- After months of improving affordability, monthly payments crept back up in April.

- Last month, the average buyer signed up to spend $762 per month to buy a new car, 1.8 percent more than in March.

- The increase comes as dealers offer fewer incentives, and transaction prices increased, too.

It seemed like things were finally getting a little better in the first quarter of 2024, and vehicle prices were coming down. Unfortunately for car buyers, both average transaction prices and monthly payments were up in April.

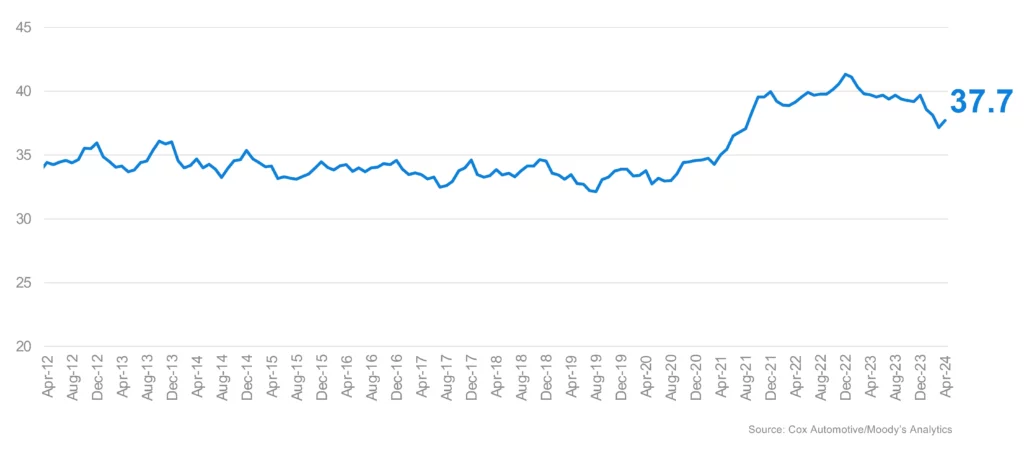

Vehicle affordability took a hit in the fourth month of the year, and the average monthly payment across the industry increased by 1.8 percent to $762, according to data from Cox Automotive. As a result, it takes 37.7 weeks of median income to buy the average new vehicle, up from 37.1 in March.

Read: New Car Prices Creep Back Up After Months of Hibernation

“The decline in affordability resulted from negative trends in pricing and incentives, as manufacturers and dealers were less aggressive on promotions and discounting than they were for the quarter end,” said Cox Automotive Chief Economist Jonathan Smoke.

Monthly payments are still high compared to pre-pandemic times, but they have been declining since December 2022, when they reached their peak of $795 in the U.S., and buyers needed more than 40 weeks of median income to buy a new car. That was providing buyers some relief, so it may be disappointing to see prices creeping back up.

In addition to monthly payments, average transaction prices also crept up in April. The average amount consumers paid for a new vehicle last month was $48,510, 2.2 percent more than they spent in March.

As Smoke noted, the shoppers had to spend more in April because incentives fell to 6.3 percent of the vehicle’s value, from 6.6 percent a month earlier. The good news is that incentives are still way higher now than they were a year ago, when pent-up demand and restricted supply created the conditions for an affordability crisis.

In general, new vehicles are more budget friendly today than they were through the pandemic, despite the affordability backslide in April. And that’s reflected in monthly payments. A year ago, the number of weeks of median income it took to buy a new car was 5.1 percent higher than it was in April 2024, so things are still better now, even if they’re trending in the wrong direction.