- New vehicle inventory in the US reached 77 days’ supply, with over 2.84 million vehicles.

- Some brands, like Lincoln and Alfa Romeo, have more than double the average inventory.

- The average price of a new car is $46,841, with incentives rising to 7.2% of ATP.

New vehicle inventory has stabilized across the United States, with prices experiencing a slight decline. Adding to this positive trend is an increase in incentives, creating a more favorable environment for potential buyers.

According to vAuto Live Market View data, the US had a 77-day supply of new vehicle inventory as of September 5, totaling approximately 2.84 million vehicles. While this figure falls just short of the 83-day average recorded in the first half of the year, it represents a significant improvement over the 60 days noted in September of last year. It’s clear that the market is gradually finding its footing.

Read: US EV Sales Soar, Thanks To Generous Incentives

The inventory uptick is partly due to the arrival of 2025 model-year vehicles, which now make up around 25% of showroom stock, as reported by Cox Automotive. This influx is contributing to a more diverse range of options for buyers.

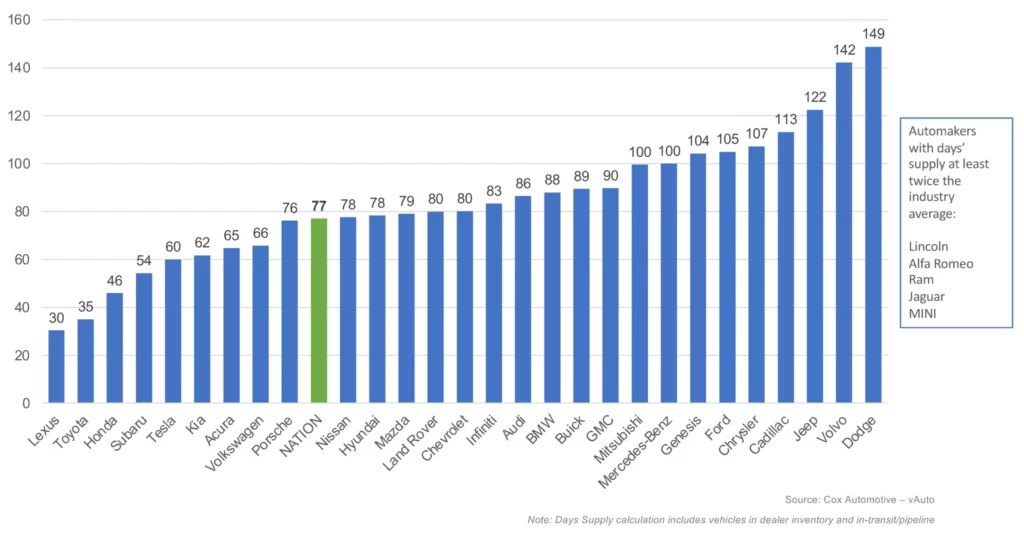

However, not all automakers are experiencing equal inventory levels. Only a few have managed to keep their stock below 77 days: Porsche at 76 days, Volkswagen at 66 days, Acura at 65 days, Kia at 62 days, and Tesla at 60 days. On the other end of the spectrum, several brands are languishing with inventories that exceed double the industry average, including Lincoln, Alfa Romeo, Ram, Jaguar, and Mini. Other brands with high inventories include Dodge at 149 days, Volvo at 142 days, Jeep at 122 days, and Cadillac at 113 days.

August Days’ Supply Of Inventory By Brand

Inventory levels for certain brands have spiked considerably in recent months. For example, Volvo saw its inventory jump from 121 days at the beginning of May to 142 days in August. Similarly, Mitsubishi’s stock has swelled from 100 days in May to 115 days, illustrating how fluctuating supply can impact market dynamics.

Average transaction prices (ATP) are falling, albeit only slightly. The average listing price for a new vehicle now sits at $46,841. This is down approximately 1% from the month prior and 0.7% lower than last year. At the same time, the average new-vehicle incentive package has jumped 7% from July to 7.2% of the ATP, or the equivalent of $3,383.