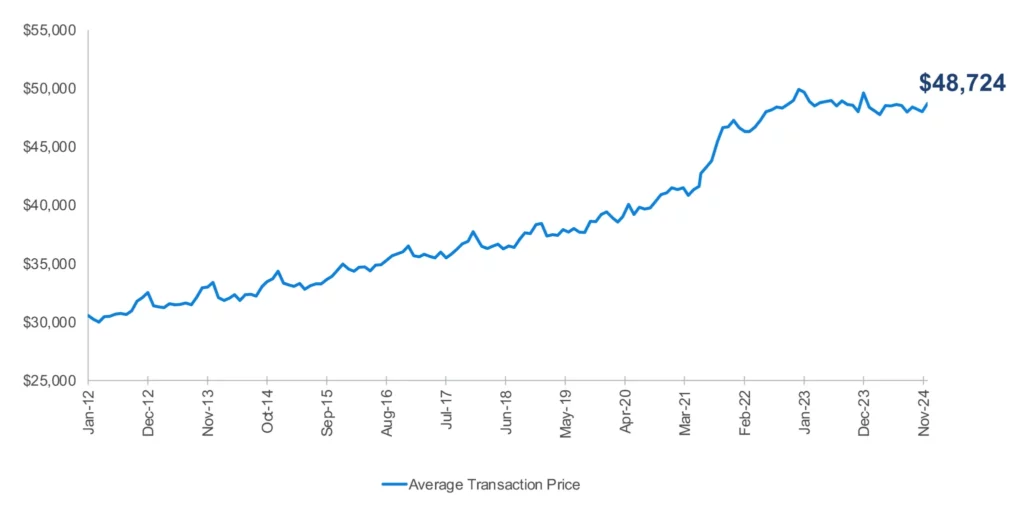

- The average transaction price for new vehicles in November 2024 rose to $48,724.

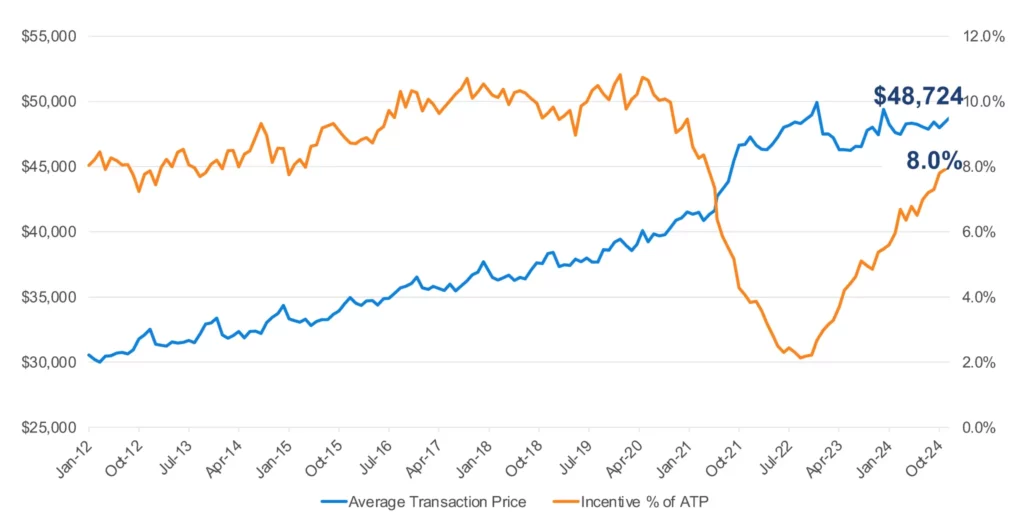

- Incentives averaged 8% of ATP, with 20 brands offering above-average discounts.

- Luxury car segment prices fell 25.1%, while subcompact prices dropped by 11.1%.

If you thought car prices were finally about to come down from their oxygen-deprived, Everest-level highs, you’re half right, but also wrong. The average transaction price (ATP) for new vehicles in the US has steadily increased this year and is 1.5% or $699 up from November 2023, now sitting at $48,724.

