- Porsche is reported to have faced issues with local dealers due to dwindling EV sales in China.

- Companies from the Old Continent are feeling the pinch, with sales being challenged by competitive entries from the home competition.

- European automakers have lost 15 percent of market share in the over 250,000 yuan ($34,500) category in three years.

A dispute between Porsche and its dealers in China over EV sales is potentially causing a rethink in the strategy of European manufacturers trying to stay competitive in the country. Presented with dwindling electric car sales in the face of impressive local competition, Chinese media has reported on a strained relationship between the German automaker and squeezed dealerships.

Porsche’s Chinese deliveries fell by 15 percent in 2023 and continue to worsen this year, forcing dealers to discount their electric EVs to the point of losing money on sales in a quest to meet sales targets.

Read: EU Tariffs On Chinese EVs Could Cost Beijing $4 Billion In Trade

According to a report from Jiemian News, three dealers asked Porsche for compensation for their losses in the form of subsidies for new inventory. Not only did the dealers not receive a favorable response, but Porsche China allegedly chose to stop sending them new inventory.

Last week, Porsche and its dealers in China released a statement saying that they are facing complex issues and will work together to find effective ways to respond to market changes. However, it serves as a warning for other foreign automakers. With looming retaliatory tariffs and EV price wars already taking effect, it could mean that Europe’s car makers may need to look at diversifying their strategy.

China is the largest automobile market worldwide, both in terms of demand and supply. China’s automobile registrations climbed to approximately 25.8 million units in 2023, representing a rise of around 11 percent.

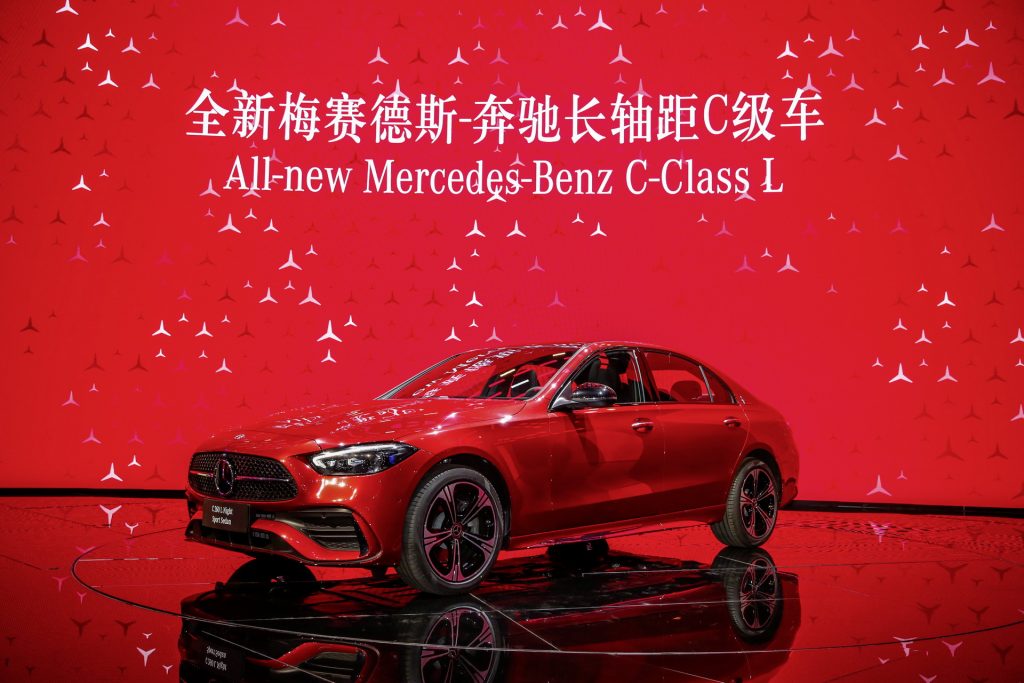

But for Europe’s automakers, trouble has been reported. According to the Wall Street Journal, Porsche’s first-quarter deliveries in China fell 24% from a year earlier, while Ferrari’s shipments dropped 25% year over year in the quarter, too. Mercedes-Benz and BMW also sold fewer cars in China in the first quarter compared with last year.

While many luxury brands, including fashion strongholds such as LVMH and Gucci, have witnessed a drop in sales due to an economic slowdown, the automotive industry is facing a different, added challenge. China’s homemade EVs are not only getting more affordable; they’re being viewed as viable alternatives to the traditionally German-dominated premium segment.

German brands are still preferred by buyers of cars more than 350,00 yuan ($48,300), but the market is changing. The likes of BMW, Mercedes-Benz, and Audi used to dominate in the field of cars priced 250,000 yuan ($34,500) and above, with a 60 percent market share in 2020. However, in just three years, that fell to 45 percent, with sales being taken by Tesla, as well as BYD and Li Auto.

With domestic options quick to market with new tech, including advanced autonomous features and cutting-edge battery and motor tech, how long will badge snobbery allow German automakers to continue their dominance of the premium sector?