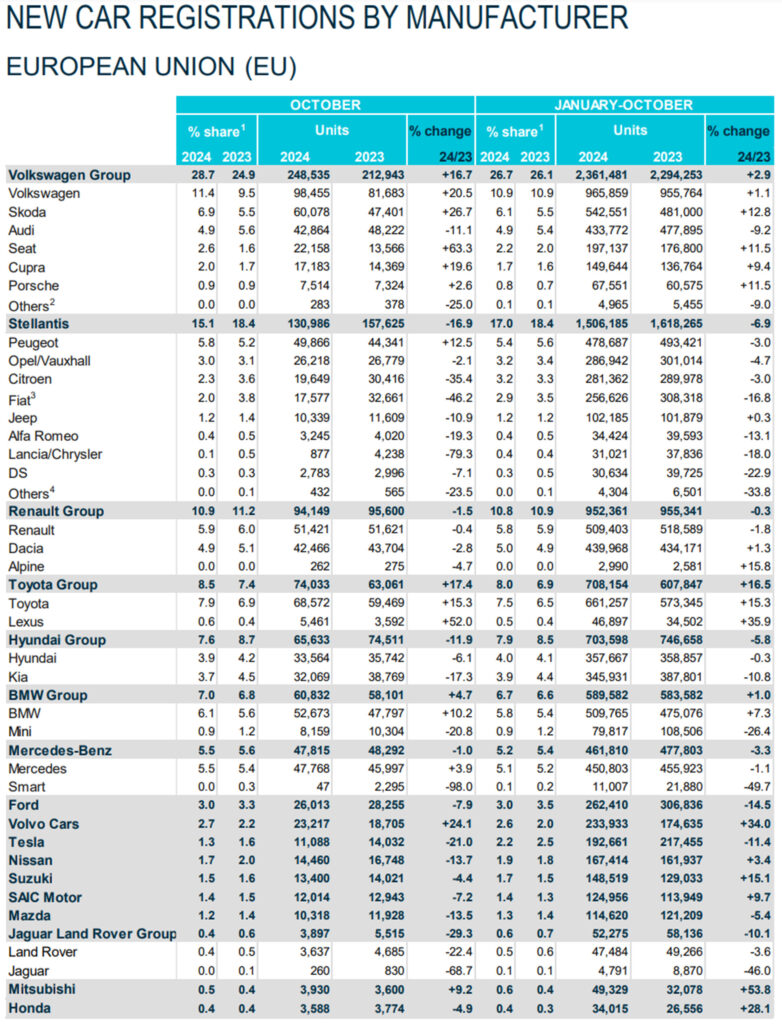

- Stellantis sold 130,986 vehicles in the EU this October, down from 157,625 last year.

- VW Group brands posted strong sales gains, driven by rising demand across the region.

- Hybrid vehicles led Europe’s October car market, surpassing gasoline cars as the top choice.

The troubles at Stellantis continue to stack up as fresh vehicle registration data from the European Union paints a grim picture. The automaker suffered a significant blow in October, with sales plunging by 16.9% and ceding market share to its more nimble competitors.

In October 2023, Stellantis held an 18.4% share of the EU’s new car market, selling 157,625 units. Fast forward to October 2024, and its share had slipped to 15.1%, with sales dropping to 130,986 units.

Much of this downturn is tied to dismal performances by the Citroen and Fiat brands, whose sales nosedived 35.4% and 46.2%, respectively. Other casualties include Lancia, with a staggering 79.3% drop, Alfa Romeo (-19.3%), Jeep (-10.9%), DS (-7.1%), and Opel/Vauxhall (-2.1%).

VW Group Surges

Things couldn’t have been any more different at the Volkswagen Group. While Stellantis struggled, the German automotive giant reported a 16.7% jump in sales, selling 248,535 in October compared to the 212,943 it sold in October 2023.

This surge boosted its market share from 24.9% to a commanding 28.7%. The standout performer? Seat, with a spectacular 63.3% rise in sales. Skoda chipped in with a robust 26.7% increase, and the VW brand itself recorded a solid 20.5% jump. Meanwhile, Cupra continued its upward trajectory with sales up 19.6% to 17,183 units—a smaller volume than its stablemates but no less impressive.

Broader Market Trends and the Shift in Powertrains

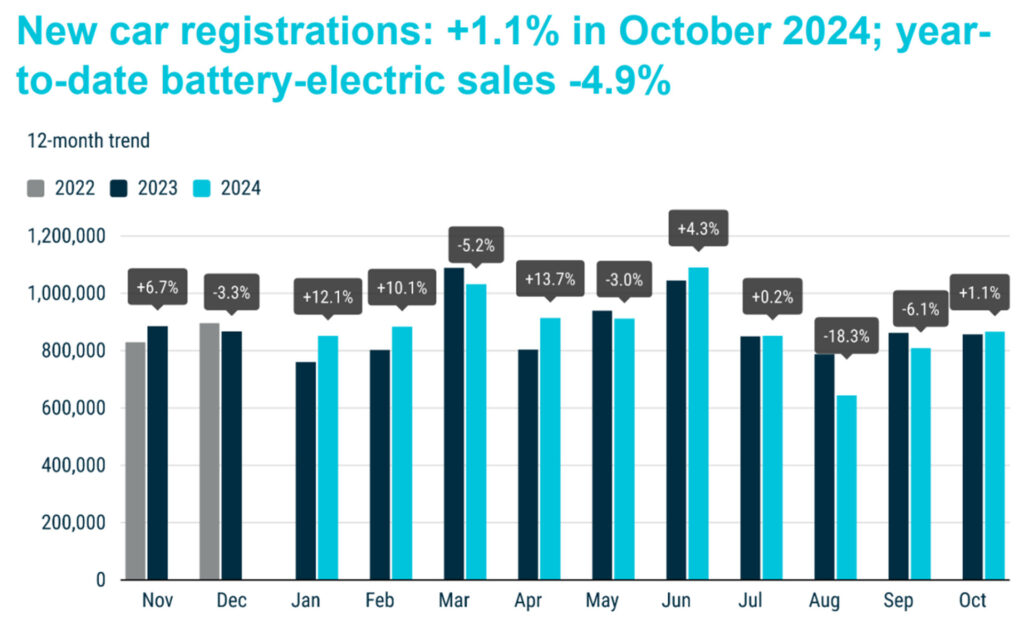

Looking at the EU market more broadly, sales rose 1.1% in October, led by Spain with a 7.2% jump, and Germany, which saw sales rebound 6% following three months of declines. Year-to-date, new car sales across the bloc are 0.7% higher than they were during the same period last year.

Read: Stellantis Delays Jeep, Dodge, And Ram EVs Again Because Quality Takes Time

As for powertrain preferences, the winds of change are blowing steadily. Demand for petrol cars has declined in the European Union this year, and in October, as they accounted for 30.8% of the market, down from 33.4% twelve months ago.

Hybrid-electric vehicles, on the other hand, are ascendant, becoming Europe’s top choice with a 33.3% share (up from 28.6%). Battery-electric vehicles are gaining ground as well, claiming 14.4%, while plug-in hybrids (PHEVs) hold steady at 7.7%. Diesels, once dominant, have shrunk to just 10.9%, while other powertrains scrape by with a modest 2.9%.