- Ford is reportedly shrinking the number of EV batteries it orders from its suppliers.

- The automaker’s Model e division continues to spend money on development, hurting its profitability.

- Ford continues to invest in new electric vehicles that it hopes will become profitable soon.

The transition to electric vehicles has been anything but smooth, and companies like Ford have struggled as consumer interest in the technology has cooled. That has prompted the American automaker to cut battery orders from its suppliers.

Although sales of EVs grew by 2.6 percent in the first quarter of 2024, the market attracted fewer new buyers than it has in the first quarters of 2023 or 2022. Like other automakers, that prompted Ford to reconsidered how quickly it wanted to jump into the EV market.

Read: EV Sales Up 2.6% In US In Q1, But Growth Sputters

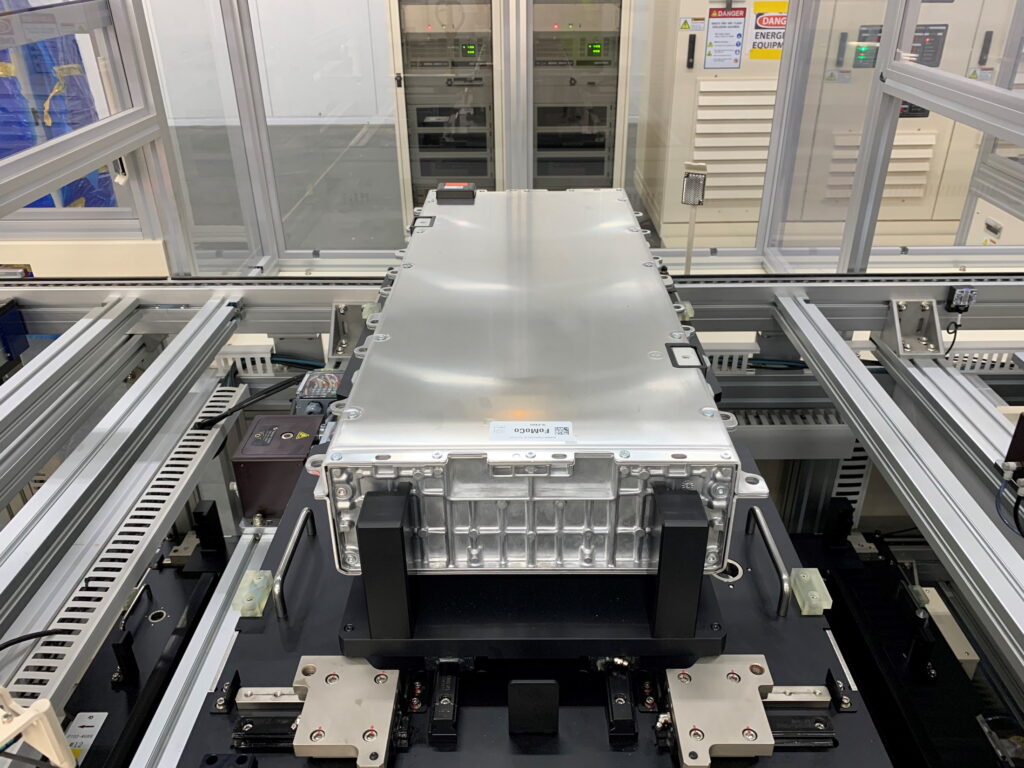

That will mean that Ford reduces the number of batteries it orders from its partners, SK On Co., LG Energy Solutions Ltd., and China’s CATL, unnamed sources told Bloomberg. However, the automaker will maintain its contracts with all three companies.

Ford is wrestling the high price of developing new electric vehicles just as wider market forces slow sales of new vehicles, causing EV losses to mount. One source told Bloomberg that in the first quarter, Ford lost more than $100,000 per electric vehicle it sold. However, in an opinion column for the same outlet, David Fickling described the number as misleading.

“The figure is bogus, dependent on a quirk of US accounting rules that mean the one-time expense of rethinking the automotive power train for the first time in a century is being treated as an ongoing annual expense, and then divided by 2024’s lackluster EV sales,” wrote Fickling. “That’s absurd, acting as if this burst of research and development spending won’t provide any benefit to the tens of millions of electric cars that will be sold over the decades yet to come.”

It’s also worth remembering that although sales of EVs grew slowly in Q1 industry-wide, at Ford, sales of electric vehicles nearly doubled. The automaker is also still investing in EVs, developing a pair of new platforms for large and small vehicles that it believes will help make its electric department profitable.

However, it remains important for automakers to listen to consumer feedback, and create EVs that promote faster market growth. As Ford’s CFO John Lawler said recently, “Model e has to stand on its own,” and has to provide a return on the amount the company is investing.