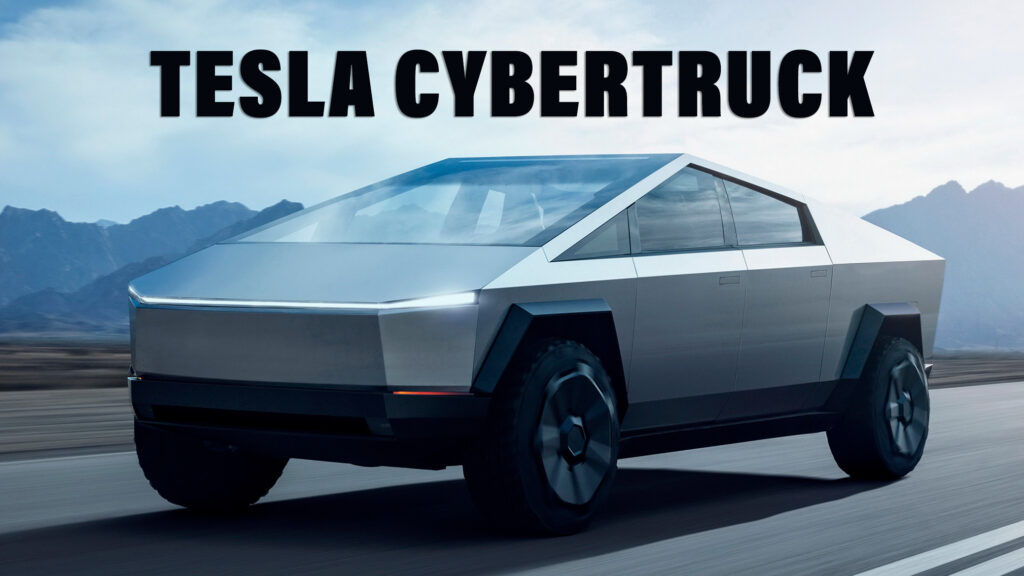

Already, these troubles have caused it to push back production of the Cybertruck. Although the automaker looked at using smaller cells and less energy-dense chemical compositions, it opted instead to wait until 4680 cells, and their associated energy density, were ready before launching the truck, about which it has made lofty promises.

To avoid delaying the launch again- the truck was unveiled in 2019 and was initially supposed to go into production in 2021 – Tesla has turned to Korea’s LG Energy Solution and Japan’s Panasonic to help it with its supply of 4680 cells as it ramps up production in the U.S.

To lower materials costs, it has turned to China’s Ningbo Robay New Energy and Suzhou Dongshan Precision Manufacturing. It is unclear what impact that will have on vehicles using those materials’ ability to qualify for federal EV tax incentives in the U.S.

Despite that, Tesla is confident that it can increase 4680 cell production by 500 percent by the end of 2023, and will do so even if it doesn’t have enough new cars to put those batteries in. The automaker is betting that avoiding a battery bottleneck for its future vehicle manufacturing is more important than efficiency right now, and it can put any extra cells it has into its commercial and residential power storage units.