Looking back on 2023, it’s clear that the year was not an unqualified success for electric vehicles. However, with growing sales, growing market share, and a positive outlook, there was a lot to celebrate for EV boosters, too.

Now that we have the full picture for the year that ended, it’s clear that the widely reported slowdown in EV sales is real. Although sales were up 40 percent year-over-year in the fourth quarter of 2023, in 2022 they were up 52 percent as compared to a year earlier — although the fourth-quarter of 2021 was still affected by pandemic restrictions.

Despite that, the quarter contributed to a full year sales tally of 1.2 million electric vehicles. That’s the best-ever sales performance for the segment, and means that the vehicle type accounted for 7.6 percent of the U.S. automotive market, which is another record.

Read: New Car Prices Drop Year-Over-Year For First Time In A Decade

Ultimately, Cox Automotive sums it up like this: “The EV market in the U.S. is still growing, but not growing as fast.” However, the auto industry insight organization is still optimistic about the future of EVs, calling 2024 the “year of more.”

“More new product, more incentives, more inventory, more leasing, more infrastructure – all the more will combine to push EV sales higher in the year ahead,” it writes. “The team forecasts EV share of the U.S. market in 2024 will reach 10 percent.”

And there’s more good news for buyers. Cox Automotive reports that transaction prices between EVs and internal combustion engines are coming closer to parity, and it believes that equal pricing across the powertrain types may be possible in the coming years.

High prices and limited affordable options

Regrettably, electric vehicles still come with a hefty price tag, averaging $50,789 for new models. Moreover, it’s becoming harder to find one that starts at less than $40,000. In December there were only two, the Chevrolet Bolt and the Nissan Leaf, and one of those has been discontinued.

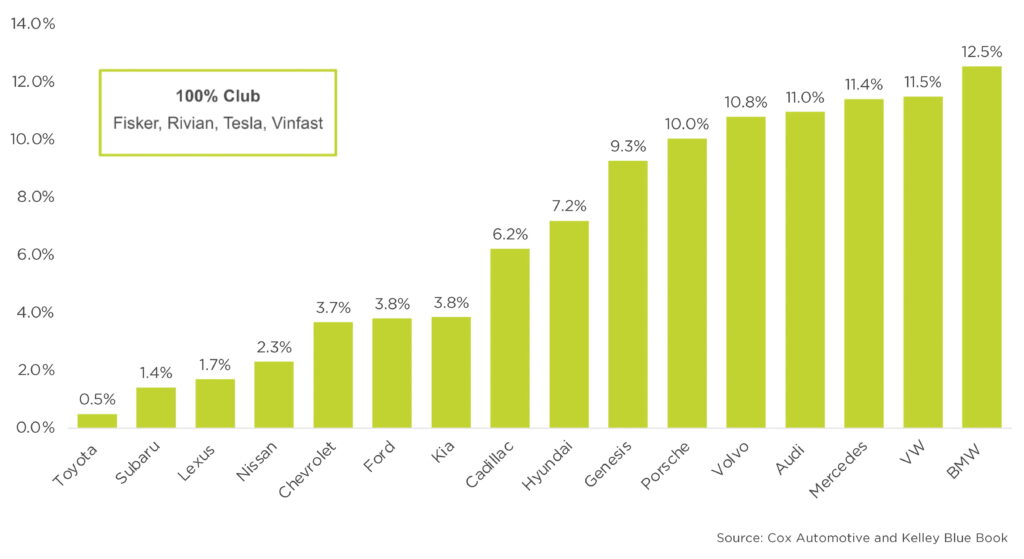

For now, the EV segment remains dominated by Tesla, which controlled 55 percent of the market last year. However, that’s down from 65 percent a year earlier, and with more EVs coming from Germany, that dominance will likely be chipped away further in 2024.

Cox Automotive writes that EV momentum is real, and the segment will continue growing in 2024. However, it’s set to be another complicated year, as the analysts predict that it may also bring the first quarter-over-quarter sales decline of the last three years.