General Motors has provided a wide-ranging business update following a handful of tough developments as well as new labor deals in the United States and Canada.

Starting with the latter, GM noted UAW members will receive a 25% wage increase, cost-of-living adjustments, a 3.6% increase in retirement contributions, an additional holiday, and a signing bonus of $5,000 (£3,935 / €4,555).

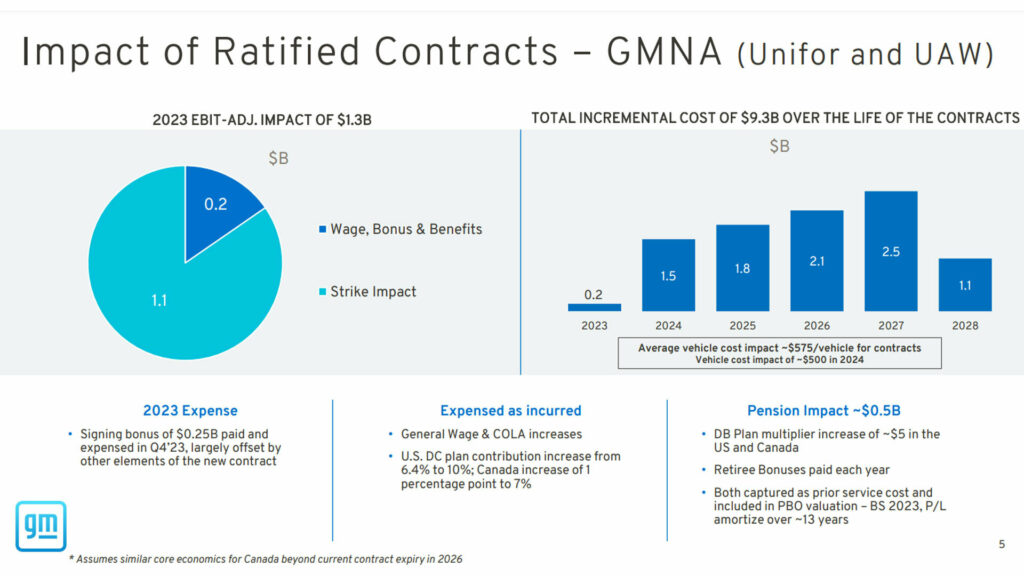

Those expenses add up and the company is expecting a total incremental cost increase of $9.3 (£7.3 / €8.5) billion over the life of the contracts with Unifor and the UAW. GM went on to say the average cost impact is expected to be around $575 (£452 / €524) per vehicle.

More: General Motors UAW Workers Ratify New Deal After Hotly Contested Vote

That’s a lot of money, so the automaker will embark on some “profitability actions.” These include increasing the profitability of electric and ICE-powered vehicles through “efficiencies in design, engineering, manufacturing, marketing and distribution.”

The company also expects billions in savings from a cost reduction program and is gearing up to launch new ICE-powered SUVs that are more profitable than their predecessors. In the face of questionable EV demand, the company is adopting an “agile approach” in order to “optimize profitability,” while balancing production and changing market dynamics.

That being said, the automaker estimates the strikes cost them $1.1 billion (£866 / €1 billion). This was mostly attributed to a loss of approximately 95,000 vehicles that weren’t built.

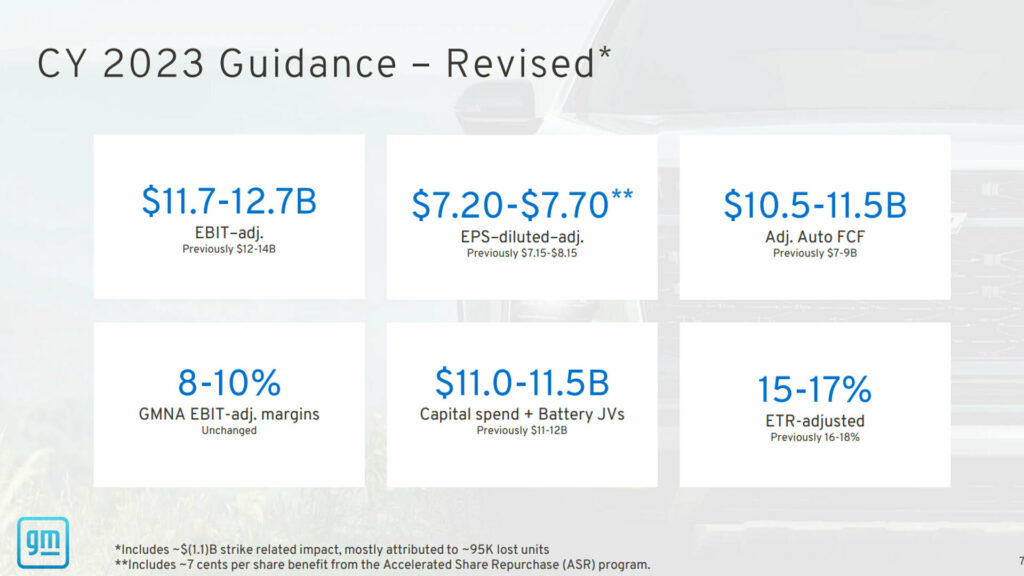

Given all of these developments, it’s not surprising that GM updated their guidance for 2023. Net income attributable to stockholders is now projected to be $9.1 – $9.7 (£7.2 – £7.6 / €8.3 – €8.8) billion, compared to previous estimates of $9.3 – $10.7 (£7.3 – £8.4 / €8.5 – €9.8) billion.

While we won’t delve into the financials too much, the company declared a fourth-quarter dividend of $0.09 (£0.07 / €0.08) per share. However, in a move designed to appease shareholders, the company announced plans to raise the dividend to $0.12 (£0.10 / €0.11) beginning in 2024.

On top of that, the automaker announced a $10 (£7.9 / €9.1) billion share repurchase program. It’s expected to be complete by the fourth quarter of next year and the move helped to send the stock up more than 9% on Wednesday.

In a letter to shareholders, GM CEO Mary Barra said “With clarity on our labor costs and production back on track, we are returning to our capital allocation framework by repurchasing $10 (£7.9 / €9.1) billion of common stock through an accelerated share repurchase program, raising our common stock dividend by 33% starting in 2024, and reinstating our 2023 earnings guidance.”

The executive went on to highlight “very strong” cash generation and record levels of liquidity. However, it’s not all good news as Barra stated she was “disappointed with our Ultium-based EV production in 2023 due to difficulties with battery module assembly.” She also noted “challenges at Cruise” as the autonomous driving firm “must rebuild trust with regulators at the local, state and federal levels” as well as with first responders and communities.

Despite these setbacks, Barra said “The profitability and cash generation of our ICE business remains strong because we’ve made strategic investments for growth in high-margin segments. We’ve spent years preparing the company for an all-electric future, and our long-term EV profitability and margin goals are intact, despite recent headwinds.”