Tesla and SpaceX CEO Elon Musk said on Monday that he wants 25% of the electric automaker’s voting power to strengthen his control over the company. Musk currently owns approximately 13 percent of Tesla, having sold over $23 billion worth of the automaker’s shares to finance his acquisition of Twitter in 2022. These statements come as the automaker deals with its most significant drop in share prices over a two-week period since its IPO in 2010

Musk took to his social media platform, X (formerly Twitter), to respond to questions about the size of his compensation package. The CEO is currently in the midst of a trial in Delaware over his $56 billion pay package from Tesla in 2018. Shareholder Richard J. Tornetta alleges that Musk used his already substantial influence over the company and its board to extract excessive compensation.

The suit claims that the pay amounted to a breach of fiduciary duty by the Tesla board, reports CNBC. Those company leaders have already agreed to pay back $735 million to the company in a settlement over their compensation packages.

Read: Hertz Selling Off Tesla EV Rental Fleet From As Low As $17k – Would You Get One?

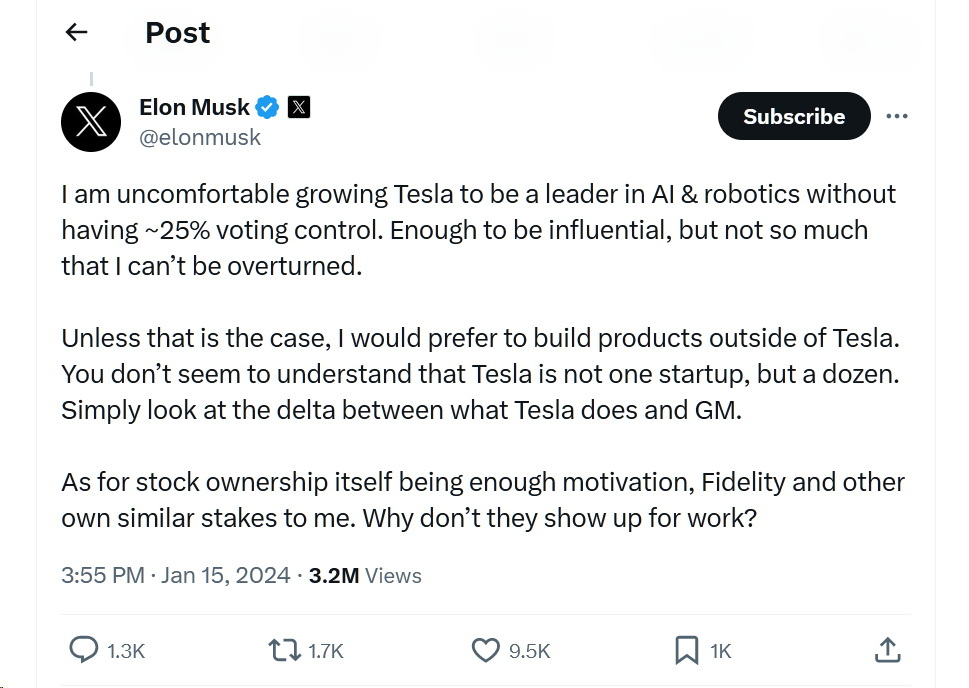

In response to an X user’s questions about why someone who already 411 million Tesla shares would need another compensation plan, Musk wrote that he would be “uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control.” He claimed that would be enough to “be influential, but not so much that I can’t be overturned.”

He added that unless he can control 25% of the company, he would “prefer to build products outside of Tesla.” He believes that the technology behind systems like Autopilot and its planned humanoid robot mean that Tesla operates like multiple startups, rather than just one.

The CEO also expressed fear that owning less than 15 percent of the company, as he currently does, following billions in sales to fund his purchase of Twitter last year, “makes a takeover by dubious interests too easy.”

Musk’s comments come as Tesla suffered the biggest hit to its market capitalization in a two-week period since it went public. Tesla has lost more than $94 billion in market valuation to open the year, reports Autonews. The hit comes as the company has suffered a string of setbacks.

In addition to falling behind China’s BYD in EV sales in the fourth quarter of 2023, the company faces cooling EV demand and shrinking profitability in 2023, and Hertz recently started selling off its Tesla vehicles. In addition, reports suggest that there was concern among Tesla’s top brass about Musk’s drug use, a claim he has denied.

Musk has used social media to telegraph his investment moves before. In 2022, he polled the website then known as Twitter about whether he should sell shares, something he had likely planned to do either way in order to pay for a large tax bill. The post led to an investigation from the Securities and Exchange Commission.