As has been covered extensively, the electric vehicle market is experiencing something of a slowdown, as consumer demand for the novel technology chills. New research from S&P Global suggests that the biggest factor in this turn away from EVs is the high price of getting into one.

In North America in particular, the majority of EVs are larger, more luxurious vehicles with high MSRPs. However, even in other parts of the world where more affordable EVs exist, like China, the price premium that batteries and electric motors bring is pushing customers away.

Almost half of consumers surveyed by S&P Global around the world said that they considered EV prices to be too high. While they understood why the technology carries a premium, they said that getting into it costs too much.

It’s not hard to understand where consumers are coming from. In a period when average monthly payments for new cars have hit all-time highs in the U.S., and are dangerously high for people buying used vehicles, price has become a bigger focus.

Read: You’re Now Paying An Average Of $533 Per Month For A Used Car – And That’s A Risk For Everyone

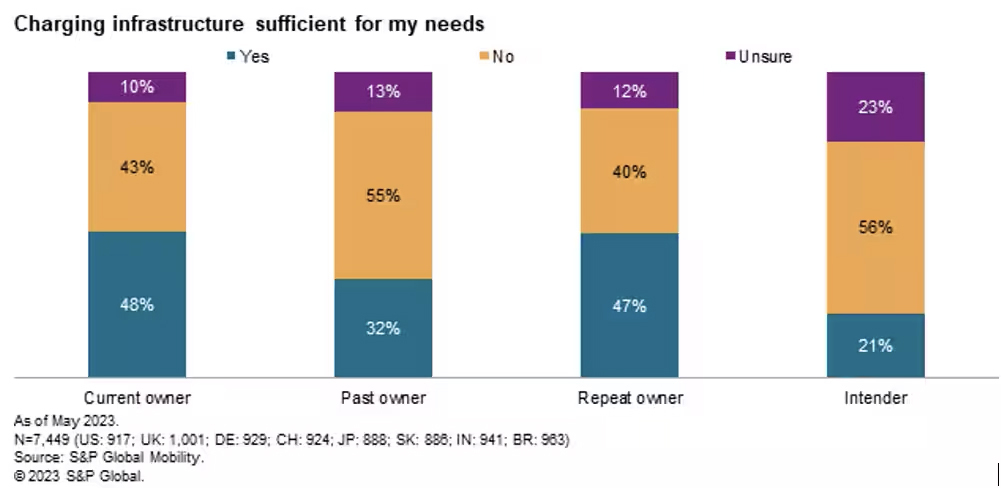

However, it is not the only one. While price is the biggest barrier to EV adoption, the practical reality of driving on battery power is still a concern. Of the consumers surveyed by S&P Global, 46 percent said they were worried about how long charging takes, and 44 percent were concerned about the availability of stations.

Although the majority of people surveyed were willing to wait between 30 and 60 minutes to charge a vehicle, recent reports about the reliability of America’s infrastructure, and the relative rarity of stations (as compared to gas stations), means that the question of refilling a battery still weighs on consumers. Fortunately, collaboration between traditional automakers and Tesla may help address that concern in the U.S.

Interestingly, charging at home isn’t yet the solution many hoped it would become. Just 51 percent of EV owners said they have a charger at home, and most are unwilling to pay extra to install a Level 2 fast-charger in their garage, if they have one. Instead, most are willing to charge at work, or at a public charging station, which could increase the cost of ownership.

The good news for automakers is that range anxiety appears to have been quelled, if not completely cured. Just 29 percent of people said they expected a vehicle to be able to drive more than 300 miles (483 km) per charge. Meanwhile, 19 percent said they would be fine with a range of between 251 and 300 miles (404 – 483 km), while 21 percent said 201 to 250 miles (323 – 402 km) would be fine, which means that there are plenty of vehicles on the market that match the expectations of buyers.

