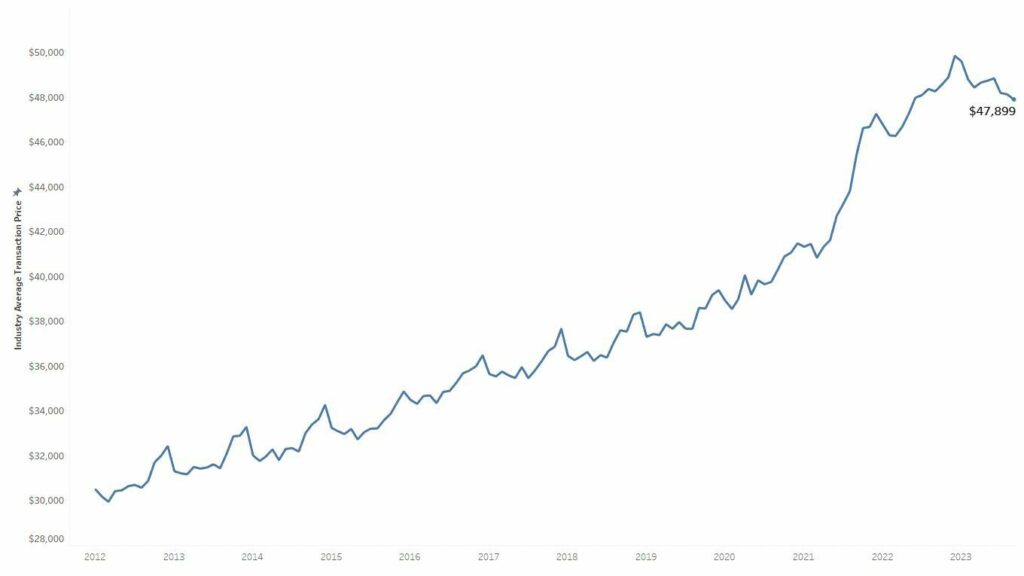

The average transaction price of a new car sold in the U.S. has fallen yet again, meaning new car buyers are finally starting to get some reprieve. However, buying a new car in the U.S. remains a costly endeavor.

