- Carlos Tavares believes that Europe’s manufacturing overcapacity could lead to local carmakers shutting down their plants.

- Chinese EV makers, such as BYD and Dongfeng, are planning to establish production facilities directly in Europe.

- BYD has confirmed that the majority of its electric vehicles destined for Europe will be manufactured in Hungary.

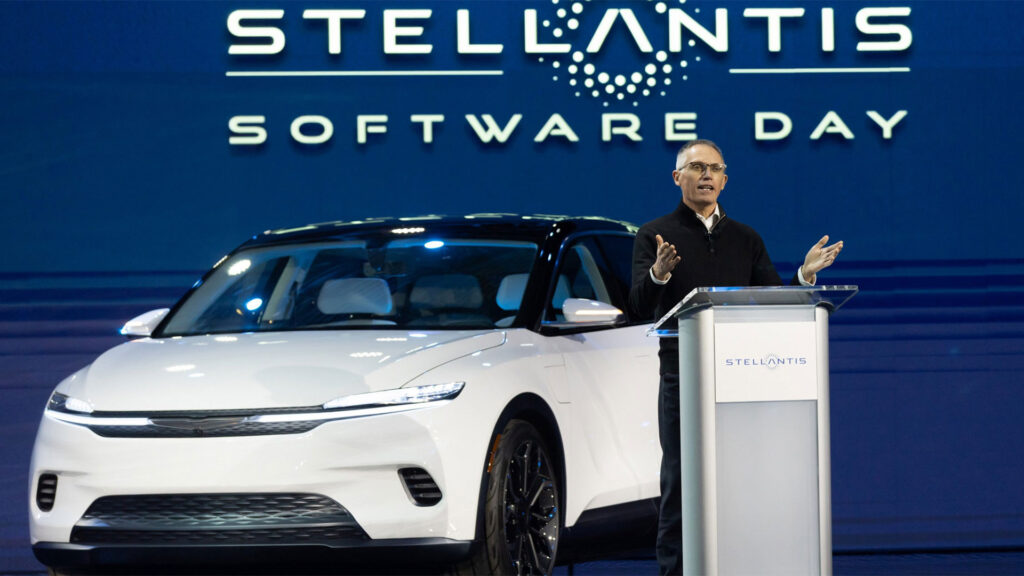

Carlos Tavares might have his hands full with challenges at Stellantis in North America, but that hasn’t stopped him from bluntly sounding the alarm about the future of European car manufacturing. The Stellantis CEO sees the writing on the wall—Europe’s automotive sector is teetering on the edge of overcapacity, and he believes local carmakers may be forced to shut down plants as a result.

The cause? Not just weak demand or shifting markets, but the influx of Chinese EV makers establishing operations right in Europe’s backyard.

EU member states recently supported steep increases in import duties on Chinese-made EVs to counter the unfair subsidies provided by the Chinese government. However, many Chinese brands are already looking to sidestep these measures by shifting production to Europe, a move that Tavares believes could further exacerbate the region’s overcapacity issues.

Read: China’s Dongfeng Could Build Over 100,000 Electrified Cars Annually In Italy

“It increases the overcapacity of the manufacturing system of Europe,” he told Auto News at the Paris Auto Show. “The way to avoid customs duties is to build in Europe. You are accelerating the need to shut down plants.”

Several countries in Europe are courting Chinese brands, trying to convince them to manufacture vehicles on local shores. Italy is particularly eager to attract new carmakers and has held talks with numerous carmakers. Its efforts could soon pay off as the Italian government is in advanced discussions with Dongfeng Motor to build a local factory, perhaps capable of building 100,000 electrified vehicles annually.

Leading Chinese carmaker BYD is also investing heavily in Europe. The company’s executive vice president Stella Li said that the majority of their EVs destined for the European market will be manufactured at a plant in Hungary. BYD is also going to source parts from as many European suppliers as possible and only intends to import battery cells from its home country. While this is good news for consumers and will increase competition, it’s hardly a surprise that Tavares appears nervous about Chinese brands setting up shop in Europe.

While Dongfeng’s plans for Italy are causing a stir, Tavares is skeptical that Chinese carmakers will try to establish factories in Europe’s larger, more expensive markets. Germany, France, and Italy simply don’t offer the same cost advantages as smaller nations like Hungary.

“Chinese carmakers will not go to Germany or France or Italy to build their cars, because they would have cost disadvantages there, starting from energy costs,” he told Auto News, predicting that Chinese brands will instead focus their investments in countries where the economics make more sense.