- Ford has revealed mixed third quarter results as revenue was up, but net income was down.

- The company’s electric vehicle unit continues to struggle and their results were weighed down by the cancellation of three-row SUVs.

- CEO Jim Farley is upbeat about the future and said the automaker has a “significant financial upside.”

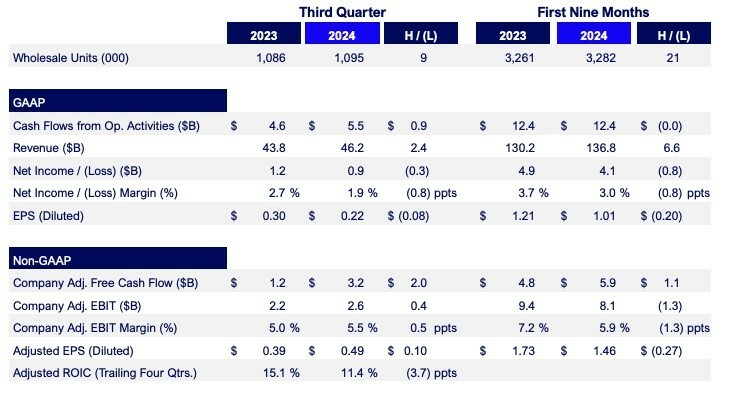

Third quarter earnings continue to trickle in and the latest come from Ford, which revealed revenues of $46.2 billion and a net income of $0.9 billion. The former number jumped by $2.4 billion, although net income fell by $0.3 billion compared to a year ago.

While the results were mixed, the automaker pinned some of the blame on a $1 billion hit from electric vehicle missteps. The big kicker there was the cancellation of three-row electric SUVs as well as a “retiming” of the launch of the redesigned F-150 Lightning, which is codenamed Project T3. It’s now slated to arrive in the second half of 2027 and have “features and experiences never seen on any Ford truck,” including upgraded bi-directional charging and advanced aerodynamics.

More: GM Reports Q3 Revenues Of Nearly $49 Billion, Chevy Equinox Appears To Be A Hit

Getting back to today’s news, the automaker said their third quarter results highlight “long-term value creation made possible by a winning lineup of internal combustion, hybrid and electric vehicles for retail and commercial customers combined with an advantaged strategy and global footprint.” However, the automaker noted “electric vehicle pricing pressure” and that was recently seen on the 2025 Mustang Mach-E, which is $3,500 cheaper than its predecessor.

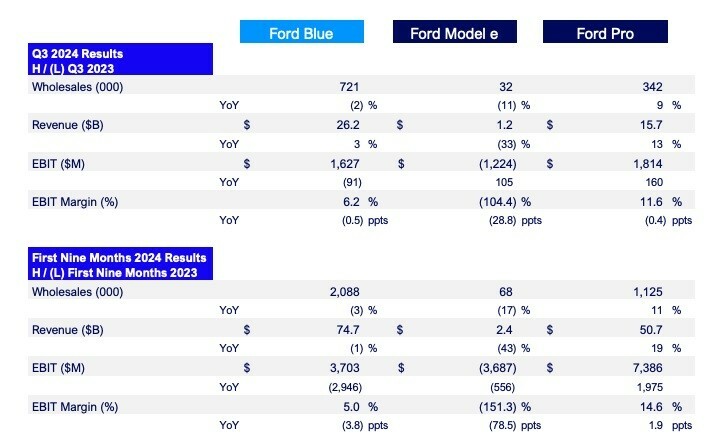

On the EV front, they weighed heavily on the quarter as Ford Model E posted a 33% drop in revenue compared to last year. This contrasts to the ICE-powered Ford Blue unit, which saw revenues climb 3%.

Despite the mixed results, Ford noted costs are down and sales are up. The company also has an assortment of new and updated models on the horizon including the facelifted Maverick and Bronco Sport as well as the new Expedition and Navigator.

Ford CEO Jim Farley said, “We are in a strong position with Ford+ as our industry undergoes a sweeping transformation. We have made strategic decisions and taken the tough actions to create advantages for Ford, versus the competition, in key areas like Ford Pro, international operations, software and next-generation electric vehicles. Importantly, over time, we have significant financial upside as we bend the curve on cost and quality, a key focus of our team.”

Wall Street wasn’t thrilled as Ford stock closed up slightly at $11.37 per share, before dropping below $11 afterhours. On the bright side, investors can expect a dividend of 15 cents per share.