- The EV market in Europe is facing a “continual downward trajectory,” according to ACEA.

- In August, EV sales dropped 43.9%, while the overall market fell 18.3% year-on-year.

- Automakers seek a smoother transition to zero-emission mobility amid sluggish EV demand.

The EV slowdown is making its presence felt across Europe, prompting automakers to urgently call for “short-term relief” from stringent CO2 targets. In August 2024, battery electric vehicle (BEV) sales plummeted by a staggering 43.9 percent year-on-year in the European Union, dragging overall market numbers down significantly.

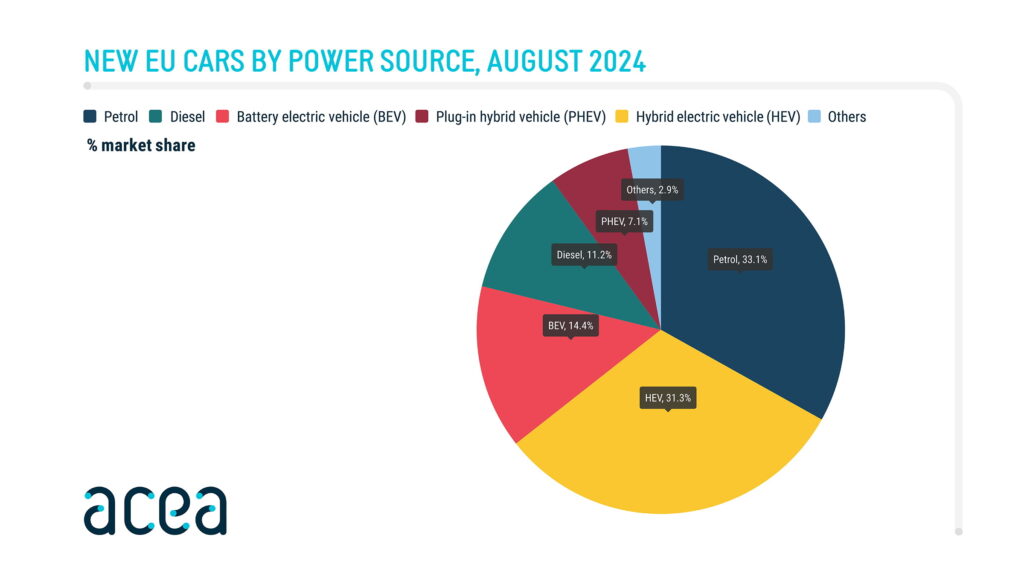

According to sales data released by the European Automobile Manufacturers’ Association (ACEA), BEV sales totaled just 92,627 units in August 2024, a sharp decline from 165,204 units during the same month last year. This dramatic fall caused the market share of BEVs to shrink to 14.4 percent, down from 21 percent previously.

More: US EV Sales Soar, Thanks To Generous Incentives

This marks the fourth consecutive month of declining sales, primarily driven by steep drops in Europe’s largest BEV markets. As we recently reported, Germany saw a shocking decline of 68.8 percent, while France wasn’t far behind with a 33.1 percent drop.

Overall Sales Fell To Their Lowest Point Since 2021

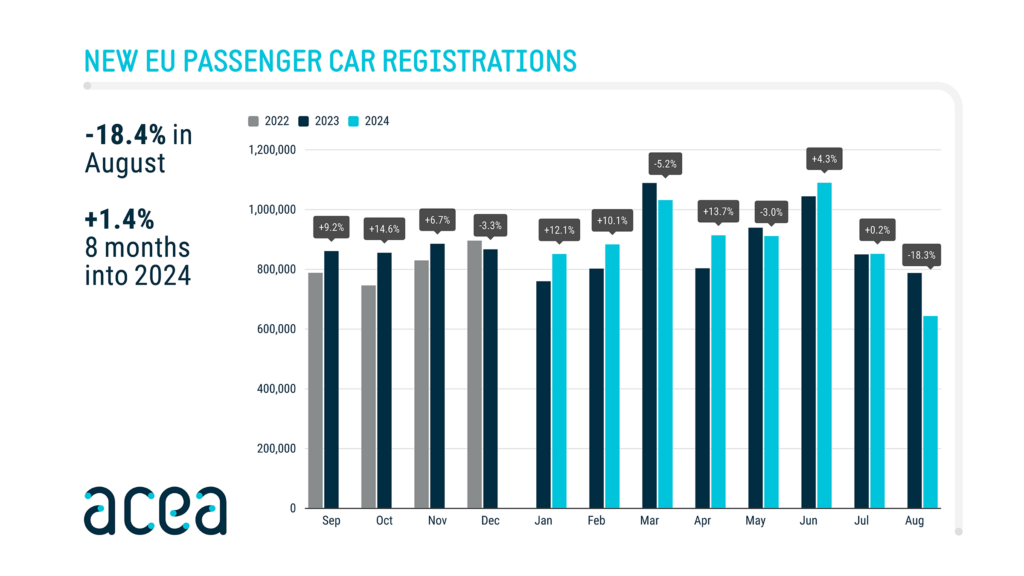

In August 2024, new car registrations totaled 643,637, marking an 18.3 percent drop compared to August 2023. This sharp decline represents the lowest sales figures in three years.

Sales of gasoline-powered vehicles dipped by 17.1 percent, accounting for 213,057 units. Diesel sales fell by 26.4 percent, or 72,177 units, while plug-in hybrids suffered a 22.3 percent decline, with 45,590 units sold. Interestingly, only hybrids experienced growth, recording a 6.6 percent increase with 201,552 units, suggesting there might still be hope for a resilient market ahead.

ACEA

Regulatory Concerns and Future Implications

The low market share of electric vehicles in the EU, currently sitting at 12.6% year-to-date with 902,011 registrations, is raising alarm bells within the automotive industry. Automakers have poured billions into electrification efforts to comply with stringent emission regulations and prepare for the impending internal combustion engine (ICE) ban in Europe. However, they’re now facing the stark reality that consumers aren’t transitioning to EVs as swiftly as initially anticipated.

In a new statement, the ACEA board pointed to several critical factors contributing to this “continual downward trajectory” of the electric car market. They highlighted the inadequate charging infrastructure, intense competition in manufacturing, insufficient purchase and tax incentives, and the precarious supply of essential materials as key challenges. Additionally, the overall lack of economic growth and consumer acceptance further compounds these issues, leaving automakers grappling with uncertainty in their transition to an electric future.

Automakers are voicing concerns that current regulations fail to reflect the “profound shift in the geopolitical and economic climate over the past years”. This oversight, they argue, is undermining the competitiveness of the automotive sector. In their statement, they emphasize that “the industry cannot afford to wait for the review of the CO2 regulations in 2026 and 2027.” Instead, they insist on the need for “urgent and meaningful action now” to address these pressing challenges.

In light of this situation, the ACEA board is advocating for “short-term relief” from the tougher 2025 CO2 targets for cars and vans. They believe that such measures would facilitate a smoother transition to zero-emission mobility while safeguarding the industrial future of Europe.