The Volkswagen Group has reported an impressive jump in battery-electric vehicle sales this year but its order banks are shrinking, reflecting a broader decline in demand for new EVs being encountered by many other car manufacturers.

In the first nine months of 2023, the VW Group delivered some 531,500 battery-electric vehicles around the world. This represents a 45% increase over the same period in 2022 and means BEVs accounted for 7.9% of all VW sales. Europe remains the company’s most important market for BEVs with deliveries increasing by 61% there to 341,100 units, but the U.S. also proved strong, experiencing a 74% increase in deliveries to 50,300 units.

The VW Group’s BEV sales in China also rose by 4% to 117,100 units and the conglomerate expects to end 2023 with between 8-10% of total deliveries being BEVs.

Read: VW ID.3 Battery Longevity Test Shows It Has 93% Capacity After 62,000 Miles

Despite these positive results, Volkswagen chief financial officer and chief operating officer Arno Antlitz noted that BEV order banks had slipped to 150,000 units at the end of Q3, down significantly from the 300,000 from last year. While speaking about shrinking order banks earlier this month, VW’s marketing and sales boss Hildehard Wortmann blamed it on lower demand, Electrek reports.

“Our order intake is below our ambitious targets due to the lower-than-expected overall market trend,” he said.

VW’s best-selling EV through the January-September period were the ID.4 and ID.5 twins, selling a combined 162,100 units. The ID.3 came home second with 90,500 sales and was followed by the Audi Q4 e-tron with 77,900 sales, the Skoda Enyaq iV at 54,400, the Cupra Born with 32,300 units sold, and the Audi Q8 e-tron with 21,800 examples finding new homes.

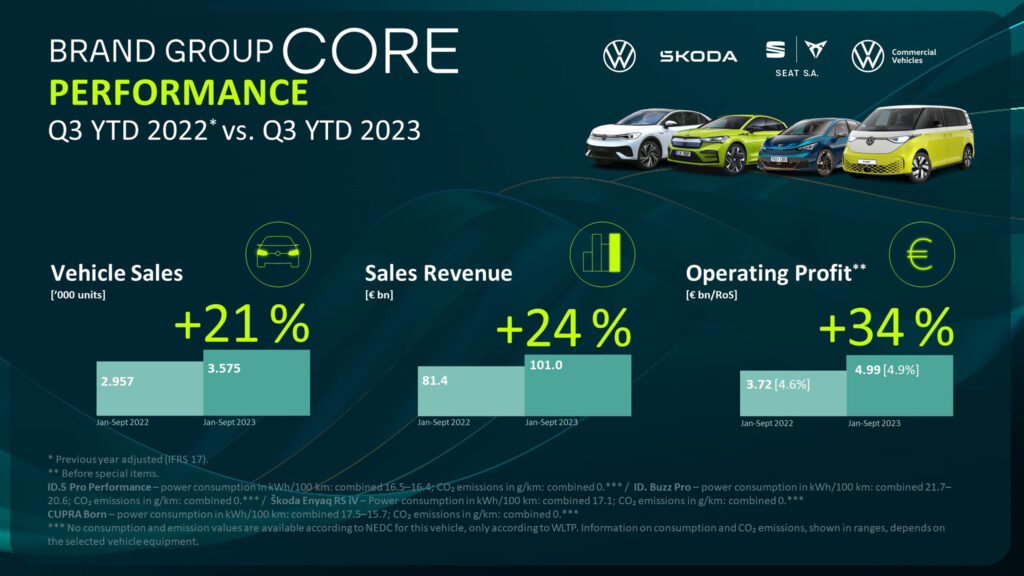

Looking at the VW group’s overall financial performance this year reveals that operating profit has fallen 7% to 16.2 billion while overall vehicle sales are up 8% to 6.8 million units.

“Overall, we are on a robust course and have again increased sales volumes and revenues in the third quarter,” Antlitz said. “However, we cannot be satisfied with our profitability, which in the third quarter fell short of our ambitious targets. We are now concentrating on the systemic implementation of the 10-point plan and our cross-brand performance programmes.”