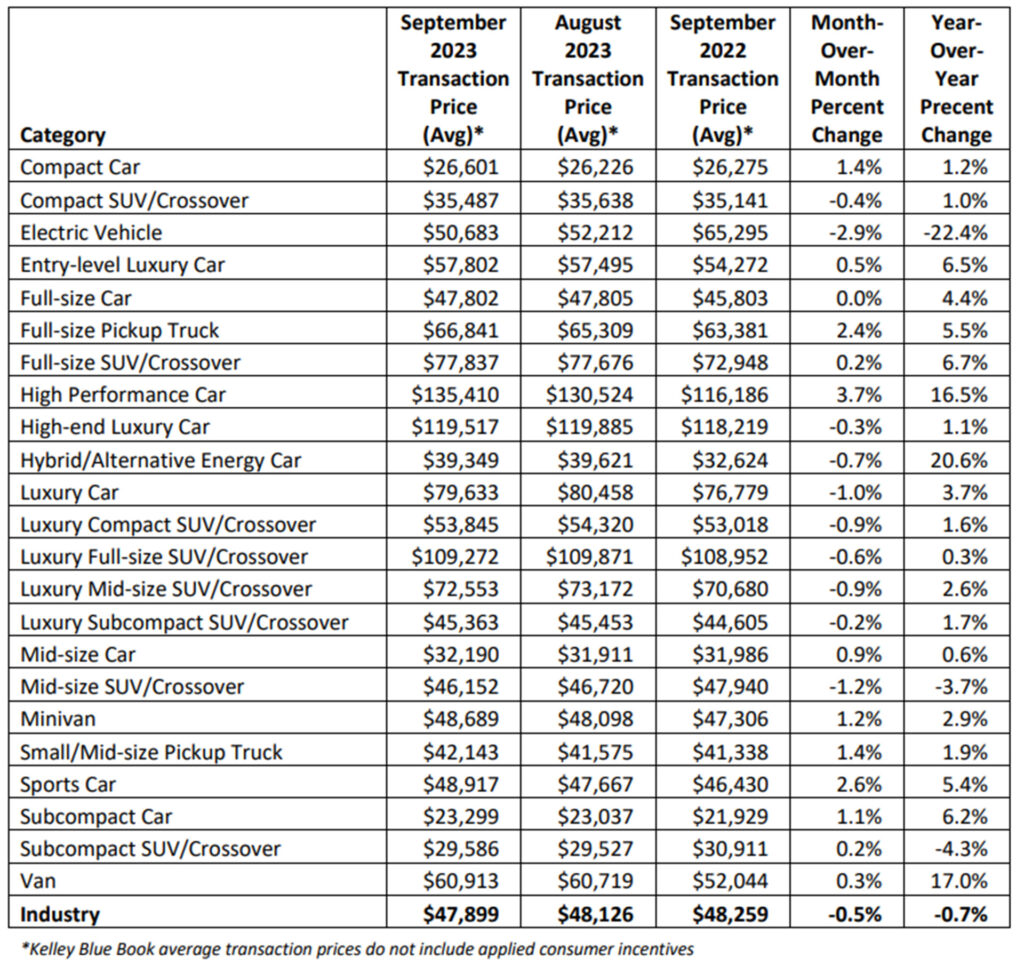

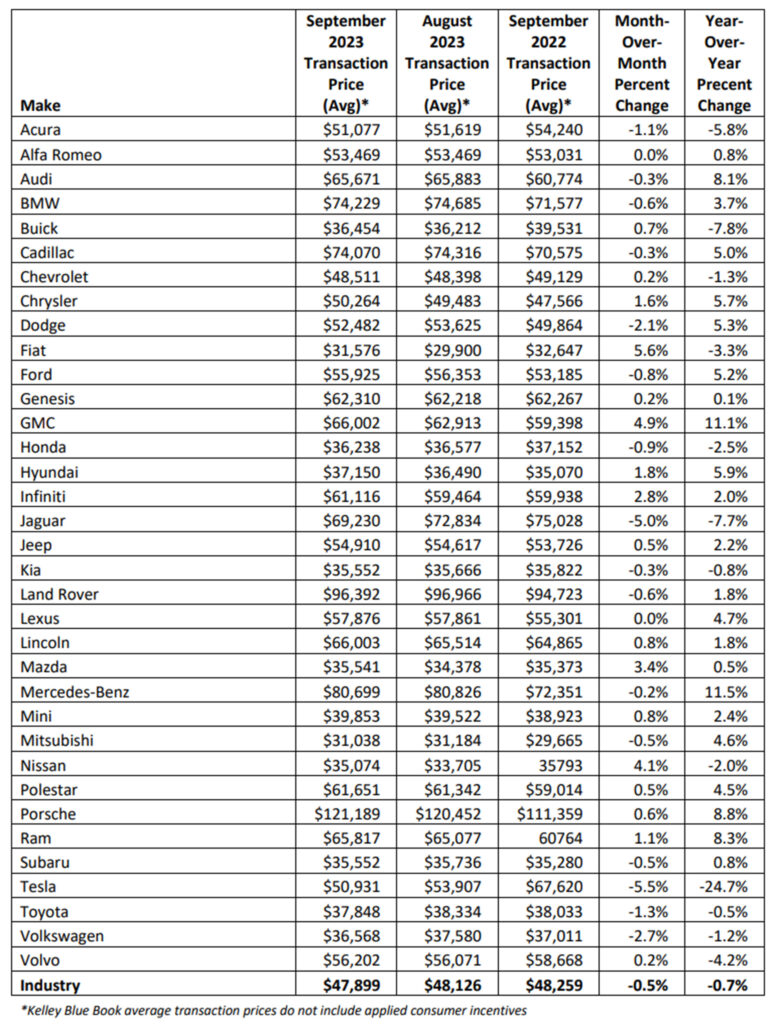

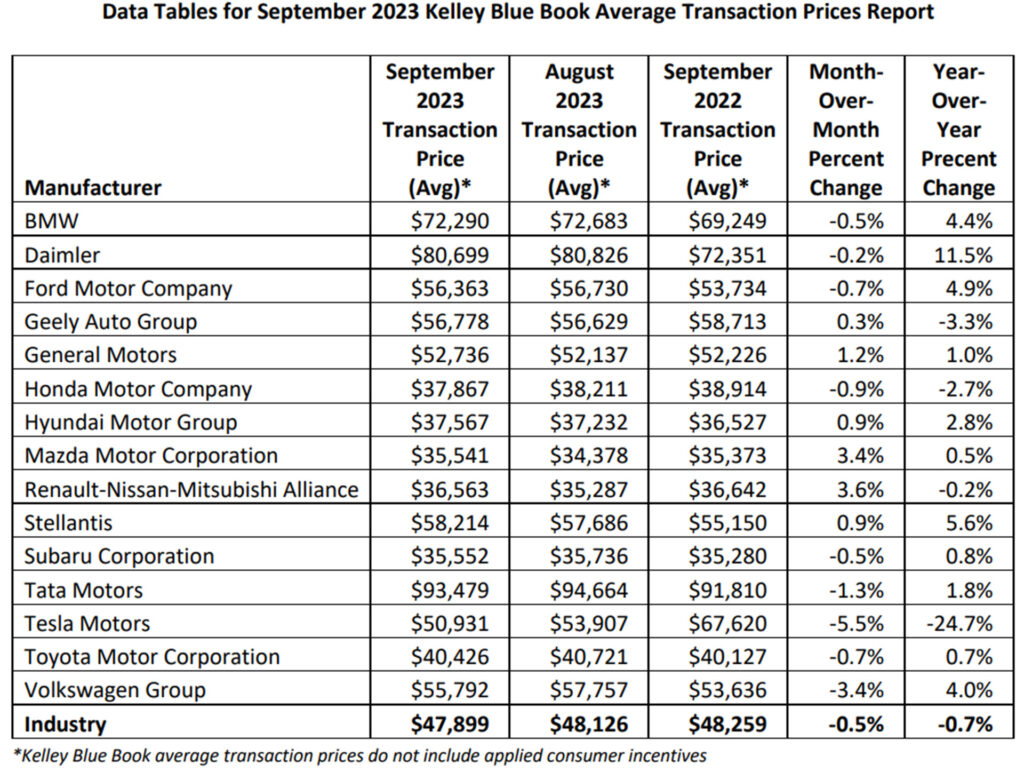

Data from Cox Automotive reveals that the average transaction price (ATP) for a new vehicle sold in September was $47,899. This represents a fall of $360 or 0.7% from September last year and is down $227 (0.5%) from August. The ATP in August 2023 had originally been forecast at $48,451 but it was later downwardly revised to $48,126.

The ATP for vehicles competing in the non-luxury space last month was $44,626 and while that represents a 1% increase from a year ago, it is down $82 from last month. The prices of luxury vehicles fell by a more significant $873 from August and were down 6.2% to $62,342 compared to last year.

Cox Automotive notes that luxury price declines this year can be largely attributed to various price cuts made by Tesla throughout the year. In fact, its average transaction prices are down 24.7% compared to September 2022 and its ATPs now fall below Acura, Lexus, Infiniti, and Volvo. The prices of many other luxury carmakers have jumped in recent times. Data reveals that Audi, Mercedes, and Porsche all saw ATPs jump compared to September 2022 with Mercedes up more than 10% and Audi and Porsche each jumping by over 8%. The likes of BMW, Cadillac, Infiniti, Land Rover, and Lexus also reported recent price increases.

Read: Have New Car Prices Finally Hit A Ceiling After Years Of Increases?

“After new-vehicle prices peaked at nearly $50,000 at the start of 2023, we’re seeing average transaction prices dip below $48,000 for the first time in more than a year,” Cox Automotive research manager Rebecca Rydzewski said. “Dealers and automakers are feeling price pressure, and with auto loan rates at record highs and growing inventory levels, new-vehicle prices continue to ease. Assuming the UAW strike is short-lived, current inventory levels are healthy enough to prevent any significant impact on consumer prices.”

Unsurprisingly, the ATPs of electric vehicles are also falling, again led by Tesla’s price cuts. The ATP for an EV sold in September was $50,683, down from $52,212 in August and well down on the $65,000 a year ago.

Incentives are on the rise. They jumped to an average of $2,368 in September, the highest they’ve been in 24 months and representing 4.9% of ATP.