- Jeep’s inventory has been cut from 129 days to 114 days as of early January.

- Dodge’s inventory dropped 52%, but its 122-day supply is still one of the highest.

- Ram’s inventory fell to 107 days in January, down from 128 days in November.

2024 was another rough year for Stellantis. US sales dropped 15%, marking the sixth consecutive year of declines. Not exactly the kind of streak you’d want on your résumé. The silver lining, however, is that Stellantis finally took a hard look at its bloated American inventory and began addressing the issue. By year’s end, the company had managed to trim down its stockpile, though it’s clear there’s still plenty of work ahead.

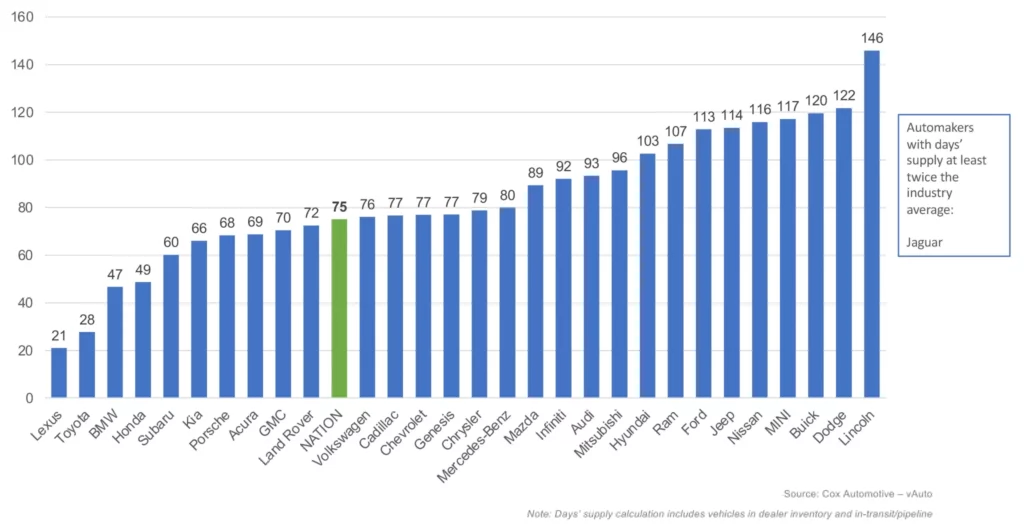

New data reveals that as of January 6, 2025, there were approximately 2.88 million vehicles in total inventory across the US. The average in December was sitting at 75 days’ worth of inventory, but some brands slipped below this, including Land Rover, GMC, Acura, Porsche, Kia, Subaru, Honda, BMW, Toyota, and Lexus. For much of the year, several Stellantis brands had more than twice the industry average, but things have started to change.

Read: Jaguar And Lincoln Are Drowning In Cars With Double The Industry Inventory

Cox Automotive reports that in December, Dodge’s inventory fell by as much as 52% year over year. However, it still has an excess supply, sitting at 122 days and only trailing Lincoln and Jaguar. Dodge’s inventory was slightly up from the 111 days it had in November.

Stellantis has done a good job of cutting Chrysler inventory by roughly 40%, bringing it down to 79 days. Jeep supplies have also dropped 14% year over year to 114 days. Additionally, Ram supplies have dropped to 107 days. Rewind to November and things weren’t looking so good for Stellantis. Jeep inventories were sitting at 129 days, and Ram’s were 128 days.

Two brands have way too much stock

Lincoln and Jaguar continue to battle with high inventories. Lincoln has 146 days’ worth of supply, while Jaguar has at least twice the industry average – equating to a minimum of 150 days’ worth of supplies. This is primarily because the British brand hasn’t released any new models in recent years. Lincoln’s swollen inventories come despite reporting a healthy 28% increase in sales last year, shifting 104,823 units.