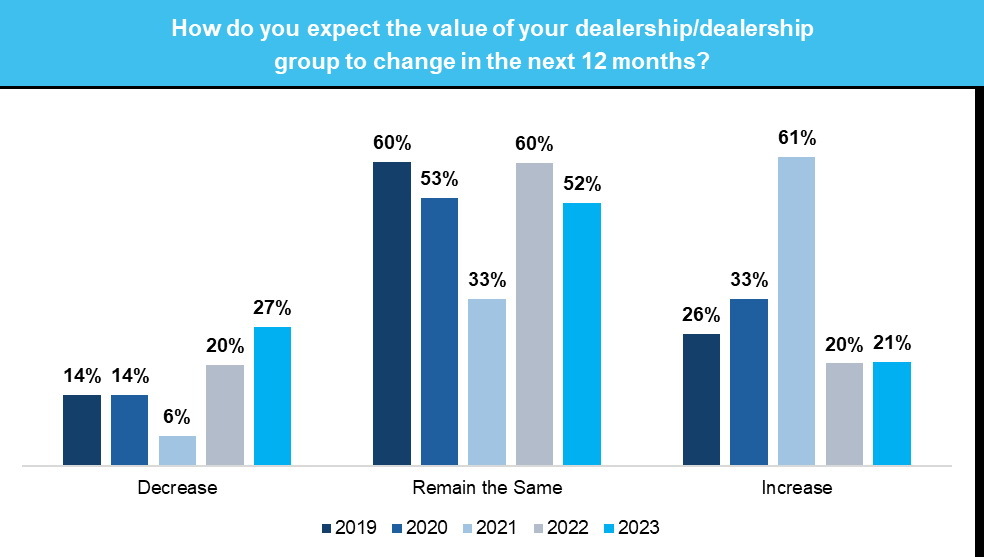

America’s car dealers have high hopes for the automotive industry in 2024, new research from Kerrigan Advisors has found. Of the 650 dealers it surveyed anonymously, 52 percent are expecting their businesses’ valuations to stay high over the next 12 months. The strong performance, and the expectation that the good times will keep on rolling, means that dealers are looking to invest in their businesses.

“Positive sentiment is leading nearly half of all dealers to seek acquisitions and expansion, certainly an endorsement of the industry’s future,” said Erin Kerrigan, Founder and Managing Director of Kerrigan Advisors. “Dealerships remain one of the most lucrative investments dealers can make in the private sector with an average return on equity of 33% in 2023.”

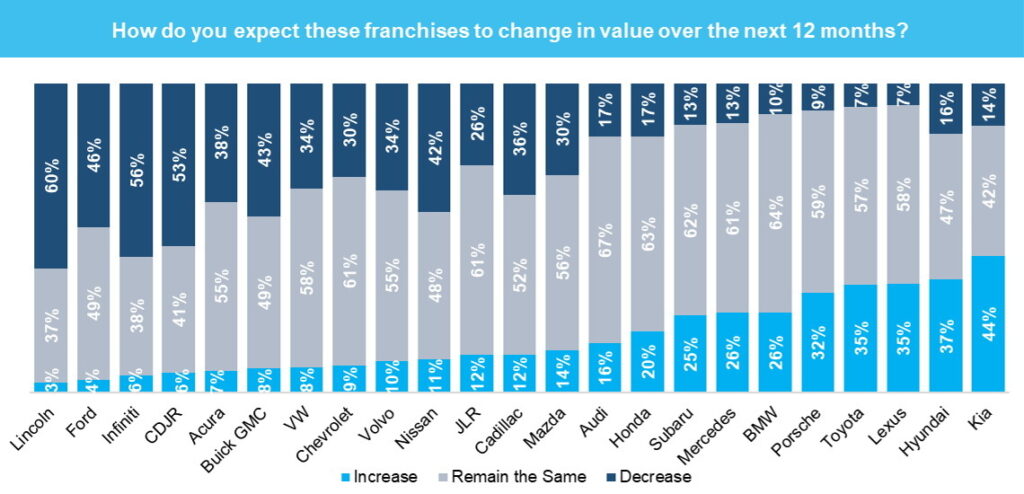

The automotive brands dealers expect to gain the most are Kia, Hyundai, Lexus, Toyota, and Porsche, reports Kerrigan. In fact, 44 percent of dealers expected the valuation of Kia dealerships to increase, which is twice the industry average.

Read: Americans Love Full-Size SUVs And The Pandemic Helped Turbocharge Sales

However, Kia and Hyundai weren’t among the brands the dealers trusted the most. That honor goes to Toyota and Lexus. When surveyed, a staggering 72 percent of dealers expressed a high level of trust in the Japanese automaker, three times more than the industry average.

Kerrigan argues that much of this disparity comes down to the brands’ differing approaches to electrification. Dealers remain unhappy about automakers’ EV strategies, especially as the vehicles have started lingering on lots for longer, making Toyota’s slow and steady approach appealing to them.

This discontent is reflected in the list of brands dealers trust the least. Topping the charts are Ford and Lincoln, which were also the brands whose valuations were the least expected to increase. That may explain why the automaker is revisiting its EV plans.

Most and Least Trusted Brands According to Dealers

Ford told Auto News that its dealers are an “important strategic partners and we are always listening and making adjustments. Working with our dealers, we have made recent beneficial changes to address dealer feedback and improve franchise value.”

Electrification wasn’t the only reason dealers distrusted brands, though. Stellantis’ Chrysler-Jeep-Dodge-Ram (CDJR) dealers were among the franchises dealers most expected to lose value in the coming 12 months. That’s as a result of rising inventory levels, and a lack of incentive spending.

However, the majority of dealers remain optimistic about the wider automotive industry in the coming year, with 62 percent believing that their earnings and valuations will remain as high as they are now, or close to it. Kerrigan calls that a ringing endorsement of the automotive industry’s future.