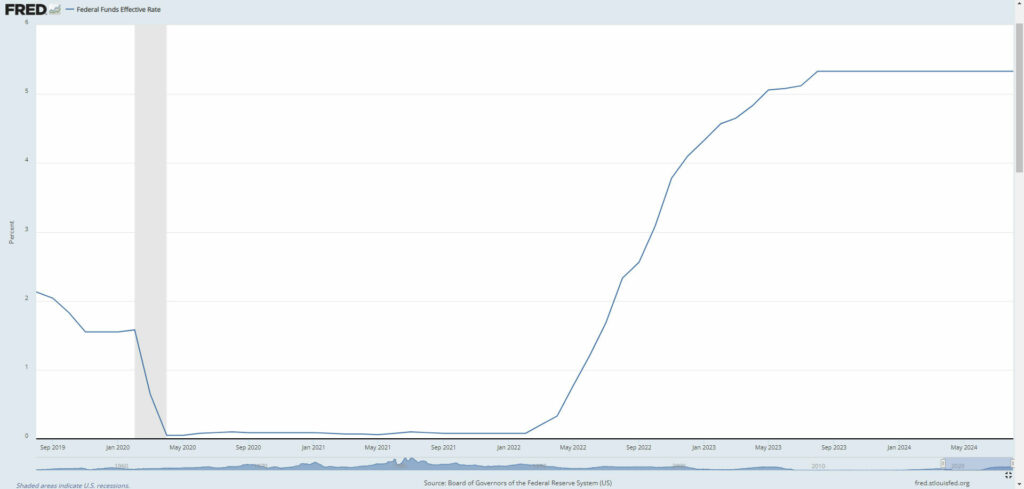

- The Federal Reserve has cut the federal funds rate for the first time in more than four years.

- This will lower the cost of borrowing, which will save car buyers money.

- Interest rates have been climbing for years and the average new car loan rate is 6.84%.

Car buyers are about to get some much-needed relief as the Federal Reserve has announced plans to cut rates by 50 basis points. This will lower the federal funds rate to between 4.75% and 5%.

In a statement, the Federal Reserve said indicators suggest “economic activity has continued to expand at a solid pace” and progress has been made on inflation, although it remains “somewhat elevated.” Despite that, they conceded job gains have slowed and the unemployment rate has ticked up.

More: Average New Car Transaction Price Drops To $48k, Incentives On The Rise

Given these developments and an “uncertain” economic outlook, the Fed decided a cut was the best move. CNBC notes this is the first since 2020 and one that will benefit consumers in a number of different ways.

In particular, car loans should become cheaper after skyrocketing in recent years. Experian’s State of the Automotive Finance Market report revealed the average interest rate for a new car jumped from 4.61% in 2022 to 6.84% in 2024. The increase for used cars was even more dramatic as the average rate went from 8.85% in 2022 to 12.01% in 2024.

Of course, those rates can vary wildly depending on your credit score. While Super Prime used car loans averaged 7.13%, those with Subprime credit forked over an average of 18.86%. For those with Deep Subprime credit, the average rate was 21.55% which is something you’d typically associate with credit cards.

Given numbers like that, any cut is appreciated. However, don’t expect major savings as CNBC quoted Bankrate as saying a 50 basis point interest rate cut would only save new car buyers $8 per month on a $35,000 loan spread out over five years. That equates to $480 over the life of the loan or a little less than $100 per year.