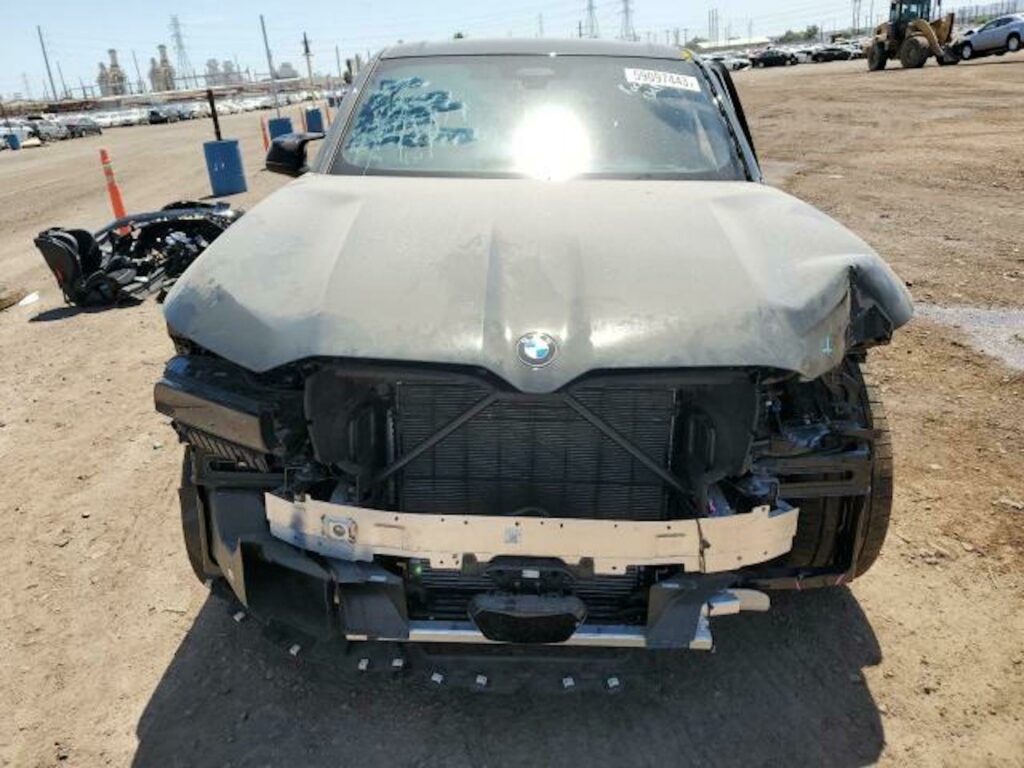

- More than one fifth of all crashed cars are now totaled by insurance assessors.

- Proportion of new vehicles written off has increased due to high repair costs.

- The cost of fixing ADAS systems designed to prevent accidents is often deemed not worth it.

The rocketing cost of repairing crashed cars means 21 percent of wrecks now result in a vehicle being totaled by insurance firms, a five-fold increase versus 1980. And some experts think that number could jump to a staggering 30 percent as cars become even more complex.

Ironically, it’s the same ADAS driver aids designed to save us from having an accident in the first place that are being blamed for the rise in write-offs when we do crash. The tech that goes into those systems is so expensive that insurers are finding that it’s not worth sanctioning a repair.

Related: California DA Sues Progressive, USAA Insurers For ‘Lowballing’ And Screwing Drivers

Replacing the multitude of sensors and cameras required to make an ADAS kit like automatic braking and lane keeping assistance function, and then calibrating those systems to make them work correctly, can add thousands of dollars to the cost of a repair, a report by Bloomberg citing data from CCC Intelligent Solutions, says. And that’s pushing up repair prices that are already elevated as a result of rising labor and material costs affecting even the most basic of car fixes.

The report notes that despite their high repair costs, EVs are still totaled less frequently than combustion cars, but suggests that might change as a result of plummeting EV values. And that depreciation is a worry for drivers who paid big money for an electric car during the pandemic and currently owe more on it than it’s worth. Additional insurance is available to cover this kind of gap, but it’s not cheap.

The winners in this situation are salvage auction companies like Copart, whose shares, Bloomberg points out, have ballooned 23 percent in the past year and a staggering 1,110 percent in a decade. And if Copart’s prediction that the proportion of totaled cars could climb from 21 percent to 30 percent comes true, business really will be booming, at least until automakers finally work out how to make ADAS and networked car systems so sophisticated that the number of accidents drops dramatically.

Maybe then, we’ll finally see a slowdown in rising insurance prices that have climbed 21 percent in a year.