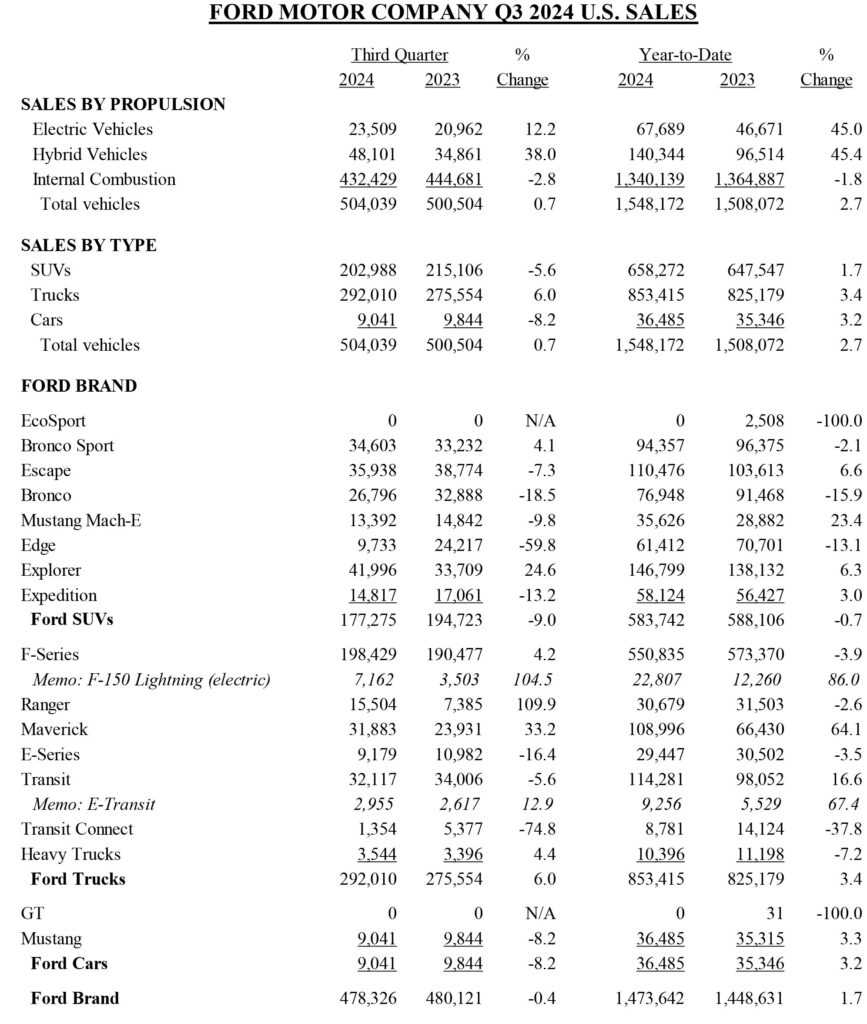

- Ford delivered 478,326 units (-0.4%) in Q3 2024, or 504,039 (+0.7%) including Lincoln.

- The Ranger (+110%) and F-150 Lightning (+105%) saw the largest sales gains.

- The Blue Oval sold 38% more hybrids and 12% more EVs in Q3, while ICE dropped by 3%.

Ford managed to move 478,326 units in the third quarter of 2024, excluding Lincoln, which reflects a slight dip of 0.4 percent compared to the same period in the previous year.

The biggest winner among the Blue Oval’s vehicles was the Ranger midsize pickup truck, achieving 15,504 sales in Q3 2024, an impressive 110% increase compared to the same period last year.

More: Ford Is Done With Boring Cars, Says It’s Now In The “Iconic-Vehicle Business”

Sales of the fully electric F-150 Lightning also soared by 105% (7,162 units), while the F-150 Hybrid saw a 64% increase (20,129 units). However, overall deliveries of the F-Series trucks dropped 4% (190,477 units) in Q3 2024. Despite this, Ford remains confident about maintaining its top-selling status among rivals for the 48th consecutive year.

On the downside, the biggest sales declines were seen in the Transit Connect (-75%), the discontinued Edge (-60%), and the Bronco (-19%). The latter sold 26,796 units but was surpassed by the unibody Bronco Sport, which sold 34,603 units, a 4% increase.

Despite cutting prices on some models and offering incentives, the Mustang Mach-E saw a 9.8% decline in sales during Q3, with 13,392 deliveries. Overall, however, the electric crossover’s sales are up 23.4% this year through September, with 35,626 units delivered compared to 28,882 in the same nine-month period last year.

2025 Ford Explorer

Ford SUVs as a whole saw a 9% sales drop in Q3, with one exception: the Explorer. The recently facelifted model led the SUV lineup with 41,996 sales, a 24.6% increase, driven by renewed customer interest. Ford is hopeful the upcoming refresh of the larger Expedition, which fell by 13% in Q3, will spark similar results.

As for the Ford Mustang, despite skyrocketing sales in August—mainly due to the discontinuation of the rivaling Chevy Camaro and Dodge Challenger—the pony car finished Q3 with 9,041 sales, representing an 8% decline.

In terms of powertrain trends, Ford’s hybrid sales increased by 38% (48,101 units), and EV sales grew by 12% (23,509 units), while internal combustion engine (ICE) vehicle sales dropped 3% (432,429 units). Ford also touts its second-place position in U.S. EV sales for 2024, with 67,689 units sold year-to-date, a 45% increase, trailing only Tesla.