While some brands continue to attract consumers back to their dealerships, rebounding post-pandemic vehicle inventory means that fewer and fewer new vehicle shoppers are loyal to the brand they currently drive.

“As vehicle availability increased and more choices hit the market for consumers, loyalty among brands as a whole saw a decline this year,” said Tyson Jominy, vice president of data & analytics at J.D. Power. “Additionally, owners were tied down to their vehicles for longer than normal due to ongoing supply chain disruptions, and as a result were more likely to experience problems with their vehicles.”

However, there are some things that brands can do to encourage their customers to remain loyal, argues Jominy. When they experience excellent build quality or a good ownership experience, shoppers tend to reward brands by returning to them.

Read: Here’s What Tesla Owners Are Buying Next

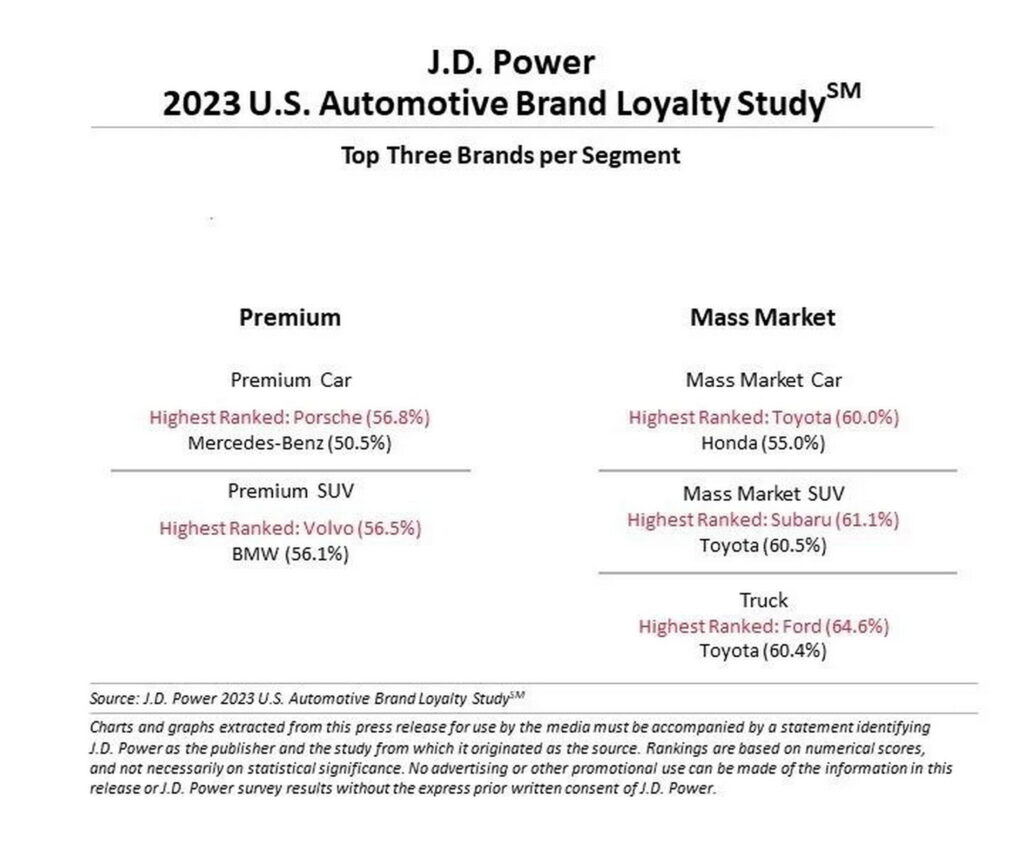

Right now, that means that the same familiar brands are at the top of J.D. Power’s brand loyalty index. For example, Porsche leads the rankings for premium car brands for the second year in a row, with a loyalty rate of 56.8 percent. It is followed by Mercedes, whose rate is at 50.5 percent. Among mass market car brands, Toyota is the highest ranking with a rate of 60 percent, and it is followed by Honda, whose rate is at 55 percent.

Stiff competition in the premium sector means that loyalty is relatively low in the SUV segment. Whereas Volvo leads the way for premium brands, with a loyalty rate of 56.5 percent (BMW ranks second with 56.1 percent), mass market brands’ customers are more loyal. Subaru leads Toyota in terms of mass market SUV loyalty, with rates of 61.1 percent and 60.5 percent, respectively.

Finally, for the truck segment, Ford leads the way with a loyalty rate of 64.6 percent. Surprisingly, it isn’t one of its Detroit rivals that ranks second. Instead, Toyota’s truck buyers are the next-most loyal customers, with a rate of 60.4 percent.