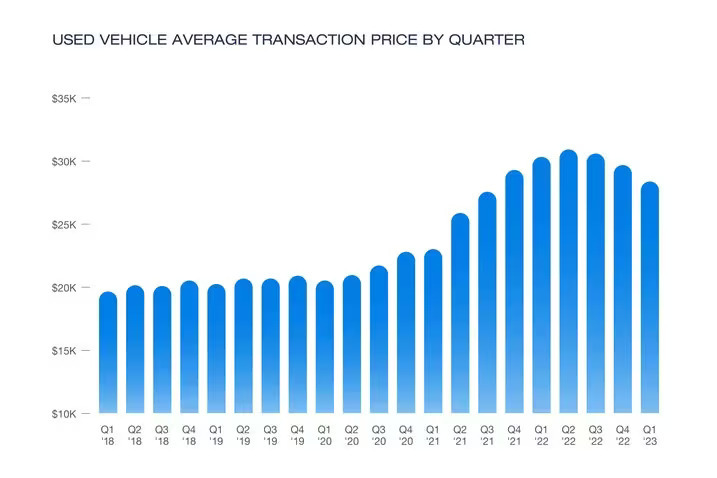

There’s good news and bad news for used vehicle shoppers. The good news is that the average price of a used vehicle fell by 6.4 percent in the first quarter of 2023, as compared to the same period in 2022. The bad news is, prices are still up a whopping 44 percent as compared to where they were before the pandemic.

“Consumers returning to the used market for the first time in years might find conditions a bit shocking,” said Ivan Drury, director of insights at Edmunds, which recently published the latest data on used vehicle prices. “Not long ago, $20,000 was seen as an acceptable amount to spend on a used car to get an optimal blend of miles and age. In today’s market, $20,000 puts consumers into a much older or much higher-mileage vehicle.”

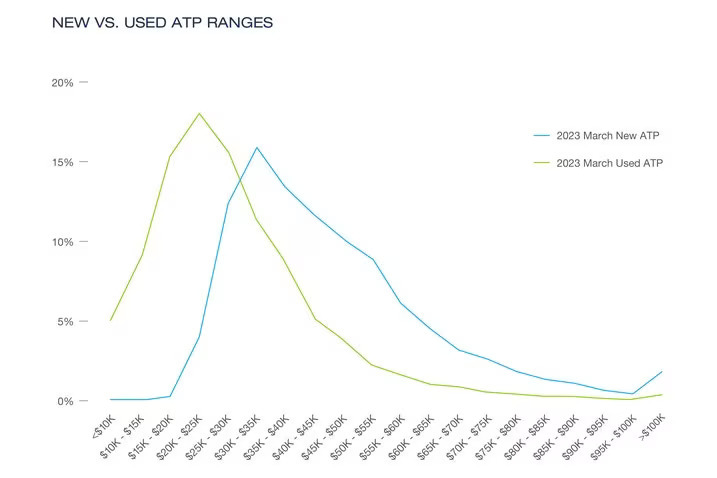

Indeed, five years ago, 60.5 percent of used cars were sold for less than $20,000. In the first quarter of 2023, that number was nearly halved, and sub-$20,000 vehicles made up just 30.6 percent of the overall market.

Although the number of affordable used vehicles is falling, there are still considerably more of them on the secondhand market than there are available from the factory. Less than one percent of the new vehicles sold in the first quarter of 2023 cost less than $20,000, meaning that there are still savings to be had on the used vehicle market.

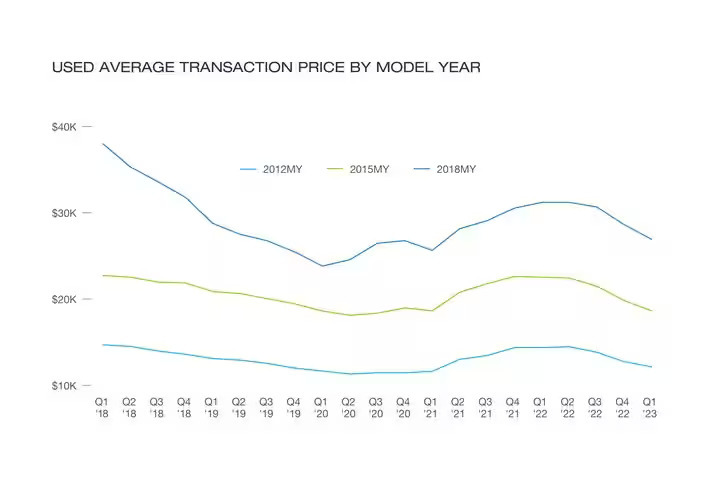

Meanwhile, people who have held onto their older vehicles have essentially been driving around for free. As the value of their vehicles falls due to mileage and use, market trends are there to catch them. For example, a five-year-old Camry with 60,000 miles costs about eight percent more today than a five-year-old Camry with 26,000 miles did in 2020.

Read: Used Car Prices Drop In April For The First Time In 2023

That’s good news for people looking to sell their used vehicle, and if they are willing to look around for the best price, they could be in for a surprisingly large payday. However, that’s a double-edged sword, and they will have to do a lot of shopping around if they intend to replace the car they sold with something newer.

“With demand and prices still high, shoppers really need to be active in search of the deal they desire and be prepared with an understanding of vehicle availability, financing options and their own budget long before they step into the dealership,” said Joseph Yoon, Edmunds’ consumer insight analyst.

And people on the used vehicle market will have to continue being savvy. Ultimately, Q1 2023’s small value drop for used vehicles isn’t likely to be the start of a market correction, and this simply looks like the new normal.

“If new car sales stall out, automakers and dealers could leverage heavier incentives to entice consumers into new purchases, which would in turn place downward pressure on used car values,” said Drury. “But since most automakers have been deliberate in aligning vehicle production and demand to avoid the inventory glut issues they faced prior to the pandemic, consumers probably shouldn’t count on any major bargains or discounts through the rest of the year.”