New vehicles are slightly more affordable in the U.S. now than they were in January but they’re still setting back consumers a considerable sum.

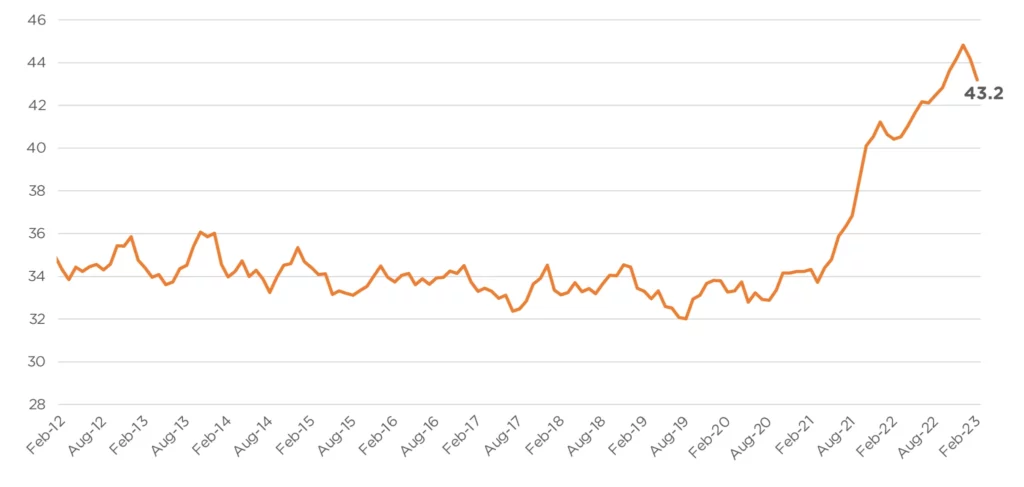

A study from Cox Automotive has revealed that declining new-vehicle prices, rising incentives, improved incomes, and slightly lower average new auto loan rates mean the number of median weeks of income needed to purchase a new vehicle declined to 43.2 weeks in February from a record 44.2 weeks in January.

Kelley Blue Book notes that the new-vehicle average transaction price declined 1.4 per cent in February from January and that in addition to the median income growing by 0.3 per cent in February, incentives from manufacturers increased. The month ended with an estimated typical monthly payment of a new vehicle falling 1.9 per cent to $765 from $781 in January and $789 in December 2022.

Read: Average New Car Prices Dip 0.6%, But Luxury Cars Take Larger Market Share

Despite these positives, purchasing a new vehicle in the U.S. still requires a huge portion of the median annual salary. From February 2012 until February 2021, the number of median weeks of income needed to make a new vehicle purchase hovered between 32 weeks and 36 weeks, significantly less than now.

“With prices easing down and incentives moving higher, new-vehicle affordability has slightly improved to start 2023,” Cox Automotive chief economist Jonathan Smoke said. “However, to put the payment in perspective, the typical American household can afford a car payment of around $400 a month. With an average monthly payment of nearly twice that, the new-vehicle market remains heavily skewed toward the most affluent buyers.”