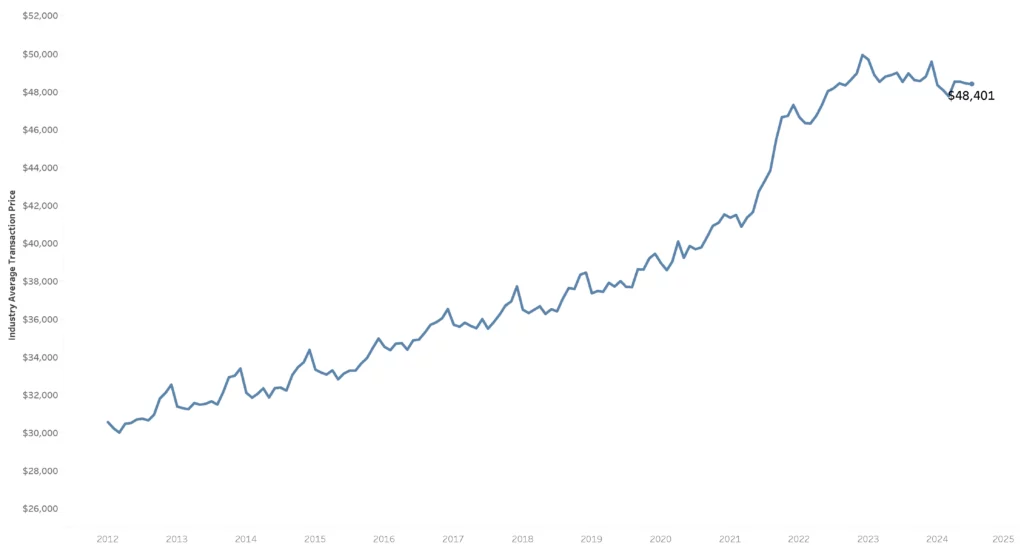

- The ATP of a new vehicle in the U.S. fell slightly to $48,401 in July.

- Prices for new vehicles reached a peak of $49,929 in December 2022.

- The average earner can now pay off a new car loan in around 37 weeks.

The average transaction price (ATP) for a new vehicle in the U.S. has soared over the last decade from around $32,000 to almost $50,000 but, fortunately, there has been a little bit of reprieve for consumers in recent months.

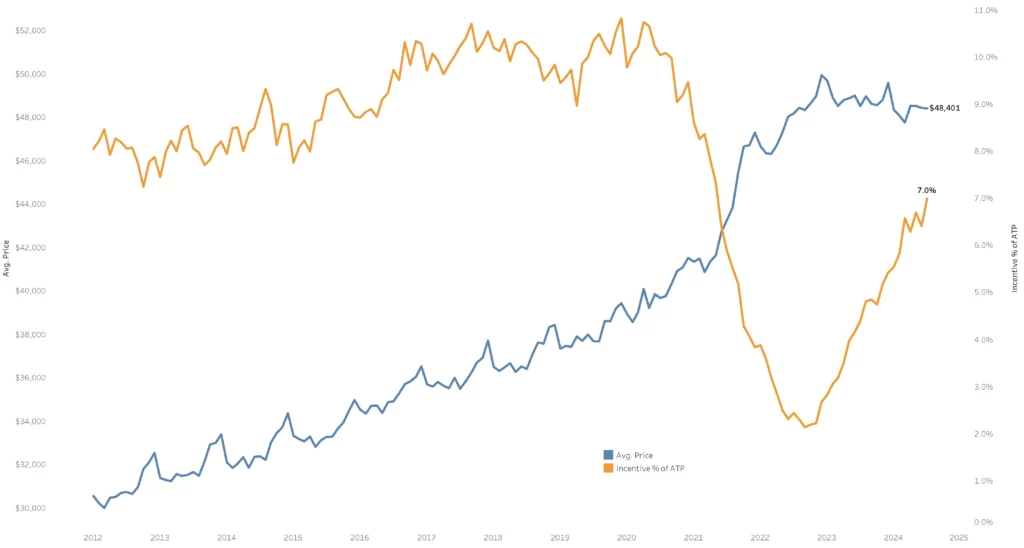

Data from Kelley Blue Book reveals that the ATP for a new vehicle in the U.S. was $48,401 in July. This is slightly lower than the ATP of $48,424 from June and down $106 from July last year. They have also dropped by 3.1% from the peak of $49,929 recorded in December 2022.

Read: Brace Yourself For Another 22% Car Insurance Price Jump This Year

There’s promising news for car buyers who finance their purchases. Cox Automotive’s analysis shows that, before the COVID-19 pandemic, it took the average earner between 33 and 36 weeks to pay off a car loan. Although this period has generally increased in recent years, it dropped to 37 weeks in July—the shortest time recorded in the past three years. Additionally, typical monthly payments have decreased by 1.5%, now averaging $753.

Solid inventory levels have contributed to the fall in prices. At the start of July, there were 2.91 million new vehicles in inventory across the country, a huge 52% jump from the same month last year.

The country’s most affordable segment for new vehicles remains the subcompact car class with an ATP of $23,031 in July, 3.9% lower than in June and down 7.3% year-over-year. The compact car class also remains affordable with ATPs of $26,798, although that is a 1.3% increase from the $26,450 of June.

Several other segments have seen minor price rises. For example, the ATP of high-end luxury cars has jumped 2.8% month-over-month to $114,181, while the luxury subcompact SUV/cross class has risen 2.5% to $41,041.

Incentives continue to increase and rose to 7% of the ATP in July, higher than the 6.4% reported in June. Compared to a year ago, incentives are 59.1% higher, and almost every major brand except Ram had higher incentive levels year-over-year in July. That’s great news for buyers.