New passenger car registrations in Europe have jumped 16% to 960,191 units in April, thanks largely to increased demand for battery electric vehicles. Plenty of combustion-powered vehicles also enjoyed strong sales last month.

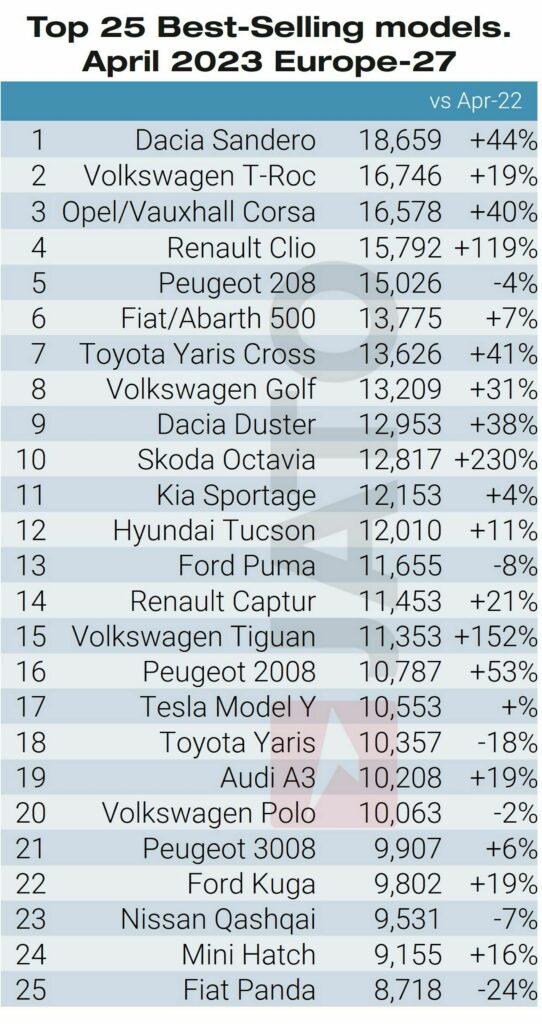

Europe’s best-selling model in April was the Dacia Sandero with a total of 18,659 units finding new homes, a massive 44% increase over April 2022. Other top sellers were the VW T-Roc (16,746 units), Opel/Vauxhall Corsa (16,578 units), Renault Clio (15,592 units), and the Peugeot 208 with 15,026 examples sold. Other best-sellers included the Fiat/Abarth 500, Toyota Yaris Cross, VW Golf, Dacia Duster, Skoda Octavia, Kia Sportage, Hyundai Tucson, and Ford Puma.

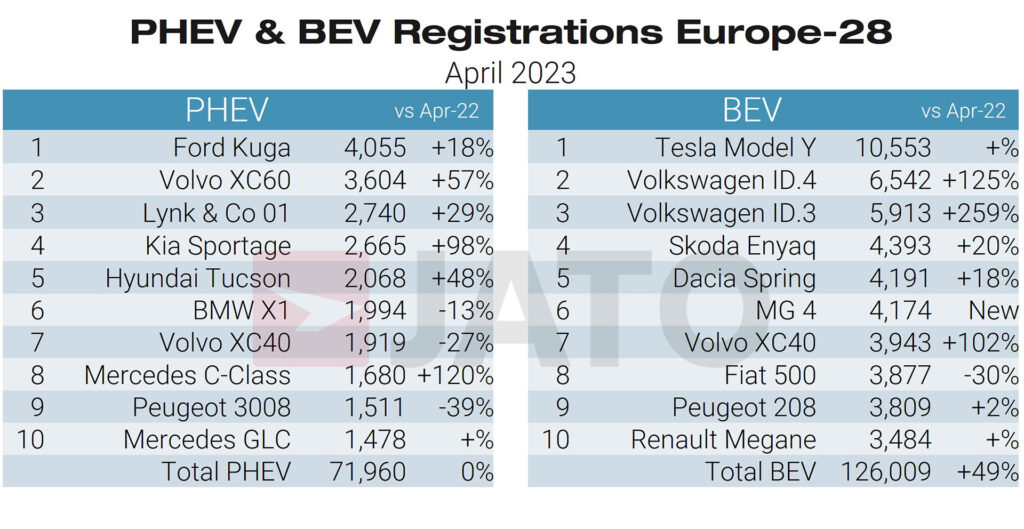

The Tesla Model Y remains the most popular EV with some 10,553 units sold in April, enough for it to retain its position as the best-selling new passenger car in Europe year-to-date. The next best-selling EV was the VW ID.4 with 6,452 units sold (a 125% increase from April 2022) and the VW ID.3 with 5,913 sold, a massive 259% increase from April last year. Rounding out the top 10 best-selling EVs were the Skoda Enyaq iV, Dacia Spring, MG 4, Volvo XC40 Recharge, Fiat 500e, Peugeot e-208, and Renault Megane E-Tech.

As for plug-in hybrids, the best-selling of them all was the Ford Kuga with 4,055 sales, positioning it above the likes of the Volvo XC60, Lynk & Co 01, Kia Sportage, and Hyundai Tucson.

Volkswagen remains Europe’s best-selling brand, selling 105,669 throughout the month, a 30% increase from April 2022. Audi took second place with 58,841 sales ahead of Toyota with 54,224, Renault with 53,013, and BMW in fifth with 52,673 new-vehicle sales. VW is also the best-seller of EVs, selling a total of 31,900 compared to the 14,200 sold by Tesla.

Read: Tesla Model Y Was Europe’s Best-Selling Car In Q1 2023

Data from JATO Dynamics also reveals that fewer Chinese-made vehicles were sold in Europe last month than some may suspect. Indeed, vehicles built in China accounted for just 3.4% of the market, totaling just shy of 32,000 units.

“These results are directly related to the easing of supply chain pressures which has increased the availability of new cars,” JATO Dynamics global analyst Felipe Munoz said. “On top of this, demand has continued to rise in response to the push from OEMs to widen their EV offering.”