The United Auto Workers union and big automotive brands like Ford are throwing big punches in the media. That continued yesterday, less than 24 hours away from what could be a historic strike with Ford’s CEO Jim Farley saying that accepting the current proposal from the UAW would bankrupt the company. That’s a bold statement considering that Ford is the only legacy American brand to never file for bankruptcy.

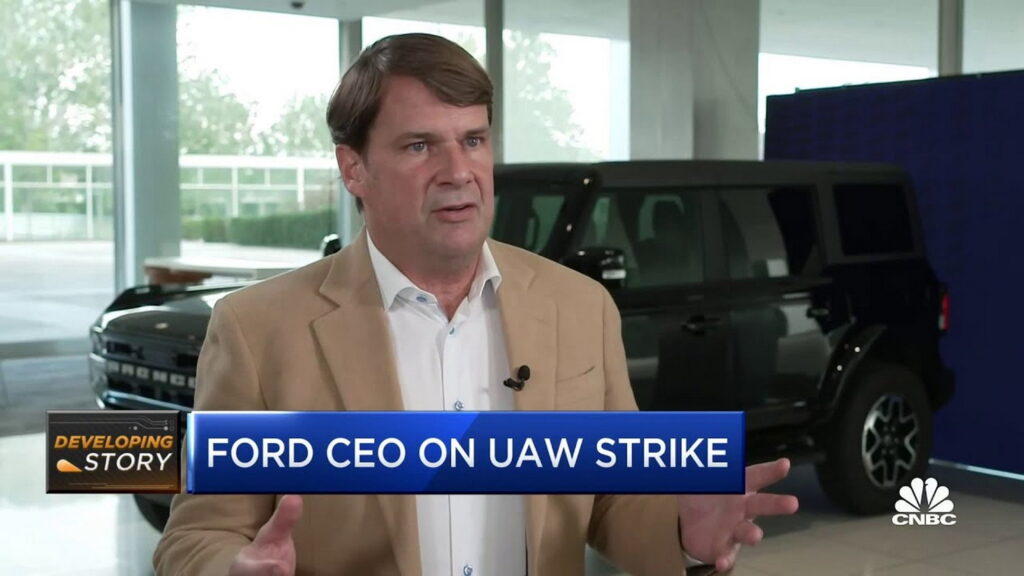

Speaking to CNBC, Farley laid out his position regarding the ongoing talks between the UAW and automakers. “Everyone imagines we’re in some room squirreled away doing this final negotiation and that’s what we’d love… but nothing is going on,” he says. “We’ve received no counter-offer from Shawn Fain and the UAW,” he continued.

Farley claims to not understand what is going on over on the UAW side: “In eighty years we’ve always been able to work through these differences because we’re always on the side of labor at Ford. We have the highest UAW headcount, we have more people than anyone, we build more vehicles, and we’ve never seen anything like this.”

More: UAW Threatens Strikes Against Stellantis, GM, And Ford, Could Cost Them $5 Billion

In fact, he presents the issue as “You want us to choose bankruptcy over supporting our workers.” Farley then said that the average pay under the unions’ proposal would be nearly $300,000 and compared that to the much lower figure that teachers, military members, or firefighters can sometimes make. Perhaps that’s a bigger indictment of how little those other professions make or how much more they need a union themselves.

In any case, Farley’s comments came mere hours away from what could be a major shutdown of production for Ford, General Motors, and Stellantis in the Motor City. “I’ll tell you this, I’m at peace with a decision to strike if we have to because I know that we’re on the right side of this battle,” Fain told CNBC. “It’s a battle of the working class against the rich; the haves versus the have-nots; the billionaire class against everybody else.”

The union is working to re-introduce cost-of-living adjustments, enhance profit sharing, and get closer to the kind of increases (percentage-wise) that executives at these companies enjoy on a regular basis.