- China is years ahead of Western automakers in battery technology, according to Ford’s CEO.

- Jim Farley told The New York Times that Ford must access China’s battery IP if it wants to compete.

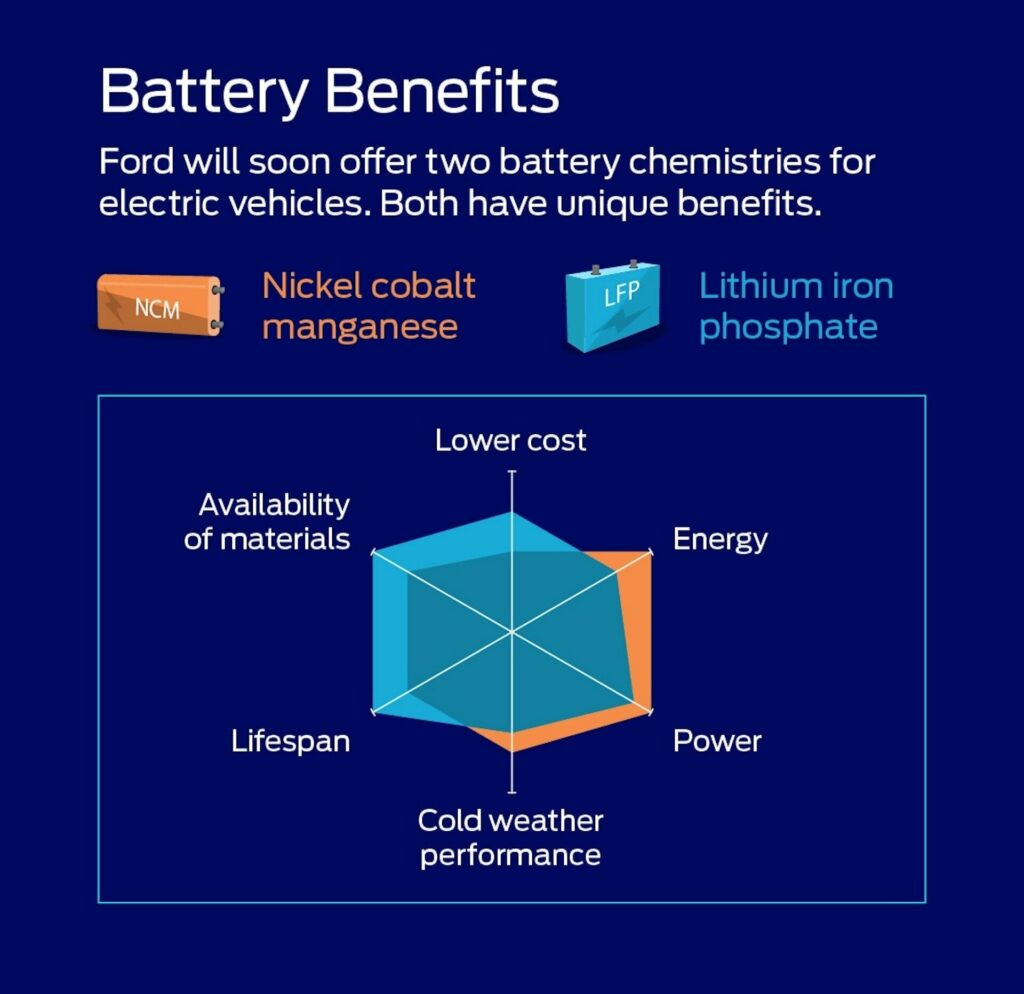

- CATL batteries use LFP chemistry, originally developed in the USA and later acquired by China.

Ford desperately wants to head off the threat posed by the Chinese car industry, but it needs China’s own technical expertise to make it happen, according to the Blue Oval’s boss.

CEO Jim Farley told The New York Times that China is years ahead when it comes to making batteries for EVs and that Ford’s only chance of getting on equal footing with the country’s auto industry, and then pulling ahead, is to leverage their tech.

Related: Ford CEO Slams Trump’s Unfair Tariffs That Benefit Foreign Brands

“The way we compete with them is to get access to their IP just the way they needed ours 20 years ago, and then use our innovative ecosystem and American ingenuity and our great scale and our intimacy with the customer to beat them globally,” Farley told the NYT’s Thomas L. Friedman. “It will be one of the most important races to save our industrial economy.”

Farley isn’t talking about some far off future plan, but something that’s already happening. The automaker’s massive BlueOval Battery Park is currently mid-build, and when it’s up and running in 2026 it’ll be churning out thousands of lithium ion phosphate (LFP) batteries that rely on tech from China’s CATL.

Paying China for American technology

That much we knew, but there’s something we didn’t know about CATL’s clever chemistry, and maybe you didn’t either: it was originally developed in the US and then picked up for pennies by the Chinese. Referencing an earlier Bloomberg story, the NYT explains how LFP was discovered by scientists at the University of Texas, then commercialized by A123 Systems LLC, a startup that received a ton of cash by the Obama administration.

But the EV market was slow to develop and A123 went bust, the remnants of it, including the battery IP, eventually being bought out by what at the time was China’s biggest auto parts company.

You might argue that hindsight is a wonderful thing and that no-one really could have known a decade ago that EVs would become such a large part of the car industry. But the Chinese figured it would. Tesla also did before any other Western brand. Every major automaker was working on EVs because they knew they’d eventually have to sell them in huge numbers to meet emissions goals.

Looking back from a 2025 vantage point, it seems incredible that the tech was allowed not just to leave US hands, but drop into the hands of one its biggest adversaries. One that, according to the Bloomberg report, controls 83 percent of all lithium-ion battery manufacturing.

Ford is working on a sub $30k baby EV to battle affordable electric cars from China that haven’t yet landed in the US, but are already making their presence felt in other regions where Ford also sells cars. While tariffs on cars imported from China to the US protect Ford from the threat of the likes of BYD in America (for now), they also make the Chinese-built Lincoln Nautilus more expensive once shipped to US dealers.