Modern connected vehicles are a treasure trove of data, and some of that information is already being used to determine drivers’ insurance premiums. Alarmingly, driver data may be utilized, whether owners are aware of it or not, often through automaker-created coaching apps.

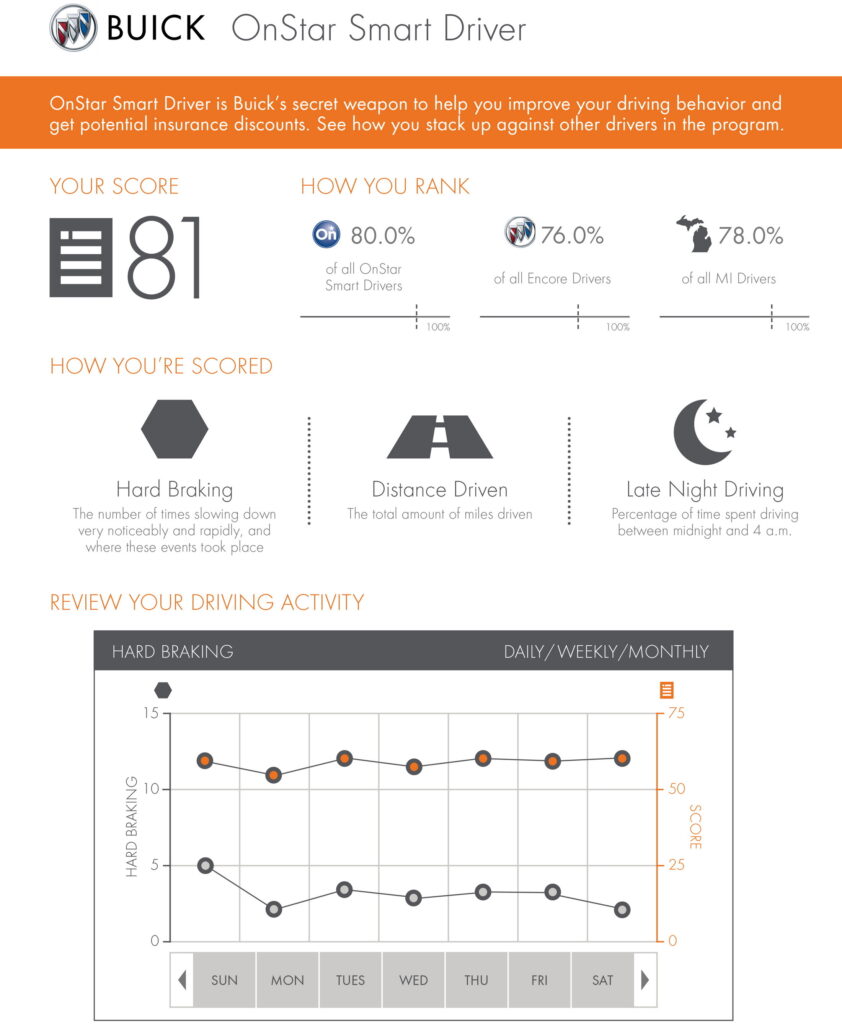

Advertised to consumers as gamified tools to enhance their driving safety, automakers across the industry are providing apps that reward users with points for good driving. However, companies like GM are selling the data collected through apps like OnStar Smart Driver to data brokerage firms, which are then utilized by insurers to determine rates.

An anonymous source who worked at the Detroit automaker told the New York Times that annual revenue from the program is “in the low millions of dollars.”

Read: Your Car Is Spying On You, From Your Sex Life To How Fast You Go

Insurer denies Cadillac owner coverage

But that revenue is coming at the expense of consumers, some of whom say they were unaware their data was being shared with insurers. The owner of a Cadillac in Florida told the Times that he was denied insurance by seven companies, and eventually learned that his vehicle had recorded many instances of hard braking and accelerations, as well as some speeding.

“I don’t know the definition of hard brake. My passenger’s head isn’t hitting the dash,” the owner said. “Same with acceleration. I’m not peeling out. I’m not sure how the car defines that. I don’t feel I’m driving aggressively or dangerously.”

Alarmingly, the driver said that he was not aware that the OnStar Smart Driver existed, had never seen it in his MyCadillac app, and could not find any evidence of having signed up for it at the dealership. For owners of high-performance vehicles like the Corvette, it’s not clear if the apps know the difference between such maneuvers when the vehicle is on and off a racetrack.

GM confesses, but asserts that you consented to it

General Motors admitted to the NY Times that it shares “select insights” about braking, accelerating, and speeding over 80 mph, as well as drive time with data brokers, but said that customers agree to share their data when they sign the user agreement.

And GM isn’t alone. Other automakers with smart apps, like Kia, Mitsubishi, Hyundai, Honda, and Acura also have driver feedback apps that share data with brokers. They also say that the information is only shared if a driver consents to it, but in Honda’s case, information about what the data is being used for is buried in a 2,000-word terms and conditions document.

Some brands require explicit consent

While not all automakers use deceptive practices — Kia says it requires additional, explicit consent from owners and Subaru says it only shares odometer data with data brokers — the fact that so many drivers don’t know their data is being mined is alarming to many, to say the least.

Last month, Senator Edward Markey of Massachusetts urged the Federal Trade Commission to investigate the collection of data from drivers. Even proponents of usage-based insurance, like University of Chicago Law Professor Omri Ben-Sharar, questioned what he described as “stealth enrollment.” He claimed that drivers who know they’re being monitored drive better, but the argument that these programs serve the public good falls apart when owners don’t know they’re being tracked.