- Ford has announced a major shift in its electrification plans that include scrapping a three-row electric SUV in favor of hybrid alternatives.

- A large electric truck codenamed T3 and slated to enter production in 2025 has been delayed to 2027 as part of the new strategy.

- Worries that the EV market has failed to develop as Ford had predicted, and the looming threat of Chinese competition is behind the rethink.

Ford has announced a radical rethink of its electrification program that will result in one EV currently in development being delayed, and another axed altogether in favor of hybrids.

Backing up a report we covered in March, Ford confirmed today it is axing its plans for a three-row electric SUV that was originally due to enter production in 2025. Replacing it is a family of three-row SUVs, but this time with petrol-electric powertrains.

Related: Ford Delays Three-Row EV SUV To Launch ‘Secret’ $25k EV By 2026

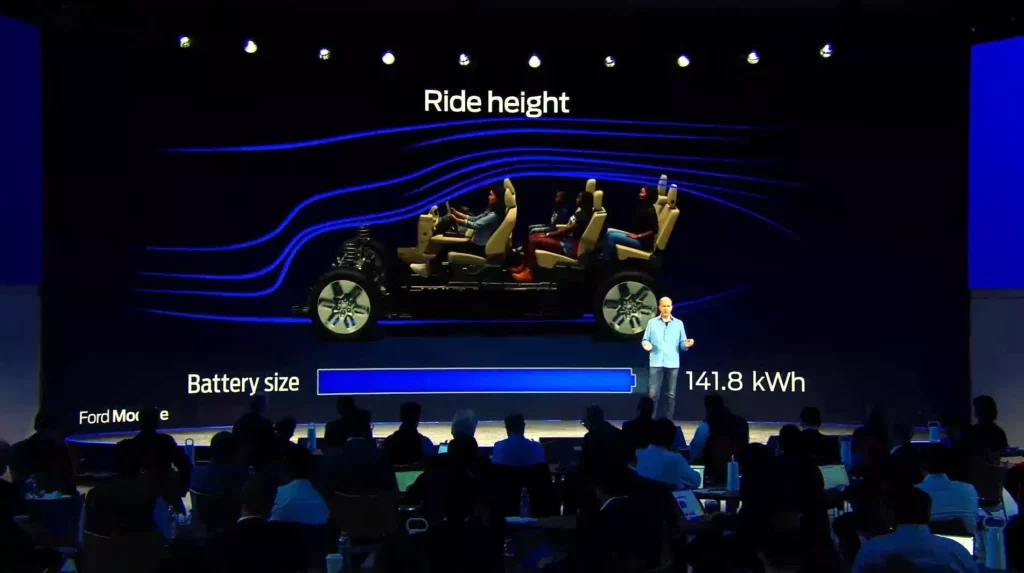

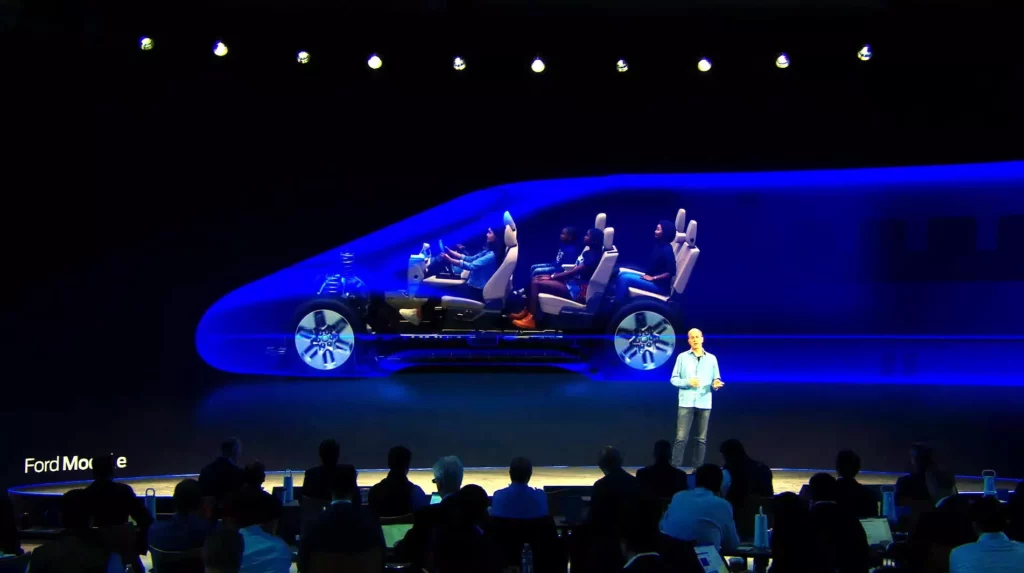

Ford teased the EV in 2023, promising wind-cheating styling, a 350-mile (563 km) range, and the ability to cruise at 70 mph (113 km/h) for 300 miles (483 km). It also claimed the seven-seater would be capable of adding 150 miles (240 km) of range with a fast charge in less than 10 minutes, and that it would feature a 100 kWh battery, which is around one-third of the size needed to achieve those feats today.

The SUV would have been built on the same platform Ford was developing for use in a large electric truck, codenamed T3. And while that truck, unlike the SUVs, hasn’t been axed altogether, it has been delayed by 18 months. Production now won’t start at the Tennessee plant until 2027, the same year Ford will launch a mid-size electric pickup built around the same architecture. The first to arrive though, in 2026, is an electric panel van.

Annual capital spend on pure EVs will fall from 40 to 30 percent, but changing the plan this late in the game doesn’t come cheap. Ford says scrapping the electric SUVs will incur a $400 million charge to cover manufacturing assets no longer needed, but that the entire rejig will add $1.5 billion of pain.

Ford, like other automakers including its big rival, GM, has been alarmed by how the EV market has failed to develop as anticipated. Three years ago it predicted it would be selling 2 million EVs by 2026, but after an initial wave of interest from buyers, demand has cooled across the industry, although Ford’s own recent EV sales figures have been relatively strong.

The looming threat of Chinese brands will have also been weighing heavily on Ford’s mind. The automaker is currently working on a $30k EV to keep it competitive should China’s car firms broach the US border. There’s no sign of that happening quite yet, but Donald Trump recently claimed he would be open to allowing Chinese automakers to set up factories in America.