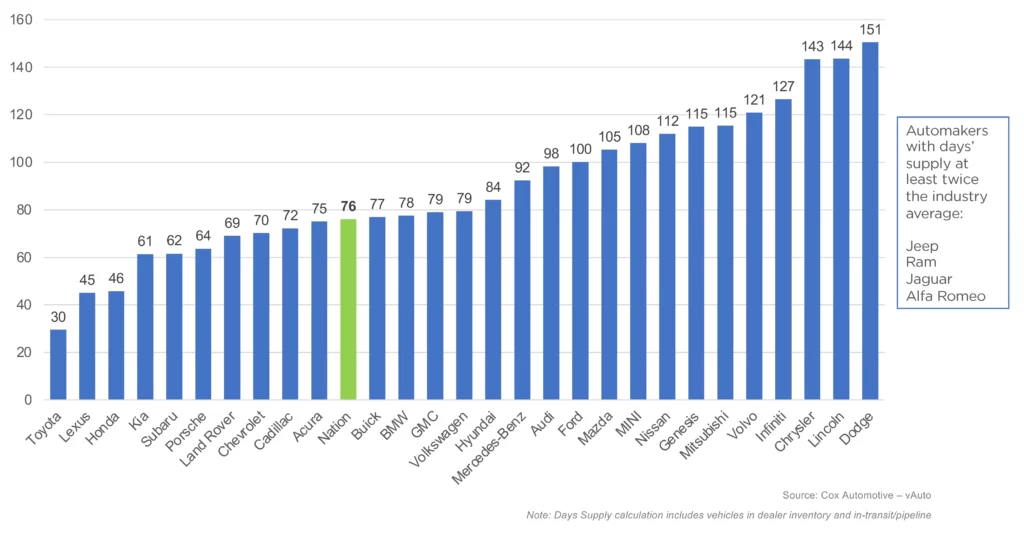

- Jeep and Ram had at least twice the industry average of inventory at the start of May.

- Toyota has the lowest inventory of any automaker with 30 days’ worth of supply.

- Inventories of companies including Mitsubishi and Mini increased last month.

New vehicle inventory in the U.S. has swelled in April and four Stellantis-owned brands are partly responsible: Jeep, Ram, Dodge, and Chrysler. So, what’s going on here?

An analysis from Cox Automotive reveals that the average days’ supply of new vehicles in the U.S. increased from 74 days to 76 days at the start of May. This means there’s roughly 2.84 million vehicles in inventory across the country, an increase from the 2.74 million available at the start of March and the 2.77 million available at the start of April. This is also 961,000 units higher than a year ago.

Read: Dodge Has Enough Inventory To Last Nearly Half A Year, If Not Even Longer

Both Jeep and Ram had at least twice the industry average of supplies. Jeep’s inventory has swelled 21% from the start of April while Ram’s inventory has increased by 14%. Dodge also had 151 days’ worth of supply followed by Lincoln with 144 days and Chrysler with 143 days.

Numerous other car manufacturers have more inventory than the industry average. For example, Infiniti has 127 days, Volvo has 121 days, Mitsubishi has joined the 100+ club with 115 days, and Mini’s new-vehicle inventory soared by 56% month over month to 108 days.

At the same time, there are some brands with inventory below the average, Cox Automotive reports. These include Acura with 75 days, Chevrolet with 72 days, Land Rover with 69 days, Porsche with 64 days, Honda with 46 days, and Toyota with the smallest inventory of them all, representing just 30 days’ worth of supply.

There is a little bit of good news for new car buyers. The average listing price for a new vehicle at the start of May was sitting at $47,433, or $94 lower than it was one year ago. Cox Automotive notes inventory of $50,000+ vehicles has increased by 5% month-over-month to an average of 90 days’ supply nationwide.