- A new study has highlighted the gulf between what new cars cost and what buyers expect to pay for them.

- Edmunds found that 48 percent of buyers wanted to spend less than $35k, but the average new car costs $48k.

- More than half of those surveyed said they would work more hours or get a second job to afford their next car.

Car shoppers returning to dealerships for the first time since before the pandemic are getting a nasty shock. Almost half of them have budgeted to spend no more than $35,000, which was the average price of a new car in 2018. Trouble is, while the cost of the average new car has dropped over the last 24 months, it’s still a hefty $47,716.

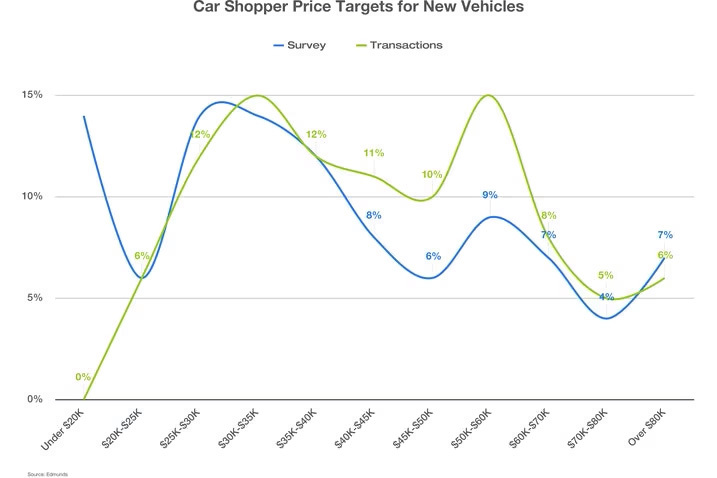

Research by Edmunds uncovered the huge disconnect between customers expectations and the unpleasant reality they meet inside a dealer showroom. And in some cases the gap is even bigger. While 48 percent of those surveyed said they wanted to part with $35k or less, a significant 14 percent said they’d like to spend no more than $20k. But Edmunds data showed almost no transactions during July of this year where buyers took a new car home for less than $20k.

Related: Car Lots Are Overflowing, And Prices Are Starting To Crack

Cars, like all goods, get more expensive over the years due to inflation (although $35k adjusted for inflation is $44k not $48k). But that’s not all that’s changed about buying a new vehicle over the last six years. Car shoppers in 2018 enjoyed incredibly low interest rates that made loans more affordable, and dealers were offering big incentives so transaction prices routinely fell well below MSRP. But in 2024, incentives are harder to come by – although they are creeping back – and interest rates are much higher.

More than 73 percent of Edmunds respondents said they’d already held off from buying a new car due to high prices, and more than 62 percent claimed they’d delayed a purchase because of unfavorable interest rates. Three-quarters of drivers said they wouldn’t accept an interest rate higher than 6 percent, but 60 percent of buyers financed at between 4 and 9 percent APR, and the average rate for all cars purchased in July was 7.1 percent, Edmunds says.

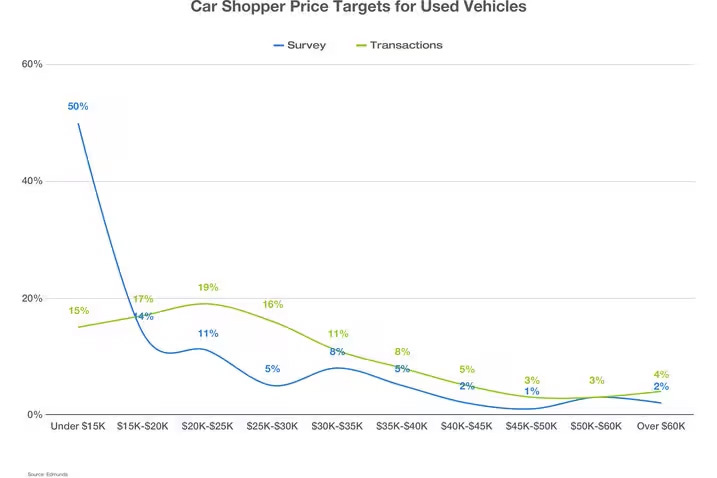

It’s a similar story on the used market, where 27 percent of drivers said they were looking to spend $10k or less when in reality only 5 percent of used cars changed hands in that price bracket.

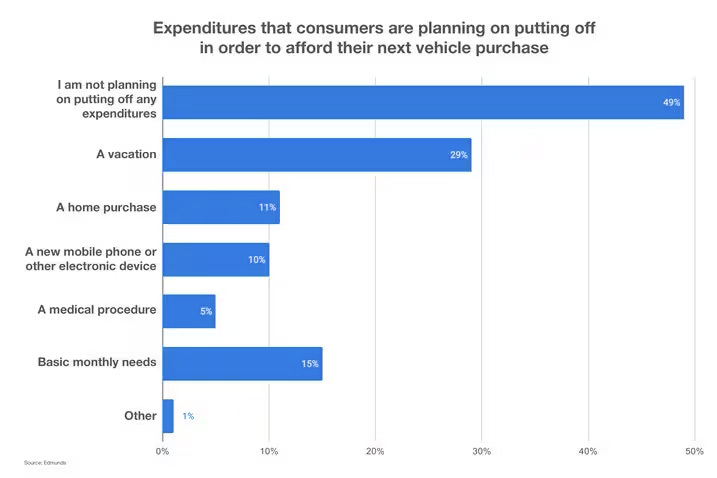

How are buyers going to bridge this chasm? Some will simply continue to delay getting a new car, but 54 percent said they were planning on working more hours or getting an additional job to afford their next vehicle.