- Alameda County District Attorney Pamela Price sues Progressive and USAA for undervaluing damaged vehicles.

- In her lawsuit, she claims that the insurers deliberately lowballed consumers so that it wouldn’t have to pay for repairs, and could recoup money at the scrap auction.

- USAA denies the claims, saying its valuation model is sound.

It seems like every day we see a car on a salvage auction site that has next to no damage, and yet has still been described as a total loss by an insurance company. Pamela Price, the district attorney for Alameda County, California, thinks part of that might be down to dirty tricks insurance companies play against their customers.

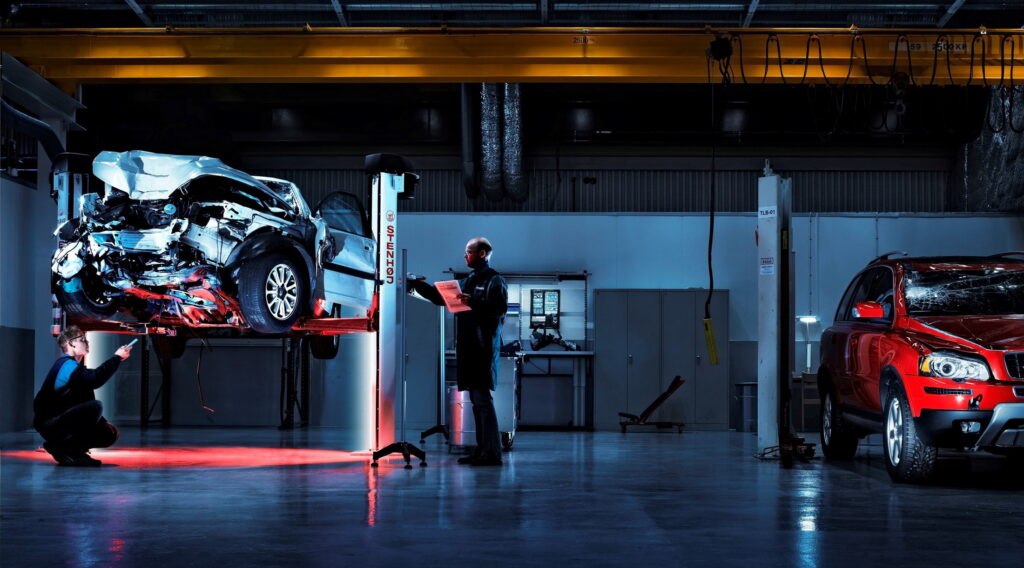

Price is suing insurers Progressive and the United States Automobile Association (USAA), as well their affiliated software developers, over what she describes as a scheme to systematically undervalue totaled vehicles and pay consumers less than what they are owed under their policies.

Read: Price Of Car Insurance Jumps More Than 20%, Majority Of Drivers Being Impacted

“Many residents live paycheck to paycheck and go deeply into debt just to buy a car,” Price said, per KRON. “When an insurance company underpays its customers for a totaled vehicle… That can lead to job losses and even homelessness.”

The complaint alleges that Progressive and USAA used specially designed software to “lowball” their customers on the value of their damaged vehicle. As a result, more vehicles were considered a total loss, and the insurers could sell them at salvage auctions.

“The nature of this transaction creates a dark incentive” for the companies, the lawsuit claims. “If [an insurer] can minimize the [actual cash value] payment to the insured, but nevertheless total the vehicle and sell the vehicle for scrap, it minimizes the indemnity losses on the claim.”

Price argues that the impacts of this pattern of behavior has ripple effects that extend beyond the insurance companies’ customers. She claims that Progressive and USAA have harmed automakers by lowering the market value of their used vehicles, repair shops that miss out on work, car loan institutions whose customers cannot pay their loans after being underpaid, and gap insurance providers, who must make up the difference between an outstanding loan and an undervalued amount.

Insurers respond

For its part, USAA said that Price’s claims are “completely lacking in merit” and that it looked forward to “disproving them in court,” per the San Antonio Express-News. The company was previously sued in 2019 for allegedly undervaluing vehicles, but it won a summary judgment after the judge in the case found no evidence that a state regulator had ever described its evaluations as “improper, illegal, unethical, unfair, or otherwise inappropriate.”

In this latest case, the USAA and Progressive are facing civil complaints, and Price is seeking civil penalties, injunctive relief, and restitution for California consumers.