The mid-range 2024 Tesla Cybertruck officially qualifies for the full $7,500 federal EV tax credit in the U.S. but getting your hands on one before the end of the year may be difficult, if not impossible.

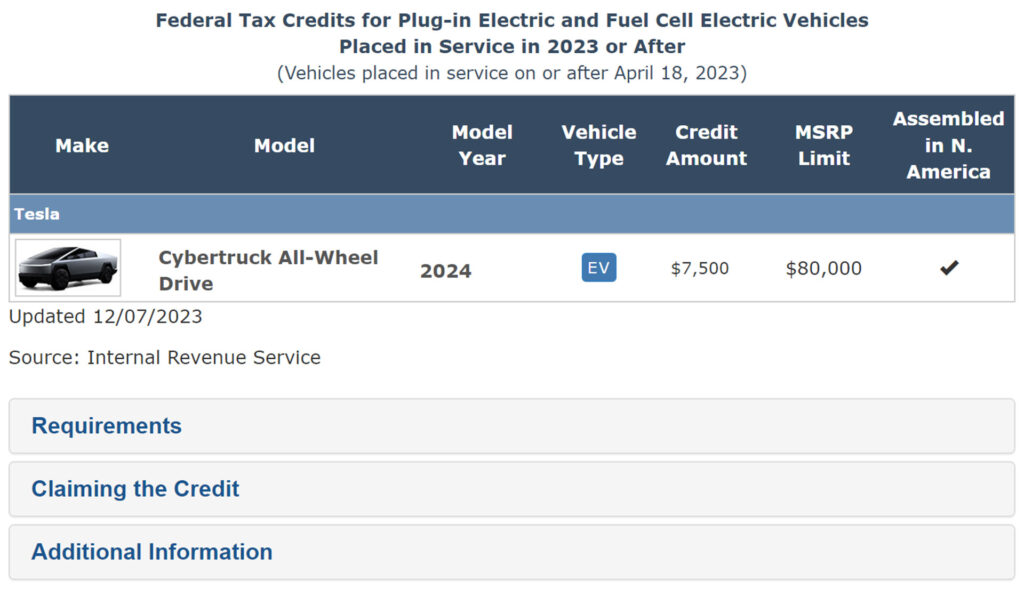

The website for the Internal Revenue Service (IRS) was recently updated to include the new Cybertruck All-Wheel Drive and also temporarily listed the Cybertruck tri-motor ‘Cyberbeast’ as being eligible for the tax credit if placed in service before December 31, 2023. The website since appears to have been updated to no longer include the Cyberbeast as it starts at $99,990, well over the $80,000 cap on vehicles that are eligible for the credit.

Read: Tesla Cybertruck’s $50,000 No-Resale Clause Returns After Flippers Sell Reservations

Tesla’s mid-range Cybertruck All-Wheel Drive has an MSRP of $79,990, allowing it to just slide below this cap. However, InsideEVs reports that deliveries of this version will only start in 2024, placing it outside of the eligibility requirements. The entry-level Cybertruck priced from $60,990 won’t arrive until 2025.

It remains unclear if the Cybertruck will be eligible for the full $7,500 tax credit next year as, from January 1, changes are being made to eligibility requirements. As recently announced by the Biden administration, EVs will be ineligible for the full tax credit if any of the battery components are made or assembled in a foreign entity of concern, consisting of China, Iran, North Korea, and Russia. Tesla has already confirmed that the Model 3 Rear-Wheel Drive and Model 3 Long Range will only be eligible for a $3,750 credit from January 1 because their battery packs contain components from China.

Tesla produces the Cybertruck at its factory in Texas and also assembles its 4680 battery cells in the Lone Star State so it’s possible it will get the full credit.