- Car repossessions are up 23 percent this year, according to a new study.

- The numbers are now back at pre-pandemic levels having fallen sharply in 2021 and 2022.

- Analysts say the rise is due to higher interests rates pushing up loan payments.

The repo man has had a busy year according to new figures that say car seizures in the US are up 23 percent compared with the same period in 2023.

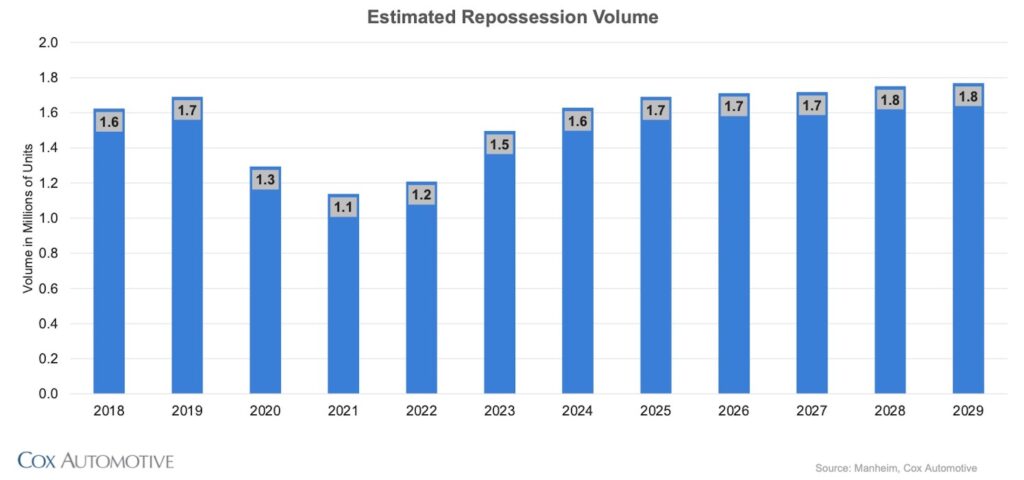

Data from Cox Automotive shows that repos are now back at pre-pandemic levels, having fallen sharply in 2021 and 2022, then started rising again the following year. Based on numbers seen so far this year, 1.6 million cars will be seized by the end of 2024, compared with only 1.1 million in 2021 and 1.5 million last year.

Related: Ford Stops Pursuing Patent Allowing Cars To Repossess Themselves

Analysts says the sharp increase in the number of cars being taken away is an indicator of how financially squeezed American drivers feel right now. High interest rates have pushed up the cost of car loans, and other living expenses like food and energy costs have also risen – even if inflation has eased recently after an earlier spike – meaning people have less disposable income than they did a couple of years ago.

Back in the spring we reported that the average new car payment had hit $762 in April, an increase of 1.8 percent over the figure for March, and not far off the record $795 buyers needed in December 2022.

“When you think about the costs for rent and shelter and insurance, all those things hit consumers and they have to choose what they will pay,” Jeremy Robb, senior director of economic and industry insights at Cox, told Bloomberg. “More people are getting behind on payments because everything is more expensive.”

Cox doesn’t expect repo rates to drop back to their 2021 low any time soon. In fact, it estimates that they will rise to 1.7 million in 2025, a number not seen since 2019, and hit 1.8 million in the years 2026-2029.

That’s great news for the repo man, and companies like Jerr-Dan, who have been building heavy duty wreckers in the US since 1972. As is Ford’s decision in 2023 to abandon a patent that would have enabled autonomous cars to repossess themselves and drive back to the loan provider, cutting our today’s repo industry altogether.