- Used car prices continue to fall as they dropped 0.6% last month.

- Wholesale prices are down 12.1% from a year ago.

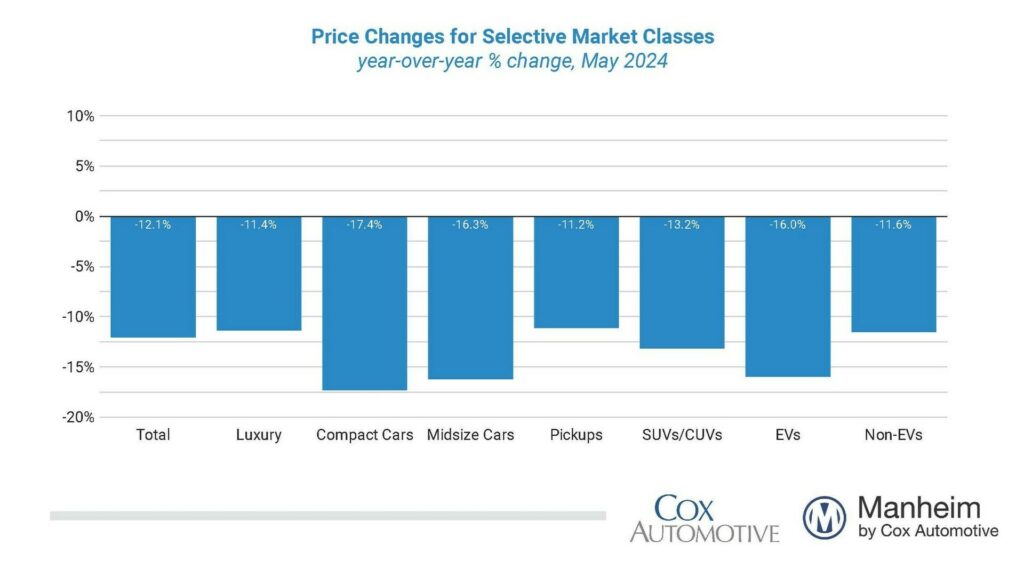

- EVs and compact cars were the biggest losers as their values have dropped significantly.

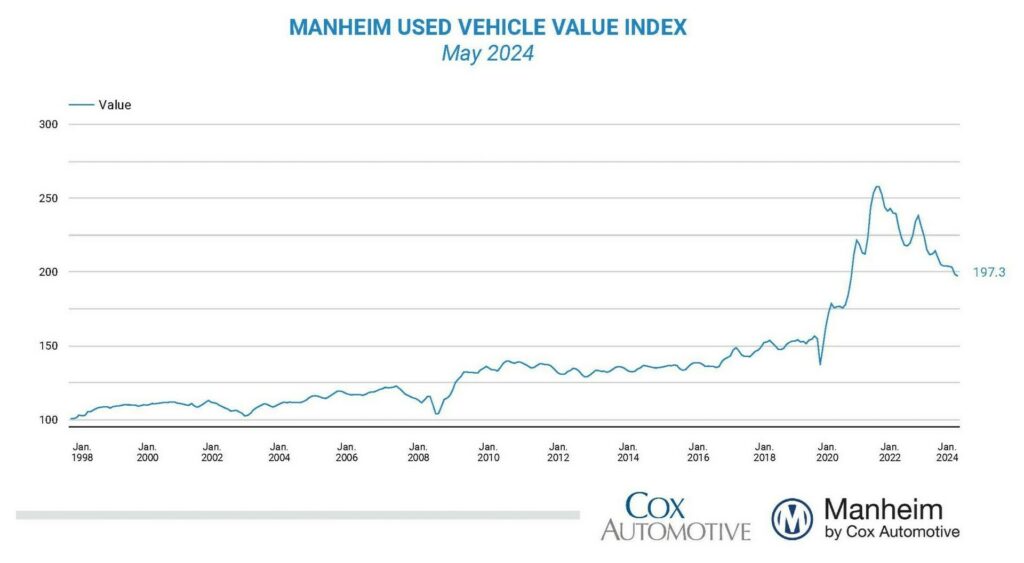

If you’ve been in the market for a used vehicle, you’ve undoubtedly noticed prices are significantly higher than in the past. However, there’s been some relief as prices have been trending downward since the tail end of the pandemic.

That continues as the Manheim (wholesale) Used Vehicle Value Index fell 0.6% in May and is down 12.1% from a year ago, on a mix, mileage, and seasonally adjusted basis. While the Memorial Day holiday likely had an impact, Cox Automotive noted “depreciation trends are currently tracking higher than long-term averages for the year.”

More: Used Car Inventory Piles Up Despite 6% Price Drop From Last Year

It’s important to note here that there are two key prices for any used car: retail and wholesale. The retail price, typically the higher one, is what you’d pay buying a car from a dealership. The wholesale price, on the other hand, is the lower one and essentially represents a car’s trade-in value to a dealer.

On a year-over-year seasonally adjusted basis, the biggest losers were compact cars which were down 17.4%. They were closely followed by mid-size cars (16.3%) and crossovers / SUVs (16%). On the flip side, the models that held their value the best were pickups and luxury vehicles.

EV values took a beating as they were down 16%. That compares to an 11.6% drop for vehicles powered by other means.

Cox estimates that retail used-vehicle sales climbed 6% compared to last month and 12% compared to a year ago. The company also said the “average retail listing price for a used vehicle was unchanged over the last four weeks.”

In a statement, Cox Automotive’s Senior Director of Economic and Industry Insights, Jeremy Robb, said “While declines in used-vehicle values overall were a bit muted in the first half of May, they picked up in the latter half of the month. It’s seasonally normal to get some weakening in the market over the Memorial Day weekend; but this month, we experienced a little more softening in the final week.”