Chinese EV manufacturer Nio is planning to cut its workforce by 10 percent in November, as it chases improved efficiency and lower costs. Despite rising sales, the automaker is facing pressure from competitors and a price war that is affecting profitability.

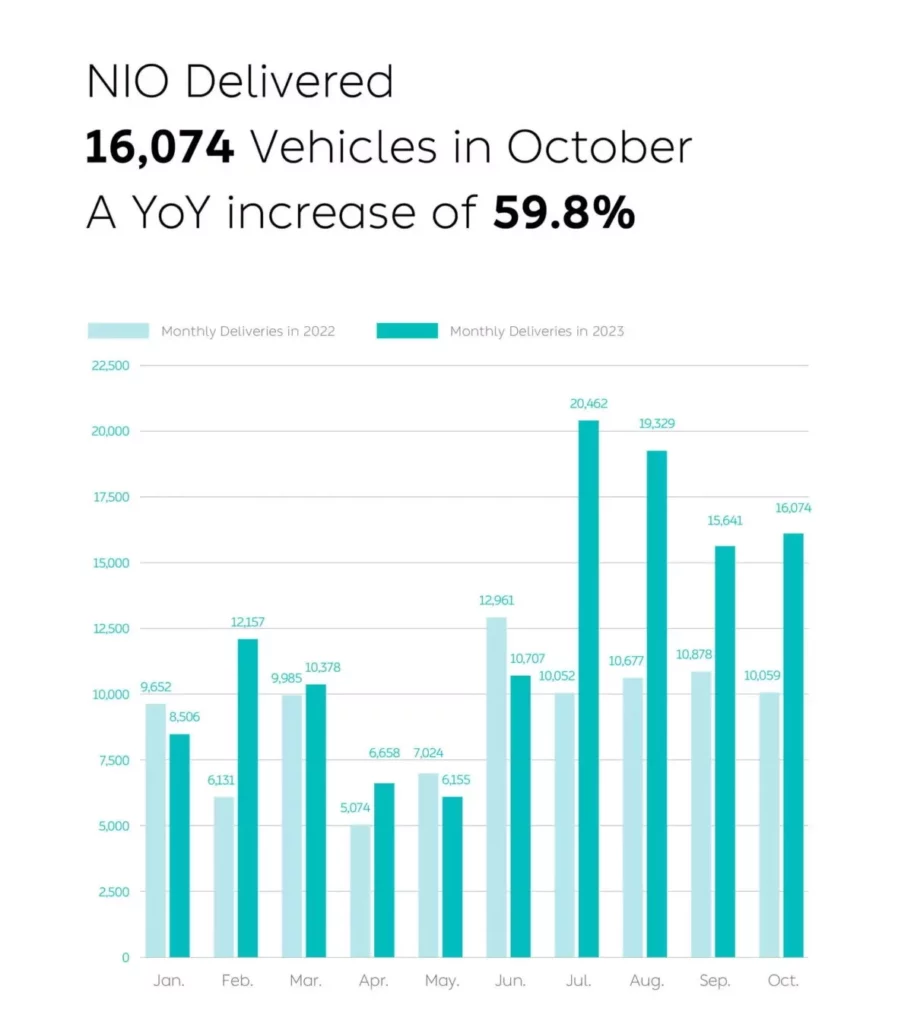

Nio announced on November 1 that it had sold 16,074 vehicles in October. That was an increase of nearly 60 percent, as compared to October 2022. Cumulatively, it has sold a total of 126,067 vehicles this year, an increase of 36.3 percent as compared to the same period last year.

That’s a big rally, considering it sold just 6,155 vehicles in May, which was 12 percent less than it managed in May 2022. Despite the recovery, and the strong sales turnaround in the latter half of the year, the automaker still believes it can do better.

Read: Nio Loses $35,000 A Car. That Should Scare The U.S. And Europe

Nio still has “a gap between [its] overall performance and expectations,” it said in an email to staff seen by Reuters. “This is a tough but necessary decision against the fierce competition.”

Although its sales continue to increase, its profit margins are being hurt by an EV price was launched by Tesla. In fact, reports indicate that the brand loses $35,000 per vehicle is sells. Adding to its troubles, Chinese consumers are increasingly turning to even more affordable plug-in hybrid vehicles, sales of which have increased by 84.5 percent in the first nine months of 2023.

In a sign of how seriously it is taking its performance gap, it is not limiting its cost-cutting efforts to layoffs. Nio says it also deferring or cutting long-term project investments that will not contribute to its financial performance within the next three years.

Last month, reports indicated that Nio is also considering launching a dealer network in Europe, a market it is attempting to break into. It hoped that better service will help accelerate sales of its EVs, and ease pressure on the division, which is currently losing money for the company.