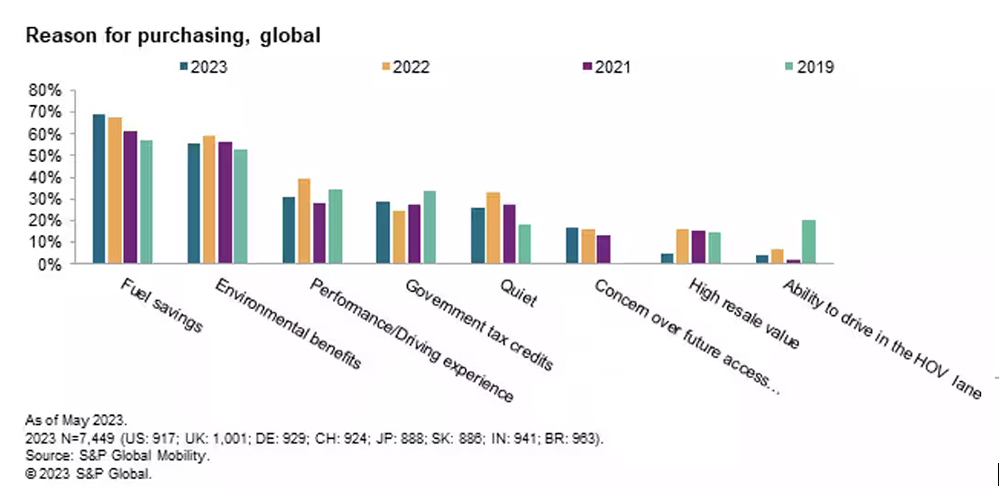

For those who are actively interested in buying an EV, the reasons remain consistent. The biggest appeal is the fuel savings (which 69 percent of respondents cited), then the environmental benefit (56 percent) and the third-biggest reason is the performance and driving experience (31 percent).

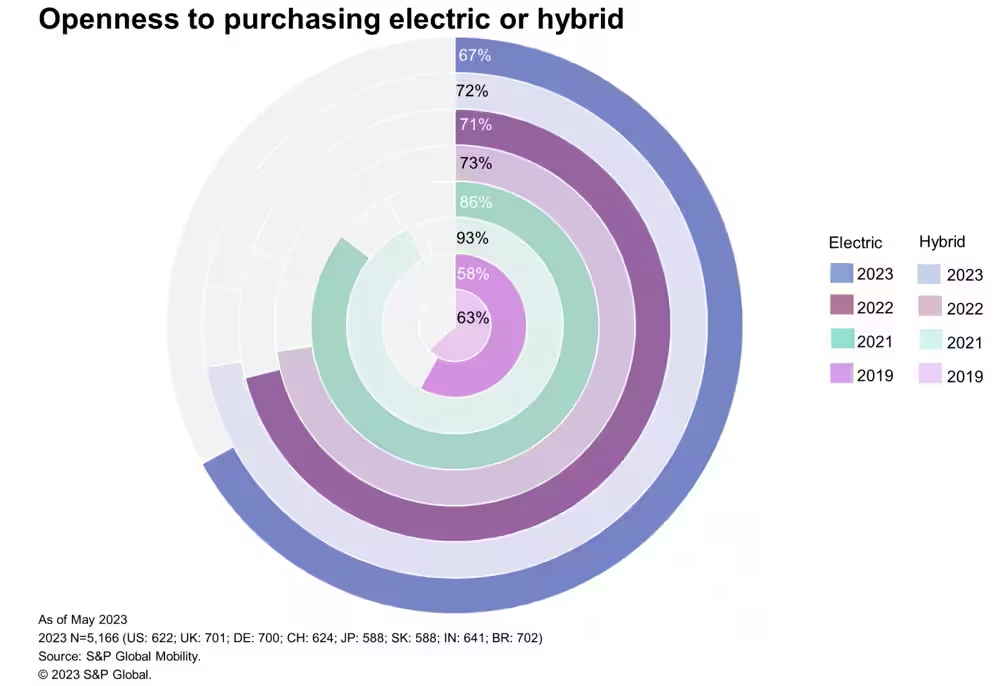

Those positives aren’t as appealing as they were two years ago, though. In 2021, 86 percent of consumers said they were open to buying an EV as their next vehicle. Now, pricing and charging concerns mean that just 67 percent are open to buying one. The silver lining for automakers who are investing in the technology is that their new vehicles, and the wider variety of choices they present, mean that more consumers are looking at an EV today than they were in 2019, when just 58 percent buyers were open to the idea.