- Ford reported October sales with a 15.2% increase overall compared to the same month last year.

- Hybrid sales surged by 38.5%, while internal combustion engine models grew by 14.1% in October.

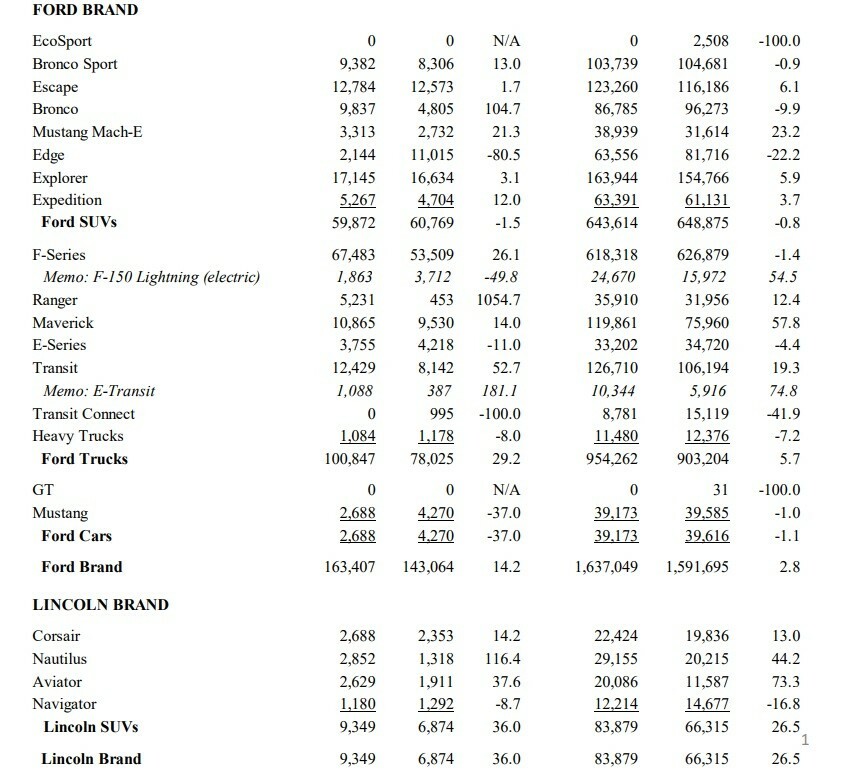

- F-150 Lightning sales plummeted nearly 50%, which explains their recent decision to halt production.

Ford has high hopes for their next-generation of electric vehicles, but their current models continue to struggle. That’s clear today as the automaker reported an 8.3% drop in EV sales compared to October of last year.

The big loser was the F-150 Lightning, which saw a 49.8% drop in sales. Given the steep decline, it’s not surprising the company recently announced plans to temporarily halt production later this month until early next year.

More: Ford Halts F-150 Lightning Production Until 2025 Over Weak EV Demand

While buyers turned their backs on the electric pickup, they embraced the Mustang Mach-E as sales were up 21.3% to 3,313 units. That upward trend could continue in the future as Ford recently announced pricing for the 2025 model would start at $36,495 which is $3,500 less than its predecessor.

Meanwhile, E-Transit sales rocketed up 181.1%, but before popping the champagne, consider this: they only sold 1,088 units. It’s hard to celebrate when the numbers are still so small. A triple-digit percentage increase doesn’t mean much when the baseline is barely on the radar.

Ford US Sales

While Ford doesn’t breakdown hybrid sales in a similar fashion, the automaker reported a 38.5% jump in October. That outpaced sales of conventionally powered models, which were up 14.1% to 148,268 units.

It’s not immediately clear which eco-friendly models performed best, but Ford has previously credited strong truck sales. During their third quarter earnings bonanza, the automaker revealed they “commanded 77% of the U.S. hybrid truck market during the quarter, with hybrid truck sales up 42%.”

Putting hybrids aside, Bronco sales were up 104.7%, while the Bronco Sport saw a 13% improvement for the month. Mustang sales were off by 37% and they’re down 1% year-to-date.

Over at Lincoln, the company continues to see strong demand for the facelifted Aviator as well as the redesigned Nautilus. The luxury brand could also get a boost from the 2025 Navigator, but it won’t arrive until next spring.

Ford October 2024 US Sales