Ford has revealed its earnings for the first quarter of 2023. While its EV unit may seem to be losing cash hand over fist, there’s more to it than that. Meanwhile, Ford’s ICE and commercial operations are raking in the moolah, keeping the company profitable for the time being.

For the first time, Ford has detailed earnings by its new divisions that were formed just over a year ago — namely, Ford Model e, Ford Blue and Ford Pro. As the name implies, Ford Model e deals in electric vehicles and digital connectivity, while Ford Blue handles the production of internal combustion vehicles. The third unit, Ford Pro, focuses on commercial vans and trucks.

Ford’s Huge Losses On EVs

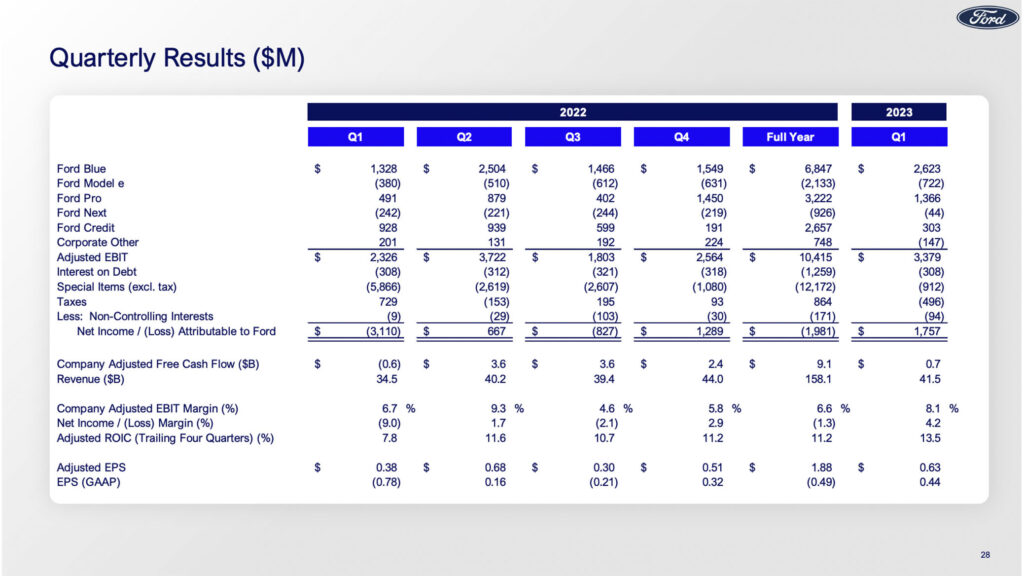

The headline figure from the earnings report is that the legacy car maker is losing an average of $58,333 per electric vehicle sold in the first three months of 2023. Ford only delivered 12,000 EVs for the first quarter, and in turn, Ford Model e lost $700 million (before interest and taxes) in the same period. Meanwhile, EV sales only generated $700 million in revenue, compared to $1.6 billion in the last quarter of 2022.

Related: Ford’s Electric Car Unit Braces For $3 Billion Loss In 2023 As It Invests In New Tech

No matter how you slice it, just under $60,000 per unit is a sizeable chunk of change to lose on each EV. However, there are several factors to consider. Firstly, volume is reduced thanks to scheduled downtime at the Cuautitlan plant in Mexico which produces the Mustang Mach-E. The temporary slowdown in production is to increase output at the plant to 210,000 per year by the end of 2023.

Similarly, Ford’s EV unit is hemorrhaging cash while scaling production. That includes $3.5 billion being spent on the Ford-owned LFP battery plant in Marshall, Michigan, and BlueOval City in Tennessee, which will produce Ford’s next-generation electric truck in 2025, with a capacity of 500,000 units each year.

Ford’s ICE And Commercial Vehicles Rake In The Cash

It’s a different story for Ford Blue, which reported net income before interest and taxes of $2.6 billion in the first quarter, for an operating margin of 10.4%. Leading this charge was the F-150, while Ford retains its position as America’s leading truck manufacturer, building one every 30 seconds.

While new product costs and inflationary pressures tempered profits, Ford Blue and Ford Pro helped see the Blue Oval return a 4.2% net income margin — the highest figure seen in over a year.

Sink Or Swim For EVs

Despite the staggering headline loss on each EV, there may be no cause for alarm. Unlike other manufacturers, Ford isn’t willing to throw in the towel on ICEs just yet, and the sustained profitability from the Ford Blue line gives the EV division a bit of breathing room.

While Tesla’s Model Y price cuts won’t help Ford’s bottom line — especially as the legacy automaker has had to make similar slashes to the Mach E’s price to keep it competitive — a higher volume of EV sales in Q2 could reduce the average loss.

Nevertheless, Ford’s play into the EV space is a long-term one, with the company predicting a $3 billion operating loss for EVs in 2023 — more than the $2.1 billion operating loss recorded in 2022. But with new models on the horizon, improved production facilities, and increased capacity set to come online in the next few years, investors will be keeping a close eye on how Ford performs. In fact, financial and investing advice company The Motley Fool reckons now may be the time to get in on the Ford action. They note that, while the EV business will take years to grow, if investors start to see improvements in margins over the next few quarters, it may be a sign of good things to come.