Read: Average New Car Cost $48k, But Buyers Only Want To Spend $35k

While this figure is lower than December 2022’s record-setting $49,926, it’s still the highest recorded so far this year. Some brands are riding this modest uptick, but others, including Mercedes-Benz, are watching their prices drop faster than a novice skater on thin ice.

Big Drops Hit Luxury and Legacy Brands

In November last year, the average transaction price of a new Mercedes-Benz model in the US was $77,240, but that figure plummeted to $69,444 last month, a massive 10.2% decline. Things were even worse in October when Mercedes-Benz’s ATP fell to $66,896. The German brand isn’t alone in having to deal with these declines.

In November, Volkswagen’s average transaction price (ATP) dropped 6.2% compared to the same month last year, now resting at $35,872, according to a Cox Automotive report using Kelley Blue Book (KBB) data. Jaguar’s ATP also fell significantly, down 13.7% to $63,283, likely due to dealers slashing prices on older inventory. Other brands with notable declines include Dodge (-7.0%), Cadillac (-6.3%), Buick (-4.4%), and Mitsubishi (-3.8%).

Kia Tops the Charts in Price Gains

Things couldn’t be any more different at Kia. Its average transaction price jumped 12.6%, climbing from $35,005 in November 2023 to $39,423 last month, the largest gain among all carmakers. Other brands also posted impressive increases, including Acura, which saw its ATP rise by 7% to $54,012, Tesla, which recorded a 4.3% jump to $54,610, and Ford, which experienced a 3.8% increase, bringing its ATP to $56,344.

NEW-VEHICLE AVERAGE TRANSACTION PRICE

The Cheapest and Priciest Brands of November

Overall, Mitsubishi recorded the lowest ATP of all brands included in the November study, coming in at $29,733. Close behind were Nissan at $34,031, Subaru at $34,804, and Buick at $34,995, all staying under the $35,000 mark. Meanwhile, at the opposite end of the pricing spectrum, Porsche dominated with an ATP of $115,703, followed by Land Rover at $97,687, BMW at $73,900, and Mercedes-Benz at $69,444.

A breakdown of different car segments shows that ATPs in the luxury car segment have plummeted by 25.1% over the past twelve months, falling from $75,238 to $56,366. Meanwhile, the compact SUV segment, accounting for nearly 20 percent of all new-vehicle sales in the U.S., remains the most popular and competitive category. With over 20 models in the mix, the average price in November was $36,858, or 1% higher year-over-year but over 30% below the industry average.

Other segments include subcompact cars with an ATP of $22,377 (-11.1% year-over-year) in November, full-size cars at $44,524 (-8.3%), full-size pickups at $64,530 (-1.0%), and sports cars at $46,327 (-9.8%).

ATP VS. INCENTIVE SPEND (%)

Incentives

The data also reveals that new-vehicle incentives in November accounted for an average of 8% of the ATP, offering some relief to buyers navigating high prices. Notably, 20 brands exceeded this average in incentive spending, with 11 of them pushing incentives to over 10% of their ATP. Among the brands offering the most aggressive discounts were VW, Ram, Audi, and Nissan, highlighting how some automakers are leaning heavily on deals to move inventory and remain competitive in the market.

Segments with the lowest incentive spending last month included High-Performance Cars, Compact Cars, and Small/Midsize Pickups. On the higher end, Luxury Cars, Full-Size Pickups, and Compact SUVs stood out, with incentives for the latter reaching 10.2% of ATP, according to the latest Kelley Blue Book report.

Discounts and Demand Keep Sales Moving

“Higher prices were met with higher discounts in November, which has kept the retail business moving,” said Cox Automotive Executive Analyst Erin Keating. “Following the national election, pent-up demand and some improvements in consumer confidence seem to be driving the market. And higher incentives are certainly helping as well.”

“The end of the year typically sees an increase in transaction prices, as luxury sales pick up as the year winds down,” Keating explained. “If sales volumes in November are any indication, we think 2024 will end on a positive note for the auto business. Yes, prices are trending higher year over year, but higher incentives and discounts are bringing in buyers.”