- European countries like Spain and Austria are increasingly leaning toward Chinese EVs

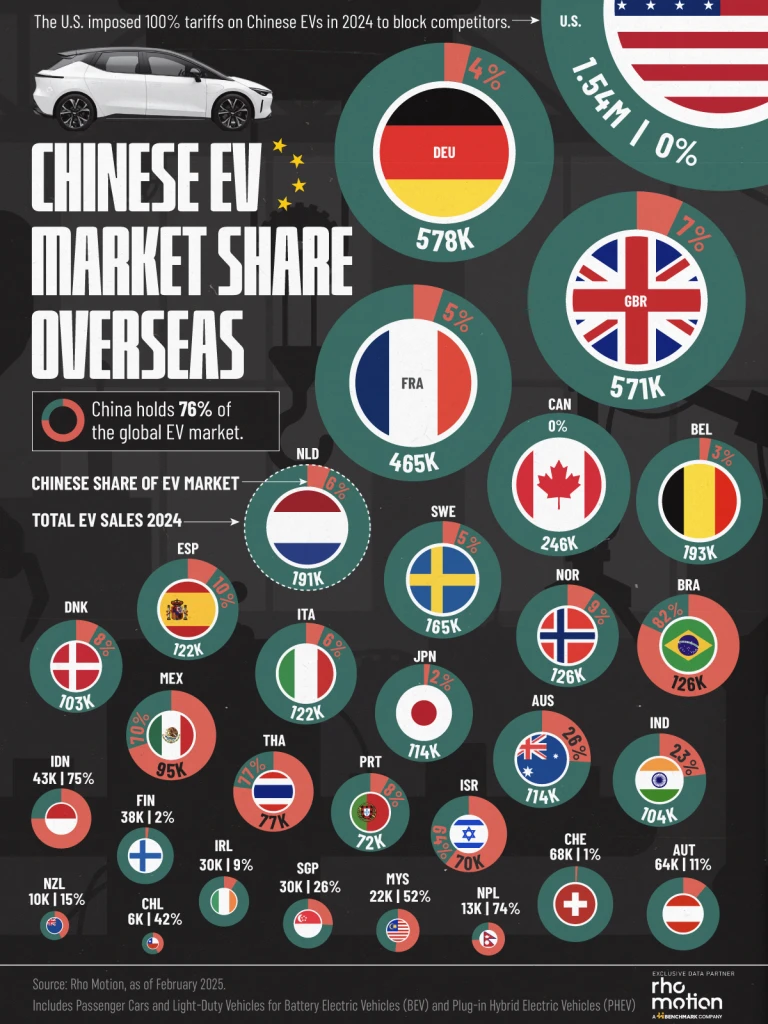

- Despite zero U.S. presence, Chinese EVs now account for 76% of global market share.

- In Brazil, Thailand, and Mexico, they hold hold a massive share of over 70 percent.

It’s no secret that Chinese car manufacturers are leading the charge when it comes to electric vehicles (pun fully intended). What’s surprising, though, is that they’ve managed this without selling a single car in the United States, the world’s second-largest and most lucrative car market. So, how are they pulling it off? By focusing on just about every other major region instead.

More: Porsche’s High Prices And Outdated Tech Are Killing Its Sales In China, Could It Happen Here?

According to recent data from Rho Motion, Chinese brands now command a staggering 76% share of the global EV and plug-in hybrid (PHEV) market, thanks to aggressive expansions into new territories. In Europe, their market share varies by country, but they’ve made particularly strong gains in less developed markets around the world.

Gaining Ground in Europe

In Germany, Europe’s largest car market, Chinese manufacturers accounted for about 4% of the 578,000 EVs sold last year. The numbers are slightly higher in the UK and France, where they captured 7% and 5% of total EV sales, respectively. In the Netherlands, Sweden, Norway, and Belgium, Chinese EVs make up 6%, 5%, 8%, and 3% of the market. Meanwhile, their presence is even more pronounced in Spain and Austria, where they hold 10% and 11% of total EV sales.

Dominating Emerging Markets

Outside Europe, Chinese automakers are enjoying even more significant success. In Brazil, a remarkable 82% of all EVs and PHEVs sold in 2024 came from China. Similarly, they have a 77% share of the market in Thailand and a 70% share in Mexico. They also account for 75% of all EVs and PHEVs delivered in Indonesia, 52% in Malaysia, 74% in Nepal, and 64% in Israel. They’re also popular in Australia and New Zealand, accounting for 26% and 15% of sales.

Why Are They Winning?

Part of this success can be attributed to the fact that many of these countries lack a strong local car industry, giving Chinese brands an easier path to market dominance. Additionally, China’s electric vehicle industry has benefited from at least $231 billion in government subsidies and aid from 2009 through the end of 2023. This substantial financial support has allowed Chinese EVs and PHEVs to be more affordable than those from traditional automakers, giving them a competitive edge.