Europe is investigating whether electric vehicles made by Chinese automakers benefit from unfair subsidies, and how it should react. However, the probe, accused by some of being protectionist, could cut both ways, as it may also impact nominally European vehicles that are made in China.

The European Union’s executive vice president, Valdis Dombrovskis, said on the heels of a trip to China that the investigation will not be limited exclusively to vehicles made by companies headquartered in the country.

“Strictly speaking, it’s not limited only to Chinese brand electrical vehicles, it can be also other producers’ vehicles if they are receiving production-side subsidies,” Dombrovskis told the Financial Times, responding to a question about brands like Tesla and Geely.

Read: How China Is Flooding The World With Cheap EVs — And Why Europe Wants To Stop It

The former, although headquartered in the U.S., receives a number of unusual advantages from China, such as the freedom no to have to collaborate with a local joint venture partner, as well as tax breaks, cheap loans, and other forms of assistance. These have made it easier for Tesla to build Model 3s in Shanghai and export them to other markets, such as Europe.

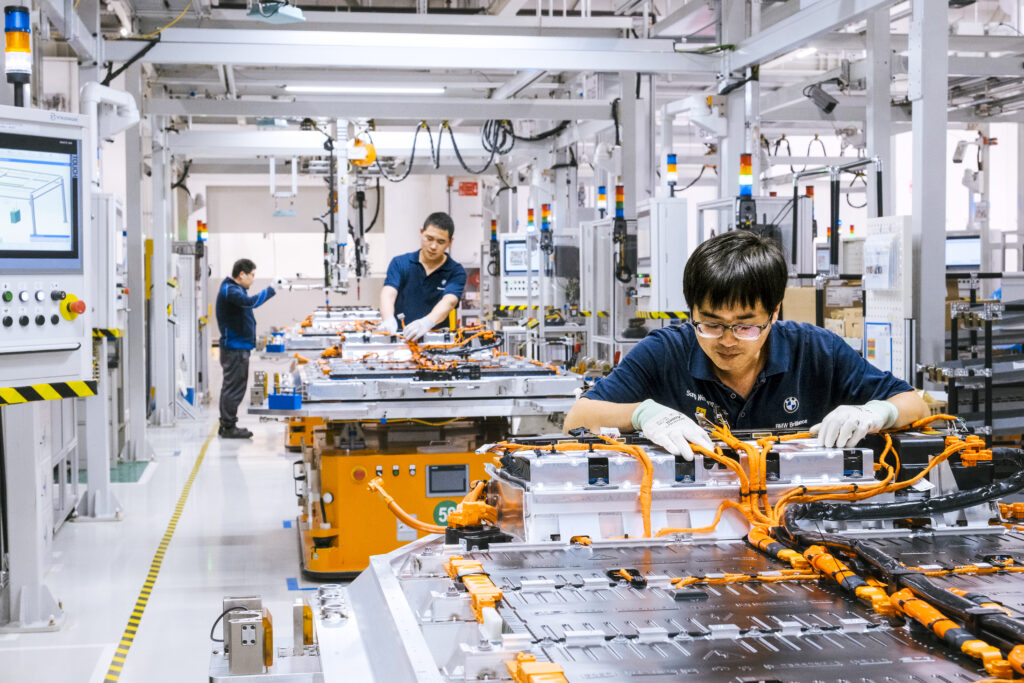

Meanwhile, Geely owns Volvo and Polestar, both of which produce electric vehicles in China, despite still considering themselves to be European brands. In addition, automakers like BMW and Renault produce vehicles in China that are sold in Europe, including the iX3 and Dacia Spring EVs respectively.

The European Union announced its anti-subsidy investigation earlier this month. The second-largest market for electric vehicles in the world (China is number 1), it has become a valuable marketplace for Chinese EV manufacturers that have had the opportunity to build up their manufacturing networks thanks, in part, to that country’s subsidies.

As European automakers now fight to get their own EV manufacturing infrastructure up to speed, the EU is concerned that China’s early start may give it an advantage over its automakers, and may make local production sites vulnerable.

For its part, China appears to be watching the EU’s investigation closely, as it seeks to promote the interests of its automakers. With the U.S. market effectively closed to China as a result of a 27.5 percent tariff, Europe is fertile ground for its automakers to grow sales. However, depending on the results of the EU’s investigation, fears that American-style tariffs could come into place are prompting strong reactions from Chinese politicians, Dombrovskis said.